Report Overview

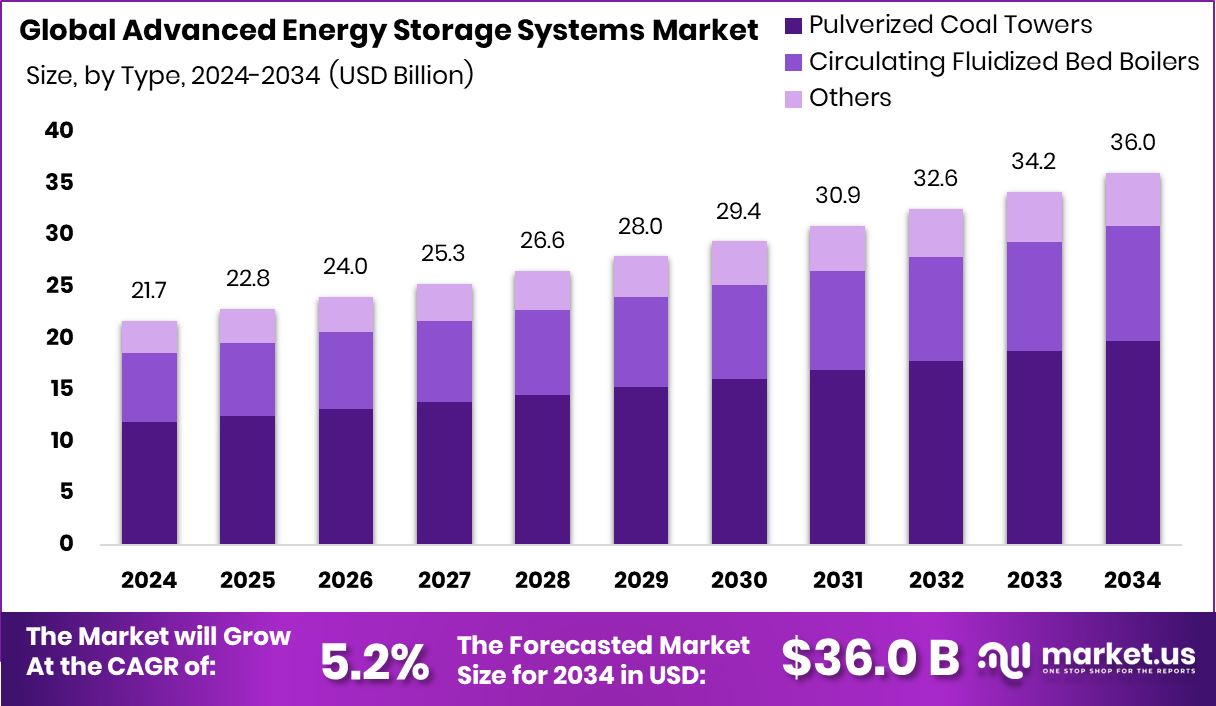

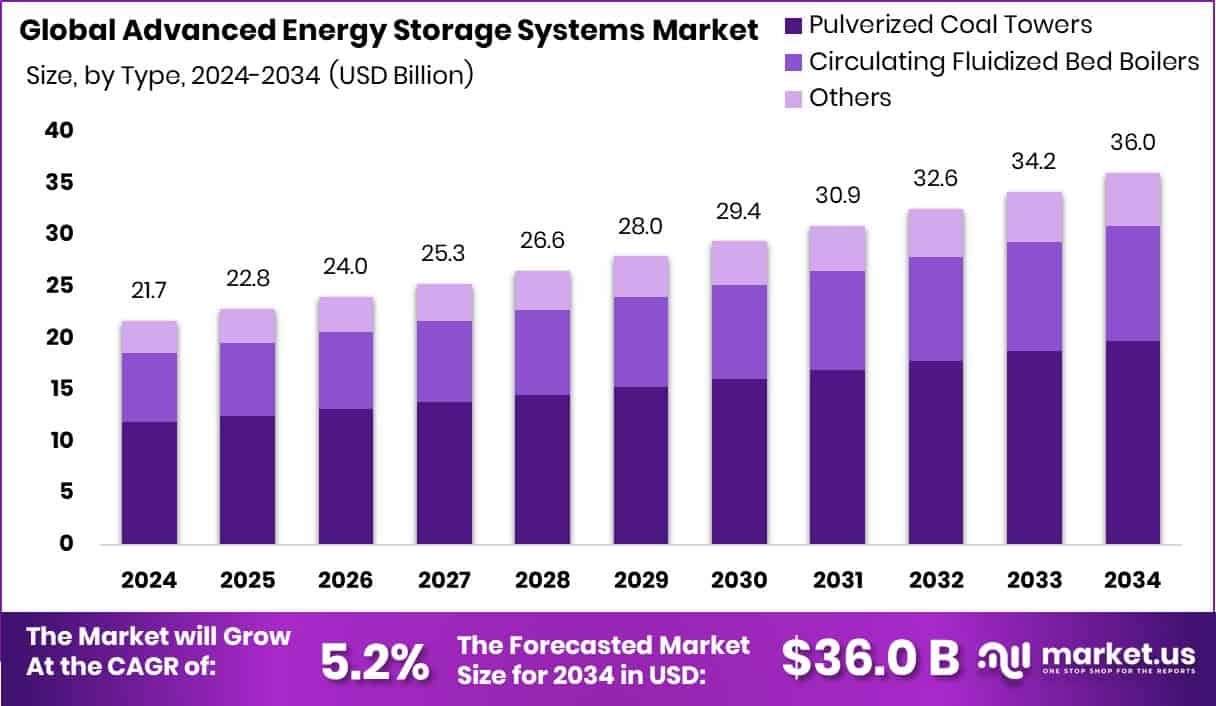

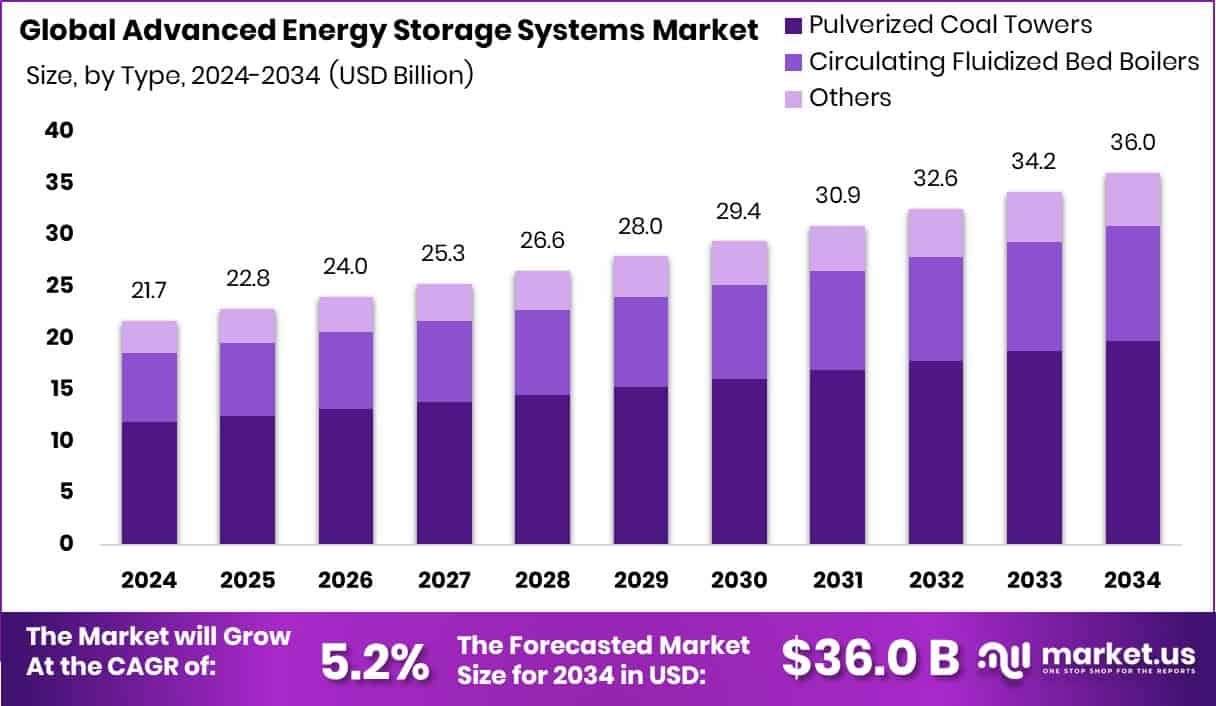

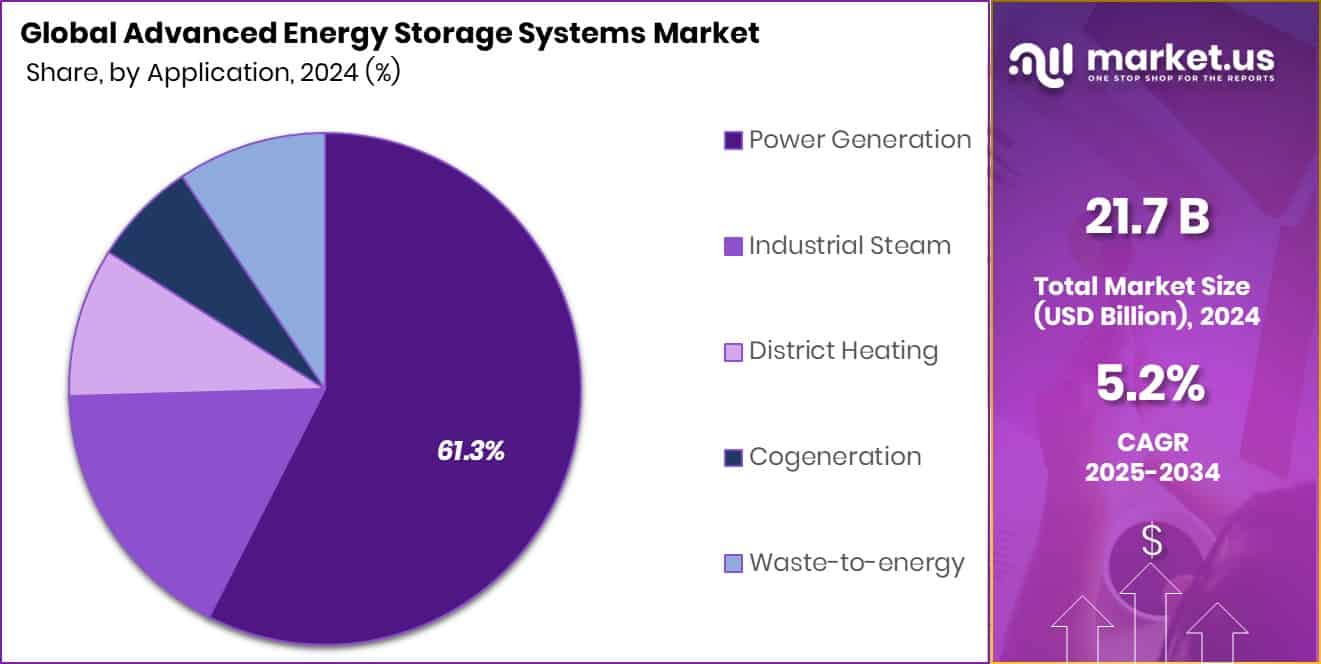

The Global Advanced Energy Storage Systems Market is expected to be worth around USD 36.0 billion by 2034, up from USD 21.7 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Strong renewable energy investments supported Asia Pacific’s dominant 47.20% share and growth.

Advanced Energy Storage Systems (AESS) refer to modern technologies designed to efficiently store energy for later use. These systems go beyond traditional storage methods like lead-acid batteries, offering faster charging times, greater energy density, improved cycle life, and better performance under variable conditions. They include solutions such as lithium-ion batteries, flow batteries, thermal storage, compressed air, and flywheels. AESS plays a crucial role in balancing supply and demand, enhancing grid stability, and supporting the integration of renewable energy sources such as solar and wind, which are intermittent in nature.

The Advanced Energy Storage Systems market represents the global industry surrounding the development, deployment, and operation of high-performance energy storage technologies. This market supports a wide range of applications, including grid management, industrial backup, electric mobility, and residential power systems. As energy systems shift toward decentralization and clean energy, the demand for efficient and flexible storage solutions continues to rise, driving growth across utility-scale and behind-the-meter applications.

