(Bloomberg) — A year after an epic rebound in the yen upended currency trading and sent shares tumbling from Tokyo to New York, Japan’s stock market has found firmer footing.

Most Read from Bloomberg

It’s taken two major routs and a significant unwinding of the carry trade strategy, used by global investors to borrow heavily in the relatively low-yielding yen to buy other currencies offering higher returns.

But twelve months on from Aug. 5, 2024, when Japan’s stock benchmarks plummeted 12% and the market lost over $670 billion in value following an unexpected rate hike by the Bank of Japan, the broader Topix Index is once again hovering near record highs.

Read: Japan’s Topix Sets Record High as Trump Deals Ease Tariff Fears

And while this summer’s share climb bears some technical similarities to last July’s ill-fated rise, a combination of clearer BOJ messaging, steady corporate reforms and a better-than-feared US tariff deal has market participants betting against a repeat of the 2024 crash.

“It looks like a lot more stable of an environment for the market to go higher,” said analyst Pelham Smithers, who runs an eponymous Japan equity research firm in the UK. “I think there’s room for further rate hikes, which it hasn’t felt like before.”

The yen is still keeping investors on their toes — the currency gained 2% against the dollar on Friday following disappointing US employment data.

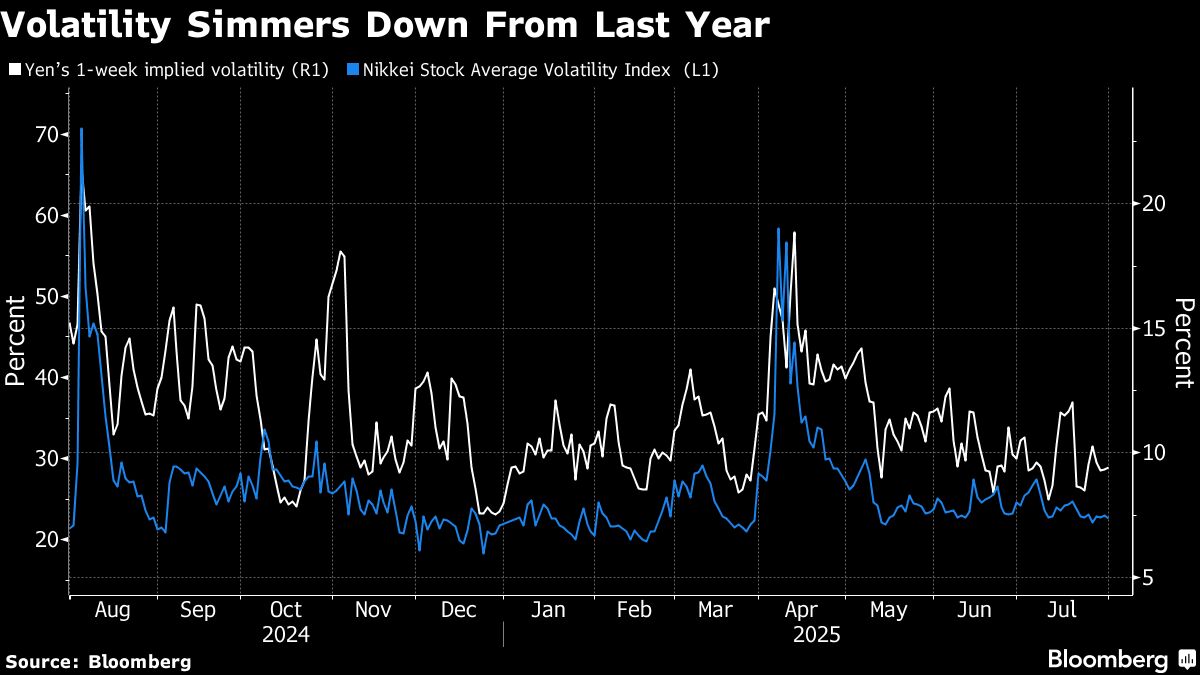

But the yen’s choppiness over the past four weeks is tame compared to its 10% surge over the same period in 2024. And stocks’ Monday decline was mild in contrast to their August 2024 collapse, which was also accelerated by weak US jobs data.

The yen was trading at around 147.2 to the dollar at 3:40 p.m. in Tokyo on Tuesday. The Nikkei and Topix rebounded to close around 0.7% up.

The relative calm is evidence that investors are finally settling into the new reality of higher Japanese interest rates, said Anna Wu, a cross-asset strategist at investment management firm VanEck in Sydney.

“The market has come to a realization that yes, the BOJ will be hiking, but the differentials between the yen and trading pairs, as well as Japan interest rates versus the Fed’s rates, are still meaningfully high,” Wu said. That makes another sharp carry trade unwind unlikely, she added.

The newfound acceptance is largely thanks to an improvement in communication by the BOJ, Wu said. Its 15 basis point hike last July caught markets off-guard, sending the yen soaring and global investors rushing to offload carry trade positions.

Story Continues