August 18, 2025 | 12:00am

Oil prices have tumbled back toward $60 per barrel. This is a dramatic reversal from the crisis-driven surge that gripped markets just two months ago. Back then, analysts were predicting a worst-case scenario of $120 crude as Israel launched airstrikes against Iran.

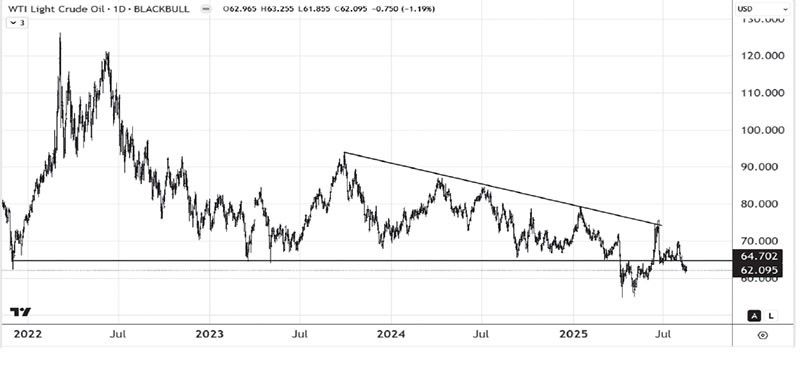

West Texas Intermediate (WTI) crude fell to $62.095 per barrel last Friday, while Brent crude declined to $65.615 per barrel. Both showed significant declines from their June peaks. The retreat reflects not only an easing of geopolitical tensions but also shows the market’s growing recognition of fundamental oversupply pressures that geopolitical premiums had temporarily masked.

From crisis to calm

The oil rally began on June 13 when Israel launched unprecedented strikes on Iran’s nuclear facilities. This sent crude futures jumping $5 a barrel that day with WTI oil surging 7.3 percent to $72.98 per barrel and Brent gaining seven percent to around $74.23 per barrel. Analysts at the time warned that oil prices could surge to $120 per barrel if the Israel-Iran conflict damaged Iranian oil infrastructure or impeded passage through the Strait of Hormuz.

The crisis deepened when the US joined and launched its own strikes against Iranian nuclear facilities. President Trump’s demand for “unconditional surrender” from Tehran pushed WTI crude and Brent to as much as $78.21 and $81.50 per barrel, respectively.

Worst-case fears failed to materialize

Oil prices quickly retreated on news of a ceasefire agreement on June 24, ending the 12-day conflict and eliminating the geopolitical risk premium that had driven the rally. None of the worst-case fears materialized – Iranian oil infrastructure remained largely intact, the Strait of Hormuz stayed open, and global supply chains continued uninterrupted.

Supply reality reasserts

The geopolitical premium proved short-lived. Global crude oil prices are now lower than they were before Israel attacked Iran. The swift retreat shows how markets have recalibrated their assessment of both the conflict’s impact on actual supply and the underlying fundamentals.

The U.S. Energy Information Administration (EIA) has slashed its Brent crude oil price forecast. In its August Short-Term Energy Outlook, it expects global oil prices to fall from $71 per barrel in July to an average of around $58 per barrel in 4Q25, before declining to around $50 per barrel in early 2026.

OPEC+ production surge

Key to the price decline is OPEC+’s decision to accelerate the pace of production increases. The cartel began raising output in April with a modest hike of 138,000 barrels per day (bpd). This was followed by larger hikes of 411,000 bpd in May, June and July, 548,000 bpd in August, and now 547,000 bpd for September. In a separate move, the UAE is planning to add roughly 2.5 million bpd or equivalent to 2.4 percent of global consumption.

This decision marks a full reversal of the OPEC+’s output cuts in previous years to support prices. The group reversed course this year in a bid to regain market share, spurred in part by calls from Trump to ramp up production.

Record US output compounds glut

Adding to the supply glut, the EIA forecasts US crude oil production to hit a record 13.6 million bpd in December 2025. The combined US and OPEC+ increases are projected to drive global stockpiles by more than two million bpd in Q4 2025 and Q1 2026. This will create a global supply surplus of 1.7 million bpd in 2025, and a surplus of around 1.5 million bpd in 2026.

Wall Street consensus turns bearish

As oil prices settle near $60, the market appears to be pricing in a return to supply-demand fundamentals rather than geopolitical risk premiums. All major investment houses have been cutting forecasts throughout 2025, with consensus now around a $60-66 range for this year, dropping to the mid-$50s to low-$60s for 2026. This outlook is consistent with the EIA’s most recent forecast projecting Brent crude to average $58 in the fourth quarter of 2025 and around $50 in early 2026.

Peace dividend ahead

Adding to prospects of lower oil prices, the ongoing peace talks between Trump and Putin over Ukraine could result into a ceasefire agreement. This would potentially remove another geopolitical risk premium from oil markets. Such a development would deliver further relief to consumers and oil-importing nations like the Philippines.

For now, the fundamentals appear to be winning. With forecasts pointing to $50 oil next year, $60 in the future is looking less like a floor and more like a ceiling in an increasingly well-supplied market.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].