The growth of the advanced energy storage systems market can be attributed to the global energy transition toward renewable sources. As solar and wind energy installations increase, the need for stable and responsive energy storage becomes critical. Additionally, declining costs of battery technologies and favorable government policies are accelerating the adoption of storage systems across sectors. According to an industry report, German-based startup Co-Power has raised €6.4 million to support European industries in managing energy expenses and improving operational resilience.

Rising electricity consumption, urbanization, and increased reliance on electrified transport are key factors pushing demand. The growing frequency of grid fluctuations and blackouts has also made reliable storage systems a necessary infrastructure component. Demand is further amplified by rising awareness of energy independence and sustainability among consumers and industries alike. According to an industry report, Fervo Energy has secured $206 million in funding to develop a large-scale geothermal power facility. and also the fusion energy sector has received a funding increase of £2.5 billion to accelerate development.

Key Takeaways

The Global Advanced Energy Storage Systems Market is expected to be worth around USD 36.0 billion by 2034, up from USD 21.7 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

In the Advanced Energy Storage Systems Market, Pulverized Coal Towers held a 54.8% share in 2024.

400–800 MW capacity range captured 49.1% of the Advanced Energy Storage Systems Market share in 2024.

The subcritical technology segment dominated with a 48.2% market share in Advanced Energy Storage Systems.

Coal-based systems led the market by fuel type, accounting for a 69.3% share in 2024.

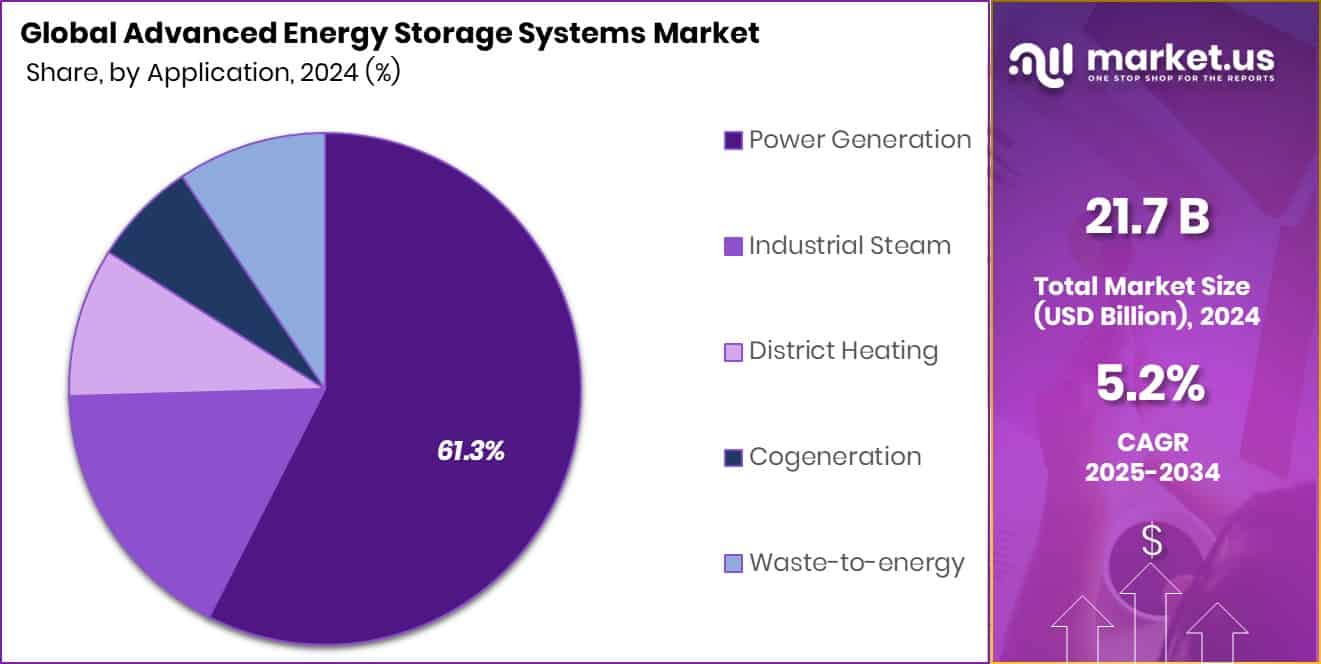

Power generation remained the top application in this market, holding a 61.3% share in 2024.

