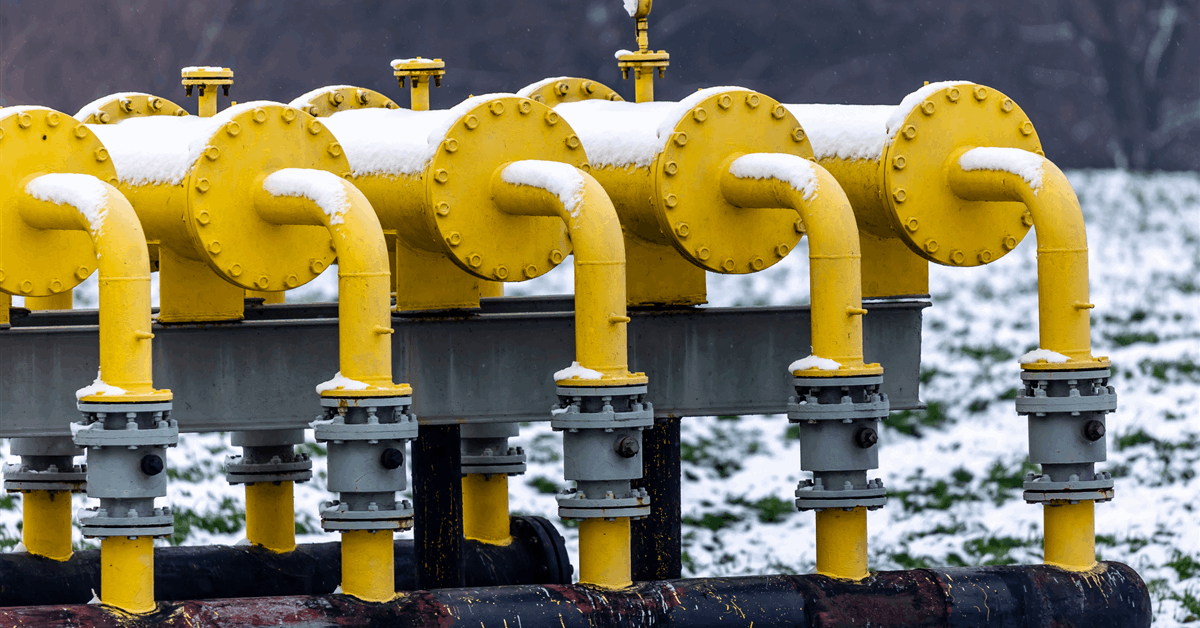

The European Bank for Reconstruction and Development (EBRD) has committed a two-year revolving loan of EUR 500 million ($585.17 million) to help state-owned integrated energy company Naftogaz Group procure natural gas for Ukraine.

The European Commission signed an agreement with EBRD to guarantee 90 percent of the loan. “For the first time, the loan is provided under a European Union guarantee within the UIF [Ukraine Investment Framework] HiBar program and will not require a sovereign guarantee from Ukraine”, Naftogaz said in a statement on its website.

The Commission said separately, “Replenishing the depleted gas reserves of Ukraine with the help of this financing package will be key to allow the country’s critical infrastructure and population to access energy sources during the winter”.

Ukraine had 60.16 terawatt hours of stored gas, a filling level of 18.7 percent, as of Tuesday, according to the latest update on the online monitoring dashboard of the European Network of Transmission System Operators for Gas.

Contracts supported by the financing will be awarded competitively, with over 30 suppliers prequalified.

Arvid Tuerkner, EBRD managing director for Ukraine and Moldova, said, “We are proud to support Naftogaz with this new loan – our largest ever signed in Ukraine. Our financing supports Ukraine’s energy security – a key priority for our investments there – and will help ensure Ukrainians have sufficient energy and heating this upcoming winter and beyond”.

The London-based EBRD has now provided four funding packages for Naftogaz since Russia invaded Ukraine in 2022, according to the bank. The latest “brings the total bank financing to Naftogaz to EUR 1.6 billion, including EUR 1.27 billion in EBRD loans and EUR 330 million (NOK 3.63 billion) in grants provided by Norway via EBRD”, the bank said separately.

“The transaction will also support the reform objectives of previous EBRD engagement, with Naftogaz working towards the integration of the Ukrainian gas market with that of the EU”.

“The EBRD is Ukraine’s largest institutional investor and has deployed more than EUR 8 billion there since the start of the war”, it added. “Its five investment priorities in Ukraine are support for energy security, vital infrastructure, food security, trade and the private sector”.

The Commission said, “Upon reimbursement of the 2-year loan, the EBRD and the Commission will reallocate the available guarantee coverage to capital investment projects enabling long-term private and public investments, for instance in the renewables sector”.

The Ukraine Investment Framework is part of the Ukraine Facility, a stable European Union funding platform to support Ukraine amid the war. The facility offers up to EUR 50 billion for 2024-27. The Ukraine Investment Framework aims to mobilize EUR 40 billion of investments for recovery, reconstruction and modernization.

To contact the author, email jov.onsat@rigzone.com

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ‘‘ +

‘‘ +

‘‘;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 76 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});