The building blocks for a broker’s career are customer service, according to industry experts.

Peter White, AM, managing director of the Finance Brokers Association of Australasia (FBAA), says, “Research tells us that brokers who earn the trust of their customers through excellent service have clients for life, and this repeat business is essential to success.”

There have been some challenging factors over the last 12 months for brokers, such as clawback, as a CoreData broker poll commissioned by the FBAA found that 94% of mortgage brokers had settled loans affected by clawback in 2024.

“The challenges of mortgage brokers reflect those of consumers, like rising property prices and the buffer rate, which continue to limit the borrowing capacity of some customers, including those who can afford the repayments,” adds White. “Brokers must be well-researched to meet these challenges and do a tremendous job.”

There is also strong competition between brokers, as their market share of the mortgage market is 77%, meaning that building long-term loyalty is crucial.

The Mortgage and Finance Association of Australia’s (MFAA) Value of Mortgage and Finance Broking 2025 report shows that 72% of a broker’s business comes from existing customers or referrals.

Anja Pannek, CEO of the MFAA, explains, “Highly trusted brokers play that vital role of being an educator, ensuring their homebuyer clients understand their financial situation and then assisting them to become finance-ready.”

The best brokers are also going beyond home loans and understand their clients’ greater needs. “This could involve offering other services such as asset or commercial finance or having a referral relationship with a brokerage that specialises in this area,” adds Pannek.

Australian Broker’s inaugural 5-Star Brokers 2025 received thousands of nominations, with the winners determined after being judged by a broad and diverse pool of industry advisers. The winners’ list spotlights those brokers who exemplify outstanding passion, dedication and a client-first mindset.

What it takes to be a 5-Star

An analysis of the reasons given by AB’s nationwide readers on what they value most in their brokers created an interesting profile of what it takes to deliver client satisfaction in 2025.

1. Expertise and strategic financial knowledge

Clients consistently prioritise brokers who possess:

deep product and market knowledge, including understanding of macroeconomic factors and investment strategies

technical skill in structuring complex loans, especially for investors, small business owners and “non-standard” cases

strategic thinking: clients want brokers who can plan not just for the present deal, but for long-term financial goals

educational capability: brokers who explain complex financial topics in layman’s terms are highly valued

Keywords: “knowledgeable,” “strategic,” “investment savvy,” “loan structuring,” “explaining complex topics”

2. Exceptional communication skills

Communication was one of the most recurring themes. Clients look for brokers who:

are accessible and responsive, even outside business hours

can translate financial jargon, especially for first-time buyers or financially anxious clients

maintain ongoing contact, including post-settlement support and check-ins

Keywords: “availability,” “clarity,” “responsive,” “follow-up,” “ongoing engagement,” “communication”

3. Authenticity, trust and care

Clients are drawn to brokers who:

show genuine care and treat them like people, not numbers

build trust and rapport through honesty, empathy and emotional intelligence

demonstrate integrity and transparency, even when delivering difficult news

Keywords: “trust,” “genuine,” “care,” “integrity,” “empathy,” “like family,” “goes above and beyond”

4. Client-centric personalisation

Buyers value brokers who:

offer tailored advice based on individual financial circumstances and life goals

understand each client’s “why” and build strategies accordingly

are proactive in reviewing and updating loan strategies to keep in alignment with the client’s changing needs

Keywords: “tailored,” “individual goals,” “customised,” “personal strategy,” “reviewing loans regularly”

5. Persistence and problem-solving

Clients deeply appreciate brokers who:

push hard to get deals over the line, especially for difficult lending scenarios

show determination, creativity and flexibility when facing obstacles

don’t give up easily and instead find workarounds and solutions

Keywords: “goes into bat,” “above and beyond,” “think outside the box,” “find a way,” “overcome issues”

6. Community and ongoing support

Clients value brokers who:

foster long-term partnerships, positioning themselves as more than just one-time service providers

create a community-like environment where clients feel supported and informed

provide ongoing education, useful tools (such as budgeting apps) and regular updates as added value

Keywords: “community,” “continued support,” “check-ins,” “tools,” “financial literacy,” “educational resources”

Data analysis of AB’s 5-Star Brokers 2025 client ratings

1. Service quality is more important than price or product variety

Conclusions:

Human-centred service (communication, responsiveness and customer care) is more highly valued than tangible factors like price or product breadth.

