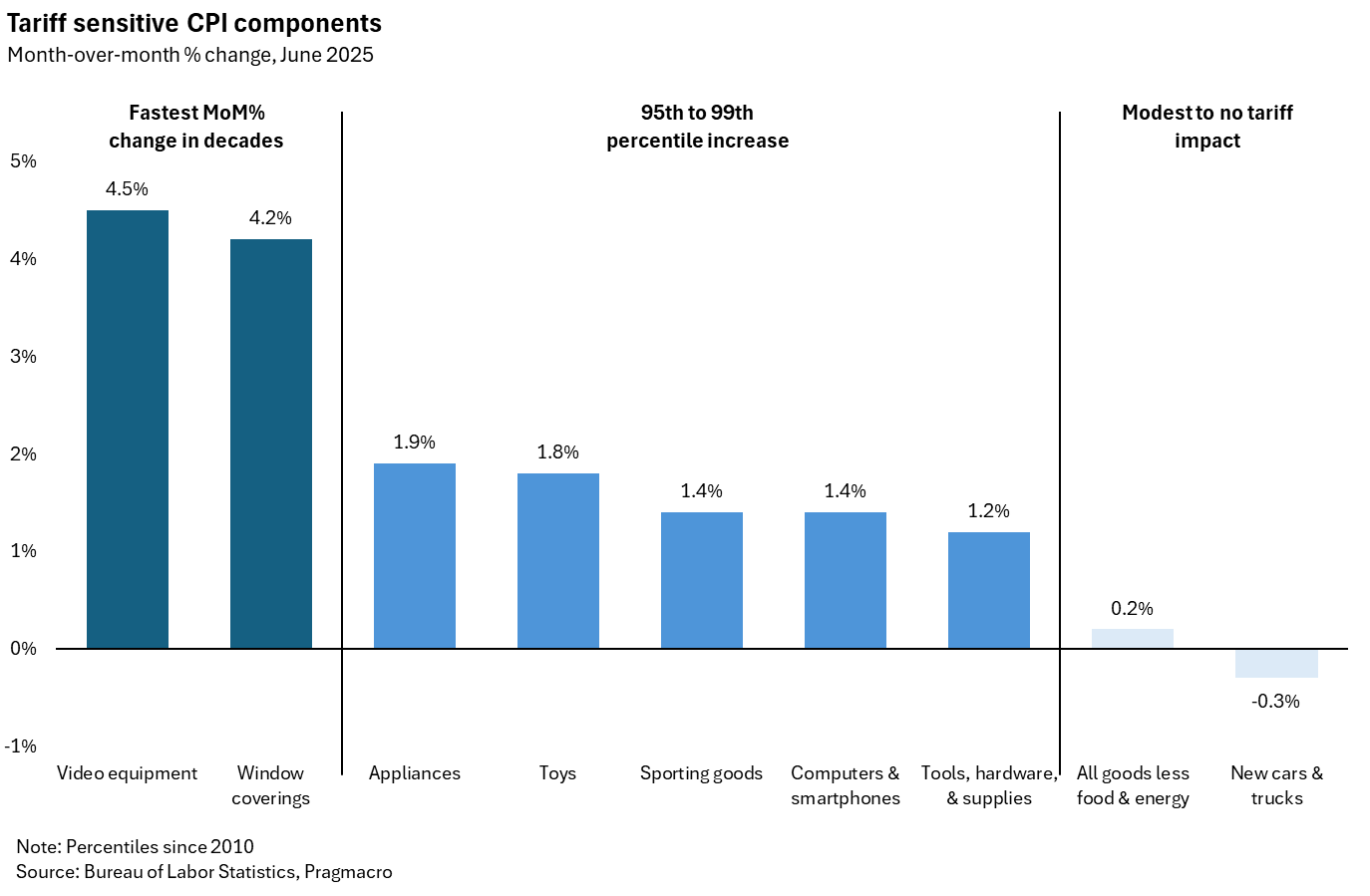

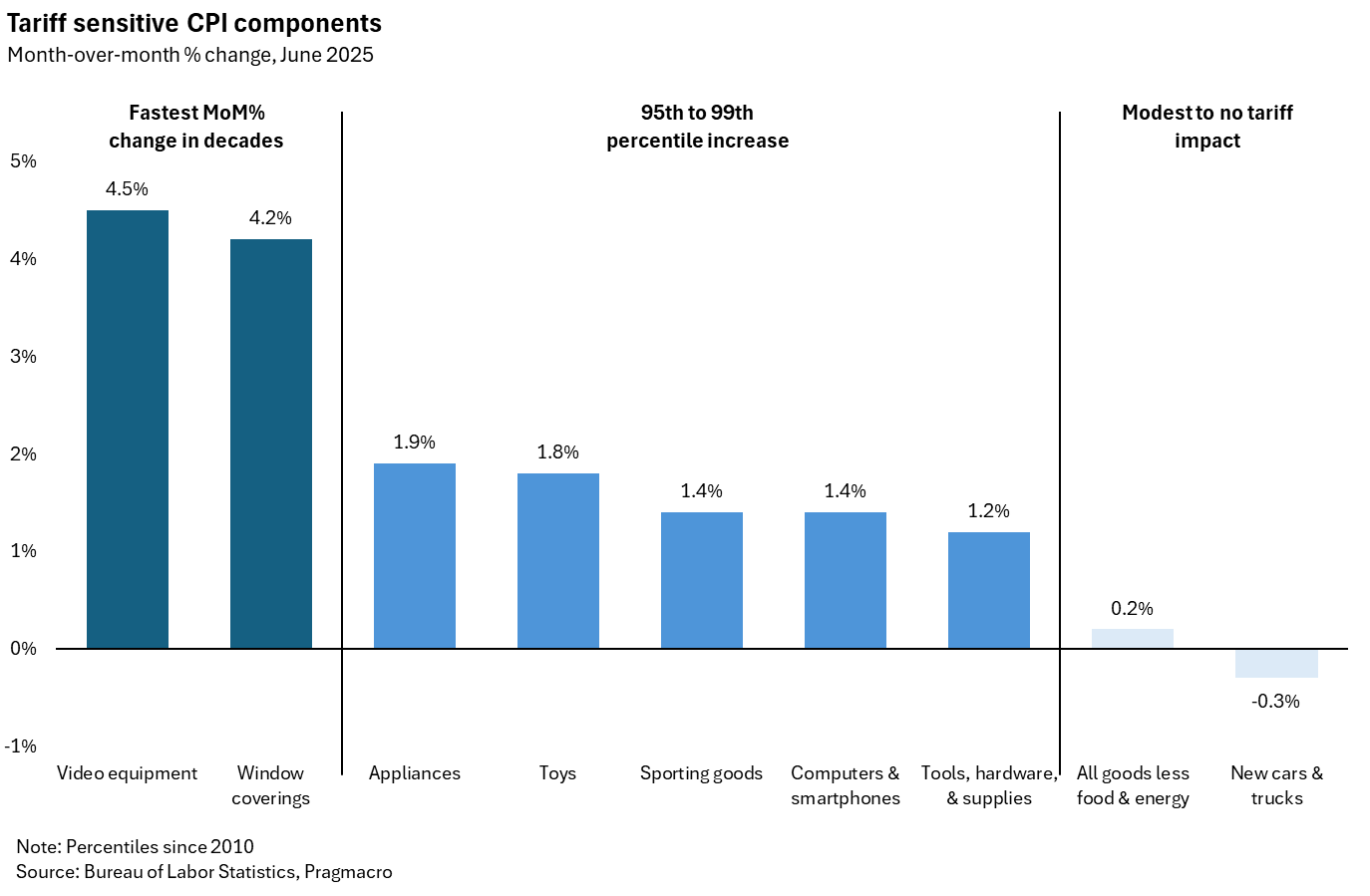

Last month's CPI release saw prices of tariff-exposed goods jump to multi-decade highs. They have yet to feed through to overall inflation but that seems like only a matter of time.

Posted by Pragmacro

![Tariffs are already feeding through to prices [OC]](https://www.europesays.com/wp-content/uploads/2025/08/5wavd92voeif1.png)

Last month's CPI release saw prices of tariff-exposed goods jump to multi-decade highs. They have yet to feed through to overall inflation but that seems like only a matter of time.

Posted by Pragmacro

11 comments

Source: [Bureau of Labor Statistics](https://www.bls.gov/cpi/tables/supplemental-files/)

Tool: Excel

I think it’s interesting to note that retaliatory tariffs and other trade measures imposed by other countries will on the other hand reduce export demand for many US products, which in turn should lower those prices. Bourbon is one example of a product that has become markedly cheaper after the tariff wars started.

Oh look mandatory inflation.

Inflation is primarily driven by high volume day to day items like food and energy. Increases in low volume and low cost items like the ones being most effected in your chart will not drive a significant increase in inflation. People will just buy less cheap plastic crap like toys and window coverings and just go longer before upgrading their electronics.

Are these tariffs low key good for the environment? Seems like they might drive a reduction in consumption of wasteful cheap goods.

irrelevant of US , such kind of plans are (if it works) for long term stability , not short term gains .

so increase in prices in short term is expected, while drop of prices and stability is expected long term

They should all give gold bars to avoid being subject to tariffs /s

Oh no! How can I afford the bare essentials now?? Like Toys and Smartphones!!

so the overall impact is 0.2%?

that’s a lot less than I was expecting based on the articles I’ve read

Easy. Just fire whoever made the chart until it shows that prices are getting lower. /s

Someone explain to me what the title means? If this is month over month inflation, why is the time period for only JUN? There’s no indictated starting time point in your title other than JUN so is the change involving just the month of JUN or is this a time series data set going up until JUN?

Also, what does data from 2010 in the notes mean? Is this from 2010 until JUN 2025? If so please update your title to avoid confusion.

Wow who could have seen that coming.

Comments are closed.