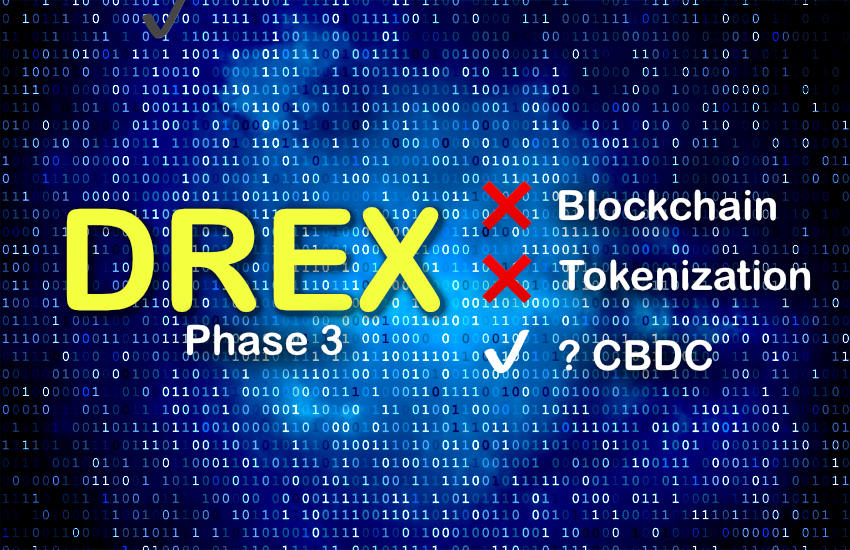

Last week during a presentation at the Blockchain Rio event, Brazil’s central bank Governor Gabriel Gallipolo spoke about the bank’s innovation agenda. The slide regarding DREX, the wholesale central bank digital currency (wCBDC) initiative, didn’t mention blockchain or tokenization. Nor was there much mention of CBDC for that matter.

DREX was always part of an open finance push by the Banco Central do Brasil, and it will remain so. But the focus of the next phase of work is now far narrower – to enable brokers to enable clients to use assets – stocks, bonds, and other assets – as loan collateral. So it’s now a lien reconciliation project that will use neither blockchain nor decentralization technologies, but will integrate with PIX, Brazil’s successful retail instant payment system. But some work using blockchain technologies will continue in the background.

There appear to be two issues driving the change of direction. The technical challenge of combining novel privacy solutions with Ethereum-based Hyperledger Besu was flagged during the first phase, resulting in delays. While the privacy solutions were progressing, the central bank did not consider them sufficient or battle tested. That first phase was quite narrow, involving a wholesale CBDC, tokenized deposits and digital treasury bonds (Federal public bonds), and smart contracts to manage their issuance, transfer and redemption. In the delayed second phase which ended last month, 16 participating consortia trialed various use cases. But the privacy solutions remain immature.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.