According to Polymerupdate Research, Asia’s #1 B2B information service provider, benchmark Brent crude futures for near-month delivery on the Intercontinental Exchange (ICE) rose 0.2 percent, or US$ 0.16 a barrel, to US$ 66.59 a barrel on Friday, up from US$ 66.43 a barrel a day earlier. The contract rebounded from six consecutive sessions of decline, but still posted an overall weekly loss of 4.4 percent. From its recent peak of US$ 73.24 a barrel on July 30, near-month Brent futures have fallen by over 10 percent, or US$ 6.65 a barrel.

Meanwhile, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) closed flat at US$ 63.88 a barrel on Friday. The U.S.-focused WTI contract recorded a weekly loss of 5.1 percent, down 8.74 percent, or US$ 6.12 a barrel, from its recent peak of US$ 70 a barrel on July 30 amid short-covering activity. This marked the steepest weekly drop since late June 2025, when tariff-related concerns over slowing economic growth weighed heavily on energy prices.

An analyst with Reliance Securities Ltd commented, “Crude oil and gasoline prices settled steady on Friday but remained above Wednesday’s two-month low. The recent strength of the U.S. dollar pressured crude prices, along with expectations of easing hostilities between Russia and Ukraine as U.S. President Donald Trump prepares to meet Russian President Vladimir Putin. Crude oil prices remained under pressure due to the potential easing of geopolitical risks.”

Trump to meet Putin in Alaska

On Friday, U.S. President Donald Trump announced that he will meet Russian President Vladimir Putin in Alaska on August 15 to discuss the future of the war in Ukraine. Shortly after Trump revealed the date and location, a Kremlin spokesperson confirmed the details, noting that “the location was quite logical given Alaska’s relative proximity to Russia.” The spokesperson added that Trump had also been invited to Russia for a potential second summit.

The Trump-Putin meeting was announced just hours after the U.S. President suggested that Ukraine might have to cede territory to end the war, which began with Russia’s invasion on February 26, 2022. “You’re looking at territory that’s been fought over for three and a half years. A lot of Russians have died. A lot of Ukrainians have died. It’s very complicated. We’re going to get some back, we’re going to get some switched. There will be some swapping of territories, to the betterment of both,” Trump said at the White House on Friday.

Experts believe Washington and Moscow may seek a deal to halt the war that would effectively cement Russia’s control over territories seized during its invasion. Ukrainian President Volodymyr Zelenskyy did not comment on the planned meeting between the two leaders. Sources indicated that U.S. and Russian officials are working toward an agreement on territorial arrangements ahead of the summit.

Energy price indicators

The Trump-Putin meeting has dominated commodity market headlines this week, with analysts speculating on the likelihood of a comprehensive deal and its potential impact on oil markets. ICE Brent has been edging closer to US$ 65 a barrel, as reduced sanction risks on Russia could further erode the market’s built-in risk premium. However, a potential failure in the talks could trigger another price rally above US$ 70 a barrel.

Saudi Aramco raised its formula prices for September-loading cargoes, increasing Asia-bound OSPs by US$ 1.20 a barrel for both its light grades and by US$ 0.90 a barrel for its largest export stream, Arab Light, in line with changes in the Dubai M1-M3 spread. Meanwhile, U.S. crude exports fell to 3.1 million bpd last month—a drop of 0.5 million bpd from June and the lowest monthly rate since October 2021—driven largely by Asia’s weakening appetite for light, sweet WTI, with China continuing to boycott U.S. crude imports.

Iraq’s Oil Minister Hayan Abdul Ghani announced this week that 80,000 bpd of oil exports through the Kirkuk-Ceyhan pipeline—shut since February 2023—are set to resume this week, even though most Kurdish production remains offline following drone attacks. India’s state-owned refiner, Indian Oil Corporation, purchased 5 million barrels of crude from Brazil, the U.S., and Libya in its second spot tender this week, bringing its total spot crude purchases to 22 million barrels as it seeks to mitigate Russian supply risks.