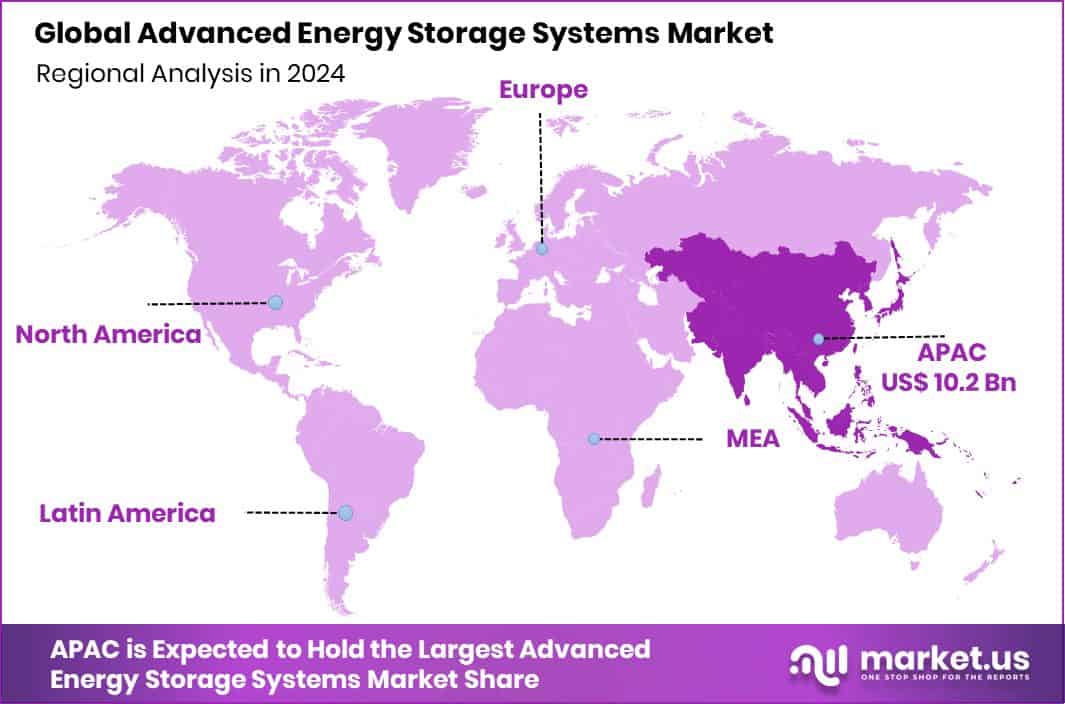

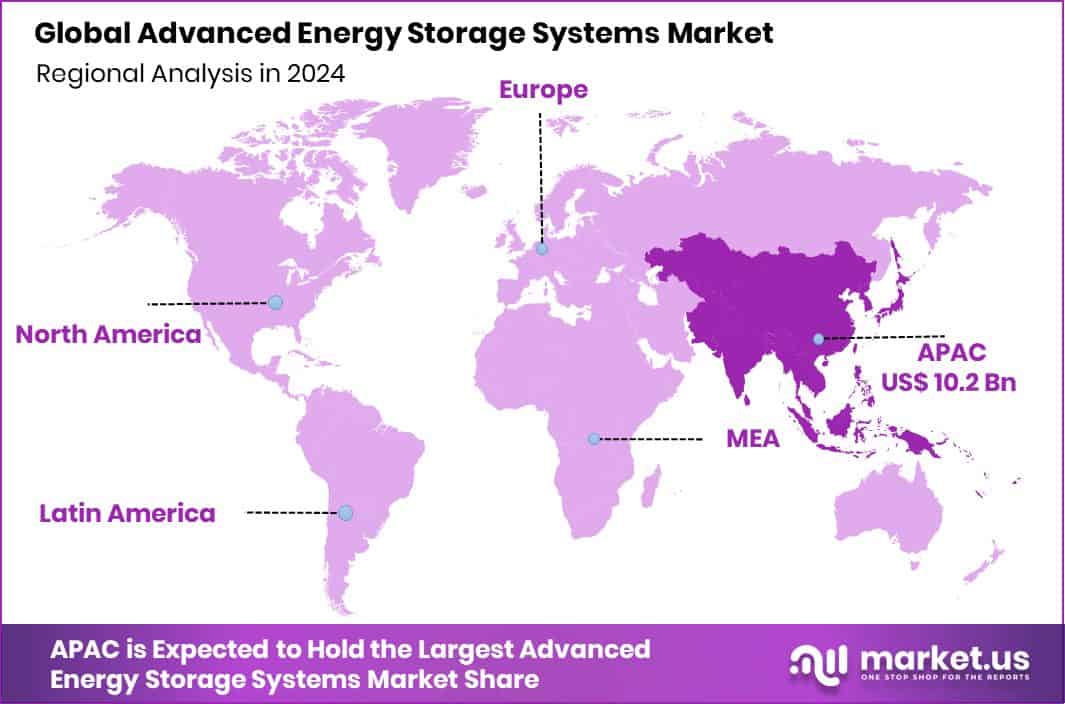

The Asia Pacific market value reached approximately USD 10.2 billion during the same year.

By Type Analysis

Pulverized Coal Towers lead the Advanced Energy Storage Systems Market, 54.8%.

In 2024, Pulverized Coal Towers held a dominant market position in the By Type segment of the Advanced Energy Storage Systems Market, with a 54.8% share. This significant market share can be attributed to their ability to store thermal energy efficiently at high temperatures, offering a reliable and cost-effective solution particularly suited for large-scale industrial and power generation applications. Pulverized Coal Towers have gained traction due to their robust performance in long-duration energy storage, especially in regions where grid stability and energy continuity are critical.

Their integration into thermal power plants has enabled smoother load management and has reduced dependency on real-time fossil fuel combustion during peak demand hours. Moreover, the existing infrastructure compatibility and relatively lower capital costs compared to some emerging technologies have further supported their widespread adoption. As energy systems increasingly require balancing capabilities to manage fluctuations in renewable energy input, Pulverized Coal Towers continue to serve as a dependable storage option.

Their dominance in 2024 reflects ongoing reliance on thermal-based systems that deliver scalable and high-capacity storage performance. This segment is expected to maintain its relevance as part of broader energy transition strategies that combine conventional energy systems with modern storage approaches.

By Capacity Analysis

400-800 MW capacity dominates storage systems, capturing 49.1% share.

In 2024, 400–800 MW held a dominant market position in the By Capacity segment of the Advanced Energy Storage Systems Market, with a 49.1% share. This capacity range has become the preferred choice for large-scale energy storage projects due to its ability to support grid-level applications, enhance peak load management, and stabilize energy supply during periods of high demand.