Clients want brokers who are engaged, knowledgeable and easy to work with, not just those who find the cheapest rate.

Pricing is least important, suggesting clients may accept higher costs if the service and trust are strong.

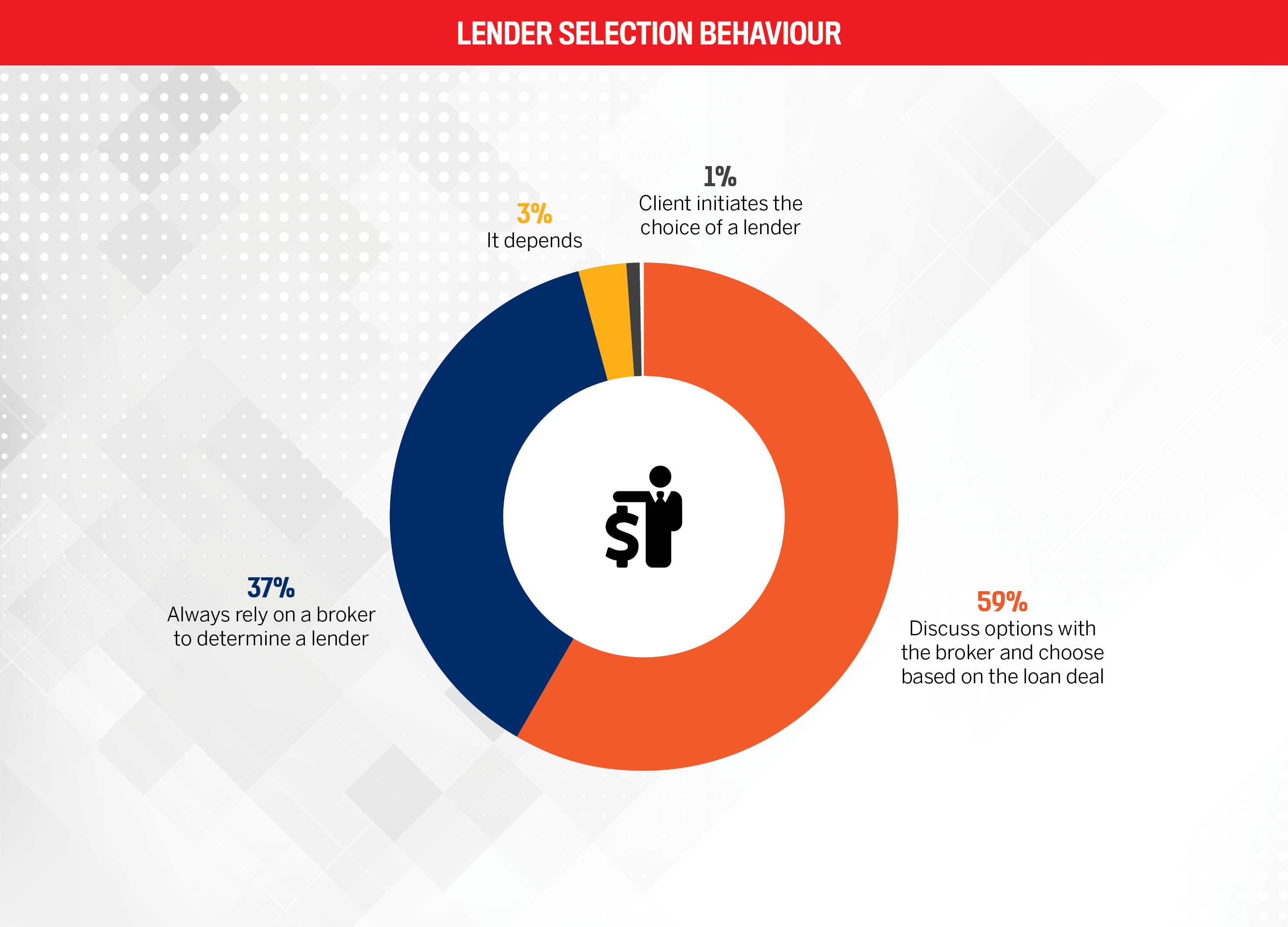

2. Clients trust and rely on their broker’s guidance

Conclusions:

96% of clients either completely rely on the broker or collaborate to choose the lender.