Easing supply

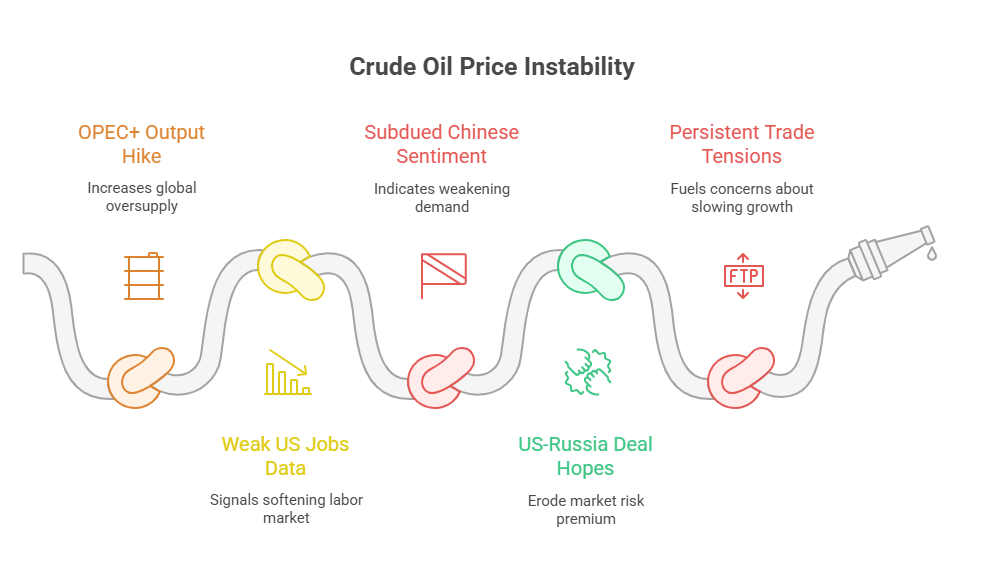

OPEC+ coalition members that had previously announced additional voluntary production cuts in April and November 2023 have now decided to increase output by 547,000 bpd in September 2025, based on the production level set for August 2025. This additional volume will add to the global oversupply and is intended to complete the first cycle of the 2.2 million bpd production unwinding by September 2025.

The price decline was capped by strong demand-side fundamentals. Bullish sentiment received a brief boost from American Petroleum Institute (API) data showing a 4.2 million-barrel drop in U.S. crude stockpiles—well above expectations. Official figures from the Energy Information Administration (EIA) also confirmed a 3 million-barrel draw in crude inventories, while gasoline stocks fell by 1.3 million barrels and distillate stocks by 565,000 barrels.

Economic growth pointers

Initial jobless claims in the U.S. rose by 7,000 from the previous week to 226,000 in the final week of July, exceeding market expectations for a softer increase to 221,000. Continuing claims jumped by 38,000 to 1,974,000, well above the forecast of 1,950,000, marking the highest level of unemployment since November 2021. The data reinforced views of a sharp slowdown in hiring and a softening labour market, although initial claims remain below the elevated levels seen in early June.

U.S. labour productivity in the nonfarm business sector rose by 2.4 percent in the April–June 2025 quarter, following a revised 1.8 percent drop in the prior period and beating expectations for a 2 percent gain, preliminary estimates showed. Output increased by 3.7 percent (compared with a 0.6 percent contraction in January–March 2025), while hours worked rose by 1.3 percent (versus 1.2 percent previously).

Separately, in China, services activity, as measured by a private sector survey, rose to a 14-month high of 52.6 in July 2025, up from 50.6 in June 2025, supported by stronger demand. In contrast, the official services PMI slipped marginally to 50 in July 2025 from 50.1 in June 2025. Services activity in Japan also gained momentum, expanding to 53.6 in July 2025 (a five-month high) from 51.7 in June 2025, driven by higher demand and growth in new business orders. China’s services sector expanded at the fastest pace in 14 months in July, buoyed by stronger foreign demand.

Outlook

Expectations of increased OPEC+ output and persistent trade tensions remain the overriding negative factors, fuelling concerns about slowing economic growth and weakening demand.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com