The 400–800 MW segment offers a balanced combination of scalability and operational efficiency, making it suitable for utility-scale installations and integration with renewable energy sources. Its dominance also reflects the growing demand from regional grids seeking dependable storage solutions that can handle considerable power loads without compromising on reliability. Moreover, installations within this capacity range are often favored for their ability to deliver long-duration storage and smooth power output, addressing challenges associated with intermittent energy generation.

In 2024, the preference for this capacity range highlights the industry’s move toward high-capacity, centralized storage systems that can be deployed across diverse energy networks. As countries continue to modernize their power infrastructure and invest in large-scale clean energy projects, the 400–800 MW segment remains at the forefront of strategic energy planning and storage deployment.

By Technology Analysis

Subcritical technology is widely used, holding 48.2% market presence.

In 2024, Subcritical held a dominant market position in the By Technology segment of the Advanced Energy Storage Systems Market, with a 48.2% share. This strong market presence can be linked to the wide adoption of subcritical systems in traditional thermal power infrastructure, where they are used for energy storage and heat recovery. Subcritical technology, operating below the critical point of water, is well-established, cost-effective, and easier to integrate into existing power plants, particularly in regions still reliant on thermal energy sources.

Its compatibility with pulverized coal towers and steam-based operations has further supported its deployment in large-scale storage projects, offering stable thermal output and relatively lower operational risks. The 48.2% share in 2024 reflects consistent demand for reliable, mature technologies that can provide both grid support and efficient energy conversion. Subcritical systems have remained a preferred choice in sectors where simplicity, proven performance, and operational stability are key considerations.