Only a tiny minority proactively choose lenders on their own.

This reinforces the importance of trust and expertise in the broker-client relationship.

Brokers are not just facilitators; they are advisers and decision-makers for most clients.

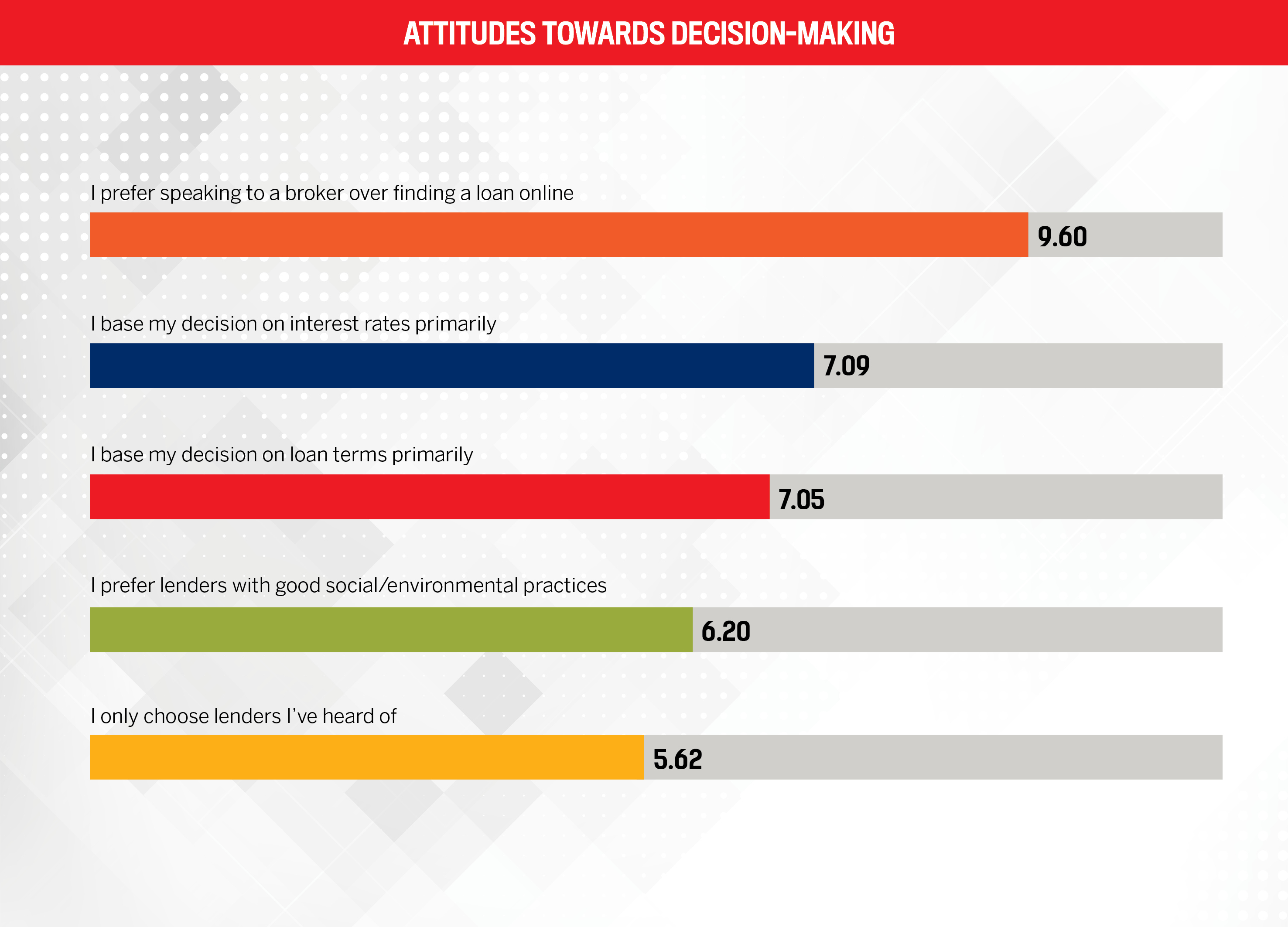

3. Clients prefer personal connection over purely rational factors

Conclusions:

The personal relationship with a broker is more important than online tools or DIY approaches.

