Austin, Aug. 13, 2025 (GLOBE NEWSWIRE) — High Energy Lasers Market Size & Growth Insights:

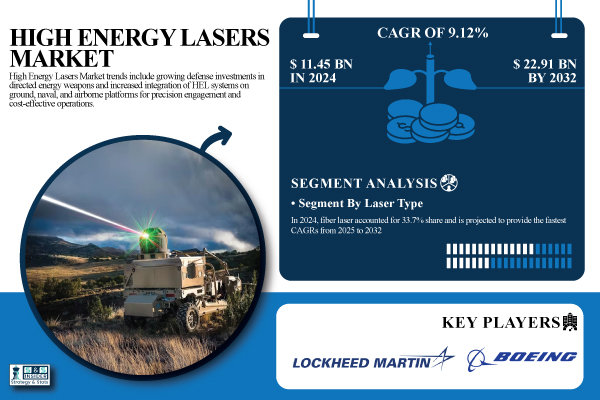

According to the SNS Insider,“The High Energy Lasers Market size was valued at USD 11.45 Billion in 2024 and is projected to reach USD 22.91 Billion by 2032, growing at a CAGR of 9.12% during 2025-2032.”

High Energy Lasers Market Gains Momentum with Precision Strike Capability and Scalable Defense Modernization Demand

High Energy Laser (HEL) market is taking increasingly high airflow by virtue of its accuracy in countering maximum aerial threats, including drone, rocket and missile activations. Because conventional kinetic weapons are limited in how fast they can respond and are costly, defense agencies have poured money into high-energy laser (HEL) systems, which engage at the speed-of-light and are low cost per-shot with scalable power. Tensions between countries are making it more important for defense modernization to take place. Finally, improved miniaturization, beam control and thermal management are allowing HEL to be integrated into more mobile and unmanned platforms to reach what are theoretically greater defense applications.

Get a Sample Report of High Energy Lasers Market Forecast @ https://www.snsinsider.com/sample-request/7832

Leading Market Players with their Product Listed in this Report are:

Lockheed Martin CorporationNorthrop Grumman CorporationRaytheon Technologies CorporationBoeing Defense Space & SecurityL3Harris Technologies Inc.BAE Systems plcRheinmetall AGLeonardo SpAMBDAThales GroupElbit Systems Ltd.Hanwha Aerospace Co. Ltd.CACI International Inc.General AtomicsDirected Energy Solutions Inc.EOS Defense SystemsBlueHaloQinetiQ Group plcIsrael Aerospace Industries Ltd.Textron Systems Corporation

High Energy Lasers Market Report Scope:

Report AttributesDetailsMarket Size in 2024USD 11.45 BillionMarket Size by 2032USD 22.91 BillionCAGRCAGR of 9.12% From 2025 to 2032Report Scope & CoverageMarket Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast OutlookKey Segmentation• By Laser Type (Fiber Laser, Solid-State Laser, Chemical Laser, Free Electron Laser, Gas Laser)

• By Application (Directed Energy Weapons, Border Security, Industrial Processing, Communication and Research & Development)

• By Power Output (Less than 20 kW, 20–100 kW and Above 100 kW)

• By Platform (Land-Based, Airborne, Naval and Space-Based)

• By End-User (Defense Forces, Homeland Security Agencies, Industrial Sector and Research Institutions)

Purchase Single User PDF of High Energy Lasers Market Report (20% Discount) @ https://www.snsinsider.com/checkout/7832

Key Industry Segmentation

By Laser Type

Fiber lasers accounted for 33.7% of the market in 2024 and are forecast to have the highest growth rate through 2032. These features make them excellent candidates for integration on ground vehicles, naval ships, and unmanned platforms, offering better beam quality and electrical efficiency compared to the current generation of solid state lasers as well as a smaller footprint. Thermal Management Coupled with scalability through modular design and low maintenance cost features, fiber lasers due to their exceptional performance characteristics are supporting a plethora of defense applications from drone neutralization to missile interception resulting in rise in R&D and global defense deployment of fiber lasers.

By Application

The largest share of the Directed Energy Weapons (DEWs) market was 47.4% in 2024, due to their ability to provide efficient countermeasure coverage against aerial threats such as drones and missiles, as well as their lower operating cost. They offer speed-of-light engagement capabilities with a high degree of precision and remarkably low collateral damage, thus, ideal for modern warfare, prompting nations such as the U.S., Israel, India and the U.K to expedite their deployment.

The fastest growing segment is expected to be Research & Development, as continued beam control, thermal management, and compact power systems innovation is supported by government efforts and prototyping from 2025 to 2032.

By Power Output

The High Energy Lasers power range market has a good-assured defense with 20–100kW power range segment that sets an optimum balance between mobility and lethality and accounted for ~44.6% of the market in 2024 Proven fielding into existing military vehicles, these systems are very much in-service across land, airborne, and naval platforms for counter-drone and short to mid-range defense.

The growth of above 100kW segment is expected to be the highest between 2025 to 2032 owing to increasing demand for long-range threat neutralization coupled with technological advancements in power scaling, beam combining, and thermal management.

By Platform

The land-based segment of the High Energy Lasers market accounted for 43.4% share in 2024 as they are extensively integrated into ground combat vehicles, mobile units, fixed installations, and other large military campaigns. They are essential for against UAVs, mortars and rockets in battlefield and border security situations.

Between 2025 and 2032, the naval segment is expected to register the highest CAGR owing to HEL integration on naval platforms and the ability of HELs to interdict maritime-based threats, such as missiles and drones, more accurately.

North America Leads 2024 HEL Market While Asia Pacific Set to Surge Through 2032 with Rapid Defense Modernization

High Energy Lasers (HEL) market had the maximum share in 2024 with massive fighter asset of 41.5% share and was led by North America due to extensive defense spending, high R&D activity and early adoption on land, naval, and airborne platforms in the U.S. Asia Pacific is estimated to grow at the highest rate from 2025 to 2032, followed by due to low border tensions, dramatic defense modernization, and HEL deployment initiatives driven by China. Through various collaborative R&D and modernization programs, Europe is steadily building its HEL footprint.

Emerging markets of MEA and Latin America includes rising threat of UAV, asymmetric warfare, and border surveillance system and counter-drone system investments.

Do you have any specific queries or need any customized research on High Energy Lasers Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/7832

Recent Developments:

In May 2025, Lockheed continues active testing of HELIOS under the Navy’s Directed Energy and Electric Weapon System programs, focusing on validating performance and preparing additional ships for future integration.

USP of High Energy Lasers Market Report

• Power density and performance benchmarks – Helps you evaluate power output, energy efficiency, and beam control precision across naval, airborne, and ground-based HEL platforms.

• Operational readiness and deployment index – Helps you track HEL unit deployments, maintenance cycles, and transition timelines from laboratory development to full military field deployment.

• Target neutralization and effectiveness metrics – Helps you assess kill probability, engagement success rates, and response latency across different target types in simulated and real-world conditions.

• Defense modernization and strategic alignment index – Helps you measure HEL alignment with national defense strategies, R&D budget allocations, and technology prioritization in defense planning.

• Subsystem cost trajectory and modularity score – Helps you understand cost breakdowns, forecast price declines for key modules, and assess modularity for upgrade potential.

• Simulation-to-field performance variance – Helps you identify deviations between controlled testing and field operations due to weather, atmospheric, and operational constraints.

• Competitive landscape – Helps you analyze leading HEL suppliers’ market positioning, innovation strengths, and strategic partnerships within the directed energy weapons sector.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.