Their dominance highlights the continuing relevance of conventional thermal technologies in the evolving energy storage landscape, particularly in markets undergoing a gradual transition toward cleaner and more flexible energy systems while still leveraging existing assets.

By Fuel Type Analysis

Coal-based systems drive demand, contributing a 69.3% market share.

In 2024, Coal-Based held a dominant market position in the By Fuel Type segment of the Advanced Energy Storage Systems Market, with a 69.3% share. This leading position can be attributed to the extensive deployment of coal-based infrastructure across several regions, where coal continues to serve as a primary energy source. Advanced storage systems designed to complement coal-fired operations have enabled more efficient heat retention and energy output management, especially during fluctuating demand periods.

The high share indicates a strong reliance on coal as a fuel for thermal storage applications, particularly in areas where grid flexibility and high-capacity load balancing are required. The integration of storage solutions with coal-based systems has allowed operators to enhance operational efficiency, reduce fuel consumption during off-peak hours, and support base-load requirements with greater stability. In 2024, coal-based storage remains vital in markets where energy security and cost-effectiveness take precedence.

The 69.3% share also reflects the continued use of thermal storage technologies that are engineered to work in tandem with conventional coal power setups. Despite ongoing transitions in the energy sector, coal-based systems remain central to advanced storage strategies in many parts of the world due to their scale, consistency, and existing infrastructure.

By Application Analysis

Power generation remains a key application, commanding 61.3% market position.

In 2024, Power Generation held a dominant market position in the By Application segment of the Advanced Energy Storage Systems Market, with a 61.3% share. This substantial share highlights the critical role energy storage systems are playing in supporting power generation activities, especially in enhancing grid reliability and managing peak load demands. The integration of advanced storage solutions with power generation systems has allowed for better energy efficiency, smoother operation of thermal plants, and more consistent power delivery during demand fluctuations.

The 61.3% share also reflects the strong need for stable, large-scale energy backup in power plants that operate on variable load cycles. These storage systems help in optimizing fuel use and maintaining energy supply during unexpected interruptions or shifts in power consumption. The dominance of the power generation segment in 2024 underlines how energy storage has become an essential component in modern power infrastructure, particularly in regions where large thermal plants remain operational.

The ability of these systems to store excess energy and release it when needed has reinforced their value within centralized power generation facilities. As of 2024, power generation continues to be the key driver of energy storage deployment across various regions, supported by demand for reliability, efficiency, and energy continuity.

Key Market Segments

By Type

Pulverized Coal Towers

Circulating Fluidized Bed Boilers

Others

By Capacity

Upto 400 MW

400-800 MW

Above 2800 MW

By Technology

Subcritical

Supercritical

Ultra-supercritical

By Fuel Type

Coal Based

Gas Based

Oil Based

Others

By Application

Power Generation

Industrial Steam

District Heating

Cogeneration

Waste-to-energy

Driving Factors

Growing Renewable Energy Integration Demands Efficient Storage

One of the main driving factors of the Advanced Energy Storage Systems market is the growing use of renewable energy sources like solar and wind. These sources do not produce energy all the time — solar power is available only when the sun shines, and wind energy depends on wind speed. This creates a gap between energy supply and demand.

Advanced energy storage systems help by storing extra energy produced during high generation periods and releasing it when demand is high or generation is low. This improves the reliability of renewable energy and reduces the need for backup from fossil fuels. As countries add more clean energy to their grids, the need for efficient and reliable energy storage continues to grow rapidly.

Restraining Factors

High Initial Investment Costs Limit Market Growth

A major restraining factor for the Advanced Energy Storage Systems market is the high upfront cost required for installation and deployment. Setting up large-scale storage systems involves significant expenses related to equipment, construction, and integration with existing power infrastructure. This makes it difficult for smaller companies or developing regions to adopt these technologies quickly.

Even though these systems save money in the long run through improved energy efficiency, the initial investment remains a big hurdle. Governments and utilities often require financial support or incentives to move forward with such projects. Without affordable pricing or strong funding programs, many potential users may delay adoption, slowing down overall market growth despite rising energy storage needs.

Growth Opportunity

Rising Demand in Remote and Rural Areas

A major growth opportunity for the Advanced Energy Storage Systems market lies in expanding access to reliable electricity in remote and rural regions. Many of these areas either lack connection to national power grids or face frequent power outages. Advanced energy storage systems can store electricity from local renewable sources like solar or wind and provide power when needed, ensuring a steady energy supply.