Clients prefer guided, human interaction, even more than rates or loan terms.

Brand recognition and ethical practices matter less, though they are still relevant to a smaller segment.

Emotional trust and reassurance in a broker appear to outweigh purely logical considerations.

AB’s 5-Star Brokers 2025

For finance strategist Rachael Howlett, the past 12 months have been among the most dynamic of her career.

She has contended with fluctuating interest rates, evolving lender policies and rising cost-of-living pressures on everyday Australians, all while more than doubling her volume.

“Strategic thinking was absolutely essential. Clients were understandably feeling uncertain, and it became my mission to be their steady hand, translating complexity into clarity and helping them move forward with confidence,” she explains. “The challenge wasn’t just about securing finance; it was about restoring a sense of control and possibility for people navigating unpredictable times.”

“Exceptional service means clients leave feeling empowered, respected and like they’ve had someone in their corner the whole way through”

Rachael HowlettInfinity Group Australia

Responsiveness is the second biggest priority for customers according to AB’s data and is also part of Howlett’s brand. She takes pride in being accessible and proactive by replying to all client queries within the same business day, often within hours. Howlett says, “Whether it’s a quick update or a complex question, I want my clients to know they’re never left wondering.”

Staying across lender policy and product changes is non-negotiable for Howlett, who prioritises ongoing professional development, whether it’s attending webinars, lender training or industry workshops or collaborating with other brokers to share insights.

Part of her week is blocked out for a deep dive into product updates and policy shifts. “That is so I can ensure every recommendation I make is not only compliant, but strategic. In such a fast-moving space, being ahead of the curve is how I protect my clients’ best interests.”

As founder of his own firm, 5-Star Broker Khan Bungate commits to a punishing schedule. He says, “The last 12 months have been a massive growth phase. I’ve put in the hours – early mornings, late nights and every weekend – to build something that delivers real outcomes for my clients, not just tick-box approvals. It’s been a tough lending environment, and the biggest challenge has been navigating a market where the goalposts are constantly shifting.”

The challenge has been made harder with borrowing capacity being tighter, lender policies stricter and complex deals requiring more time and more care; however, Bungate feels this is where he excels. He leans into difficult scenarios and takes ownership of outcomes.

“If there’s a way forward, I’ll find it, and I’ll make sure it’s the right way forward for the client’s goals, not just a short-term fix,” he says. “That’s what sets the foundation for long-term success for them and for me.”

“I get a real buzz out of helping people win, whether that’s growing their portfolio, refinancing into a better structure or just getting their foot in the door. Their success is my success”

Khan BungateTactical Finance Australia

Part of Bungate’s way of working sees clients only work with him and not being passed off. He’s ably assisted with a back office but takes the lead on all client interaction.

“It’s not just about replying fast; it’s about making sure my clients feel supported and are never left guessing,” he adds. “Clear, consistent communication is one of the main reasons my clients trust me, especially when we’re dealing with complex or time-sensitive deals.”

Keen to keep offering clients value, Bungate takes a keen interest in rate changes, niche lender options and servicing models. He also stays in regular contact with BDMs, aggregators and other high-level brokers to stay ahead of what’s coming.

For him, it’s about constantly learning, testing, and refining his approach. He says, “I don’t just read the policies; I look for ways to apply them more strategically for the client. The sharper I stay, the more value I bring, and that directly impacts how far I can take my clients’ success.”

Turning things on their head, George Mylonakis has relished the industry challenges that have hit the industry.

“Over the past year, it has been a rewarding experience helping clients navigate the challenges of a changing property and finance market,” he says. “One of the biggest challenges has been managing client expectations in response to these shifts. It’s been about finding the right balance between optimism and realism, while providing clear, honest advice to support informed and confident decision-making.”

Responding to clients within four hours or on the same business day (based on status and urgency), whether it’s via text, phone or email, is another initiative Mylonakis has implemented.

