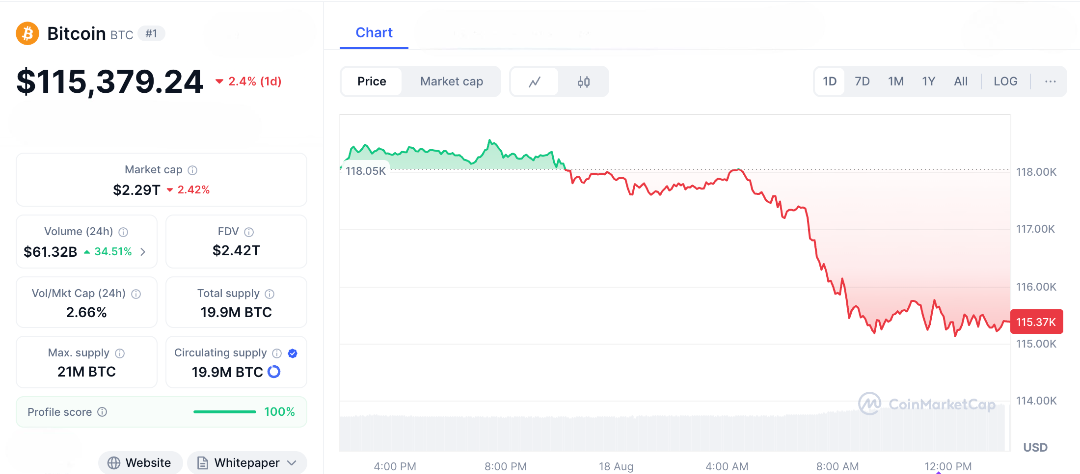

Today, Bitcoin’s price is at a crucial point, influenced by high ETF investments and signals from the Federal Reserve. Traders are wondering: Will Bitcoin reach new highs or fall due to uncertainty? For years, Bitcoin’s price has been linked to the broader economy. It rises when there’s plenty of money in the market and falls when that’s not the case. During times of economic stimulus from central banks, Bitcoin soared past $100,000. Now, it sits at around $116,000, on the edge between potential gains and risks. This situation is full of possibilities, with the chance for both significant gains and losses. Share this if you’re keeping an eye on Bitcoin’s next move!

Bitcoin’s Journey—From Satoshi to Spot ETFs

Bitcoin started with Satoshi Nakamoto’s idea of a peer-to-peer digital cash system, free from central bank control. Over time, its price has become a global indicator, influenced by Wall Street and economic trends. The introduction of spot Bitcoin ETFs made a big impact, allowing both regular and institutional investors, like BlackRock and Fidelity, to invest billions into Bitcoin. These funds have provided stability during volatile times.

However, the market isn’t always stable. Last week, there were net outflows of $643 million from Bitcoin ETFs, breaking a streak of inflows and causing some worries. This kind of reversal has happened before when profit-taking and regulatory issues led to sell-offs and lower prices.

Despite these fluctuations, the overall trend remains strong. Total inflows since the ETFs started have exceeded $50 billion, showing Bitcoin’s lasting appeal. Meanwhile, large investors, known as “whales,” continue to buy more Bitcoin, likely believing that current dips will lead to future gains.

The Fed Doves and Bitcoin’s Next Move

Enter the Fed doves policymakers advocating softer monetary policy to boost growth. Recent comments from Chair Jerome Powell and colleagues hint at possible rate cuts as early as September, with markets pricing in an 89% chance of easing to support slowing job data and tame inflation.

If the Federal Reserve adopts a more lenient approach, it could inject a lot of money into the market, which usually benefits riskier assets like Bitcoin. Think back to the time after the pandemic when low interest rates caused a surge in crypto investments. Lower borrowing costs make speculation more attractive, possibly pushing Bitcoin prices higher as investors look for better returns.

However, there’s a need for caution. Some experts warn that if rate cuts happen due to economic problems rather than strength, Bitcoin might drop along with stocks, as seen in past recessions. Everyone is watching Federal Reserve Chairman Powell’s upcoming speech at Jackson Hole. If he doesn’t signal a lenient approach as expected, it could lead to a significant sell-off, keeping traders on high alert.

ETF Tug-of-War and Market Hype

Today’s update adds excitement to the Bitcoin story. The price of Bitcoin has dropped by 2.4% over the past 24 hours, with trading volumes increasing as traders prepare for possible price changes. Social media is buzzing with optimism, with some large investors hoping Bitcoin will hit $120,000, and analysts predicting it could reach $145,000 by the end of the year if ETF investments increase again.

Recently, Ether ETFs attracted $640 million, bringing positive energy to the crypto market. However, Bitcoin ETFs have seen money flowing out for the seventh day in a row, with $157 million being withdrawn, indicating caution despite the optimism.

Charts are showing positive signs, with three main indicators suggesting a significant upward move. This situation highlights the bigger picture, ETFs are becoming more popular, which supports long-term demand for Bitcoin. At the same time, the possibility of the Federal Reserve lowering interest rates could cause short-term price spikes. This combination makes the current moment both tense and exciting for those keeping an eye on Bitcoin.

Could Bitcoin Prices Surge Higher?

Could Bitcoin break through to higher prices? Many optimists believe so. If interest rates are cut, leading to increased investment and ETF inflows, some bold predictions see Bitcoin’s price surpassing $200,000 by 2025 end. Analysts forecast a range from $135,000 to $199,000, driven by the momentum of ETFs and the lingering effects of previous Bitcoin halving events.

However, risks still exist. If ETF outflows increase or the Federal Reserve takes a more cautious stance, Bitcoin could face challenges from rising interest rates or geopolitical tensions. Technical charts show strong support at $110,000, but if prices fall below this level, it could lead to further declines toward $100,000. This creates a high-stakes situation with bulls and bears competing for control.

For traders and investors, the upcoming weeks could be crucial for Bitcoin’s future. The interplay between ETF investments and Federal Reserve signals showcases Bitcoin’s unique position as a volatile asset with the potential for significant gains or losses.

Whether Bitcoin soars due to favorable conditions or faces setbacks from market forces, its trajectory could reshape financial portfolios and define the future of cryptocurrency. Share this story widely, as the next developments in the crypto market could either elevate new leaders or disrupt existing ones.

FAQs

What is driving Bitcoin price today?

Bitcoin price is influenced by ETF outflows and expectations of Federal Reserve rate cuts, creating a volatile mix.

Could Bitcoin price break higher soon?

Yes, dovish Fed policies and renewed ETF inflows could push Bitcoin price past $120,000, though risks persist.

Why are ETF flows impacting Bitcoin?

Spot Bitcoin ETFs reflect institutional demand, with inflows boosting Bitcoin price and outflows signaling caution.

What risks could cause Bitcoin price to slide?

Hawkish Fed moves, economic weakness, or sustained ETF outflows might drive Bitcoin price toward $100,000 or lower.

Is Bitcoin a good investment now?

Bitcoin price shows long-term potential with ETF adoption, but volatility demands thorough research and risk awareness.