These systems can support small villages, farms, schools, and clinics, improving living conditions and supporting local development. As governments and development agencies focus more on rural electrification, the demand for affordable and scalable energy storage solutions is expected to increase. This opens a strong market opportunity for companies offering off-grid and hybrid energy storage technologies.

Latest Trends

Second-Life Batteries Gaining Strong Market Attention

One of the latest trends in the Advanced Energy Storage Systems market is the growing use of second-life batteries. These are batteries that were previously used in electric vehicles and are now being reused for stationary energy storage. Even though they may no longer be suitable for cars, they still have enough capacity to store electricity for homes, buildings, or power backup systems.

This approach helps reduce battery waste and lowers the cost of energy storage solutions. Second-life batteries offer an environmentally friendly and cost-effective way to expand storage capacity without producing entirely new batteries. As electric vehicles become more common, more second-life batteries will become available, making this trend increasingly important in the energy storage market.

Regional Analysis

In 2024, the Asia Pacific led the Advanced Energy Storage Systems market with 47.20%.

In 2024, Asia Pacific held a dominant position in the global Advanced Energy Storage Systems market, capturing 47.20% of the total share, which translated to a market value of approximately USD 10.2 billion. This leadership can be attributed to the region’s rising investments in energy infrastructure, increasing deployment of renewable energy projects, and supportive government initiatives aimed at strengthening energy security.

Countries across the Asia Pacific have been actively integrating storage systems to manage grid stability and enhance the reliability of solar and wind power. In contrast, North America, Europe, the Middle East & Africa, and Latin America also continued to participate in the market but did not surpass Asia Pacific’s leading position.

The market presence in North America and Europe remains steady, largely driven by infrastructure modernization and decarbonization goals, while Latin America and the Middle East & Africa are gradually adopting energy storage solutions to support growing energy demand and manage supply inconsistencies.

However, none of these regions matched the scale or pace of Asia Pacific’s expansion in 2024. The region’s ability to blend policy support with industrial-scale deployment placed it at the forefront of global adoption, making it the central hub for growth in the advanced energy storage landscape.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Babcock & Wilcox Enterprise possesses established engineering expertise and a historical legacy in thermal systems. This heritage enables it to leverage deep know‑how in integrating storage solutions within traditional infrastructure. Its advantage lies in technological adaptability and trusted execution, bolstering its appeal for large‑scale, utility‑grade installations.

Dongfang Electric Corporation benefits from strong manufacturing capabilities and scale. Its capacity to produce storage components at high volume supports cost efficiencies and rapid deployment across diverse energy systems. This scalability strengthens its competitive edge in markets requiring industrial‑scale storage rollout.

Doosan Heavy Industries & Construction stands out with integrated project delivery and turnkey implementation skills. Its ability to manage engineering, procurement, and construction (EPC) under a unified framework provides streamlined deployment for advanced storage assets, appealing to customers seeking efficient, single‑source solutions.

General Electric, a diversified global energy technology provider, contributes through cross‑industry innovation and system integration. GE’s broad product portfolio and digitalization capabilities enable integrated storage solutions that align with smart grid and utility needs, promoting flexibility and performance-oriented operations.

Top Key Players in the Market

Babcock & Wilcox Enterprise

Dongfang Electric Corporation

Doosan Heavy Industries & Construction

General Electric

Mitsubishi Hitachi Power Systems

Siemens

IHI Corporation

John wood Group

Bharat Heavy Electrical Limited

Thermax

Andritz Group

Sumitomo Heavy Industries

Valmet

Harbin Electric

Recent Developments

In January 2025, Dongfang Electric commenced trial operations at a 300 MW compressed air energy storage plant operating without fossil fuels. It demonstrated stable equipment performance and high efficiency, supplying up to 500 million kWh annually and significantly reducing coal consumption.

In July 2024, B&W completed the sale of its Denmark-based Renewable Service A/S subsidiary to Hitachi Zosen Inova AG for approximately USD 87 million. The move was aimed at reducing debt and improving liquidity, thereby allowing B&W to reallocate capital toward its core energy and thermal infrastructure competencies.

Report Scope