He adds, “To me, being responsive isn’t just about replying fast or giving an answer without much detail; it’s about acknowledging the client and keeping them well informed every step of the way.”

“True leading service goes beyond the basics and is built on strong, lasting relationships grounded in trust, empathy and a commitment to continuous improvement”

George MylonakisMortgage Navigators

Driving forward and adding new expertise is a focus for Mylonakis, who is currently completing a Diploma of Financial Services (Commercial and Asset Finance) through the Institute of Strategic Management.

Every week, he also dedicates time to reviewing current lender policies from panel lenders and researching new or emerging lenders in the market. “I also enjoy and regularly participate in industry events hosted by MFAA, our aggregator LMG, including webinars and catch-ups with our lender partners,” he says. “I am always seeking to stay educated and aligned with current markets to provide continued holistic and well-informed advice to my clients.”

Showcasing the standards that Geoff Neilson has set at this firm, new or existing clients can expect a response within 24–48 hours of making contact.

Maintaining this has enabled the firm to continually drive business via referrals. “There is no better way to achieve new business than through ‘word-of-mouth’ from people who have dealt with Joslan Financial and experienced the quality and service level we provide,” says Neilson.

Advocating for clients is another of the firm’s fundamentals. This remains the same irrespective of whether they’re seeking a home loan or a complex commercial finance facility.

“Ongoing education is vital to maintaining technical expertise and product knowledge”

Geoff NeilsonJoslan Financial Services ATF Neilson Family Trust

Neilson explains, “We maintain a candid and robust communication process whereby each client is involved in the decision-making process as to which lender they ultimately select to provide their financial solution.”

The last year has created a landscape with a series of hurdles, which include maintaining industry compliance requirements (NCCP Lending Rules and Regulations, etc.), the NSW Government applying a payroll tax to broker commissions as a result of Revenue NSW applying an extension of the relevant “contractor provisions” to aggregators that operate within the marketplace, and also dealing with continued uncertainty around clawbacks. Joslan Financial has also had to address and contend with the removal of some prime White Label Loan Products from their product offering.

Customer service stands out

The biggest factor for clients in choosing and staying with a broker is service. This is where brokers can really move the needle and become valued partners. However, there are different ways of delivering success.

“To me, it’s about anticipating needs before they’re spoken. It’s about creating an experience that’s not just transactional, but transformational. I take the time to truly understand my clients’ goals, worries and life context, and then I show up with solutions, empathy and follow-through,” says Howlett.

While for fellow 5-Star Broker Mylonakis, consistency is paramount, and fulfilling clients’ needs with professionalism, respect and efficiency. “It involves being dependable and responsive while making sure every interaction is welcoming and puts the client at ease. It also means addressing any matters promptly and maintaining open, honest communication throughout the process.”

And the cornerstone for Bungate is a clear plan, strong communication and a genuine investment in helping clients succeed. He adds, “I’ll always go the extra mile for clients as long as they’re willing to meet me halfway. Especially on complex deals, I need clients to be responsive and upfront and trust the process. If they’re in, I’m all in. I’ll often work through the night if I have to, but I won’t compromise on doing it right.”

Aaron Christie-David

Atelier Wealth

Ali Ajani

ONE1ZERO Finance

Allana Stimpson

Infinity Group Australia

Arnab Baral

Cinch Loans

Bidhan Pandey

Wise Choice Mortgage and Finance

Damien Walker

Atelier Wealth

Dean LaFranais

InReach Finance

Devendra Verma

u-value Finance Services

Grant Armistead

Loan Market Armistead & Associates

Julian Choo

Julian Choo Loan Market

Leona Teal

GO Mortgage

Mark Lancaster

InReach Finance

Mathew Holtham

White Sand Financial

Mishkat Mahmud

HMRM Financial Services

Nathan Godillon

Only Finance

Nicole Williams

For Finance Sake

Preeti Kowshik

Home Loan Experts

Renee Wardlaw

RD Finance Solutions

Siddhartha Dhar Bajracharya

Home Loan Experts

Soraya Francke

Nashi Finance

Tain Moe Lwin

Givecredit Finance

Trevor Bryce

Reach Lending

Vinay Gehi

Copper Finance

Xavier Quenon

GO Mortgage