Saudi Arabia Cryptocurrency Market Overview

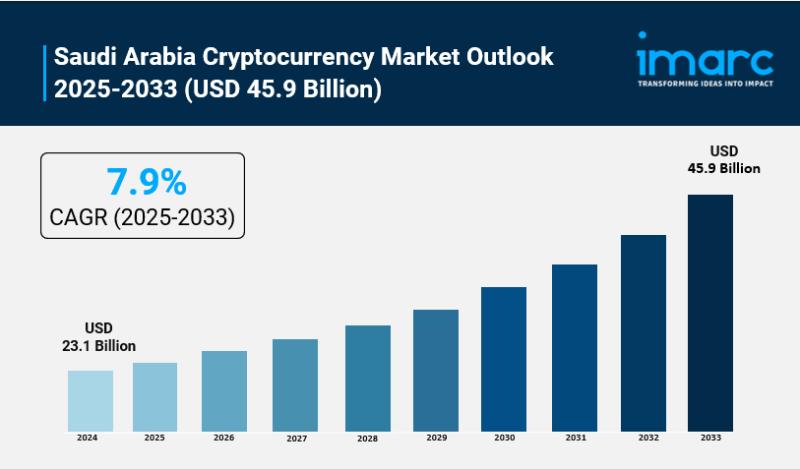

Market Size in 2024: USD 23.1 Billion

Market Size in 2033: USD 45.9 Billion

Market Growth Rate 2025-2033: 7.9%

According to IMARC Group’s latest research publication, “Saudi Arabia Cryptocurrency Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The Saudi Arabia cryptocurrency market size was valued at USD 23.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.9 Billion by 2033, exhibiting a CAGR of 7.9% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Cryptocurrency Market

Enhancing Trading Algorithms: AI-powered trading bots and algorithms are revolutionizing cryptocurrency trading platforms, enabling faster transaction processing and improved market analysis for institutional and retail investors.

Strengthening Security Infrastructure: Advanced AI-driven cybersecurity systems are protecting cryptocurrency exchanges and digital wallets from sophisticated cyber threats, ensuring safer transactions across the Kingdom.

Optimizing Mining Operations: AI technologies are improving cryptocurrency mining efficiency by optimizing energy consumption and computational power, leveraging Saudi Arabia’s cost-effective energy resources.

Supporting Regulatory Compliance: AI-based compliance systems are helping cryptocurrency platforms adhere to evolving regulatory frameworks, ensuring seamless operations within Saudi financial guidelines.

Facilitating Smart Contract Development: AI is accelerating the development of intelligent smart contracts for DeFi platforms, enabling more sophisticated financial services and automated transactions in the Saudi market.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-cryptocurrency-market/requestsample

Saudi Arabia Cryptocurrency Market Trends & Drivers:

Saudi Arabia’s cryptocurrency market is experiencing unprecedented growth, driven by Vision 2030’s digital transformation initiatives and significant government backing. The Saudi Central Bank’s participation in the mBridge project, collaborating with UAE, China, Thailand, and Hong Kong, demonstrates the Kingdom’s commitment to exploring central bank digital currencies and blockchain technology. With over 200 fintech companies operating in the country and approximately USD 1 billion invested in fintech startups in 2023, the ecosystem is rapidly maturing. The government’s proactive approach toward blockchain innovation, coupled with institutional investments from the Public Investment Fund’s backing of crypto-friendly ventures, is creating a robust foundation for cryptocurrency adoption.

The surge in institutional interest is transforming Saudi Arabia’s cryptocurrency landscape, with financial institutions increasingly exploring digital assets for portfolio diversification. Major partnerships, such as SEIYAJ TECH’s collaboration with Reltime in July 2024 to accelerate government services digitalization through blockchain technology, highlight the growing integration of cryptocurrency solutions across sectors. The emergence of decentralized finance (DeFi) platforms is revolutionizing traditional financial services, offering peer-to-peer transactions without intermediaries. This trend is particularly significant as Saudi Arabia positions itself as a regional fintech hub, with the Eastern Region’s energy sector exploring blockchain applications for oil and gas operations, while the Western Region’s trade and tourism industries adopt cryptocurrency for cross-border transactions.

The Kingdom’s strategic focus on reducing cash usage through digital payment solutions is driving cryptocurrency adoption across various applications. Trading platforms are experiencing heightened activity as both retail and institutional investors participate in the volatile yet profitable cryptocurrency markets. Remittance services are leveraging blockchain technology to provide faster, cost-effective cross-border transfers, particularly appealing to the substantial foreign population in Saudi Arabia. The payment sector is witnessing gradual integration of cryptocurrency solutions, with merchants exploring digital currency options to reduce transaction costs and enhance security, supported by the comprehensive digitalization of financial services nationwide.

Saudi Arabia Cryptocurrency Industry Segmentation:

The report has segmented the market into the following categories:

Component Insights:

●Hardware

●Software

Type Insights:

●Bitcoin

●Ethereum

●Bitcoin Cash

●Ripple

●Litecoin

●Dashcoin

●Others

Process Insights:

●Mining

●Transaction

Application Insights:

●Trading

●Remittance

●Payment

●Others

Breakup by Region:

●Northern and Central Region

●Western Region

●Eastern Region

●Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=20581&flag=E

Recent News and Developments in Saudi Arabia Cryptocurrency Market

June 2024: The Saudi Central Bank joined the mBridge project as a full participant alongside UAE, China, Thailand, and Hong Kong banks, exploring the viability of central bank digital currencies using blockchain technology for cross-border payments.

July 2024: SEIYAJ TECH, a Saudi technology localization company, partnered with Reltime, a blockchain services provider, to accelerate digital transformation of Saudi government services by incorporating blockchain technology to enhance compliance and security for the public sector.

October 2024: Saudi Arabia was confirmed as the fastest-growing cryptocurrency economy in the MENA region with 154% year-over-year growth, focusing on blockchain innovation, central bank digital currencies, gaming, and fintech innovation according to Chainalysis reports.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.