(Bloomberg) — Intercontinental Exchange Inc. will not add European Union joint debt to its sovereign bond indexes in a blow to the bloc’s ambitions to attract a larger pool of investors and lower its borrowing costs.

The Atlanta-based firm cited a lack of consensus on how best to classify the issuer, according to a notice to clients seen by Bloomberg. ICE had asked investors “Should European Union debt qualify as Sovereigns?” in a consultation which closed at the end of June. It rejected a similar proposal last year.

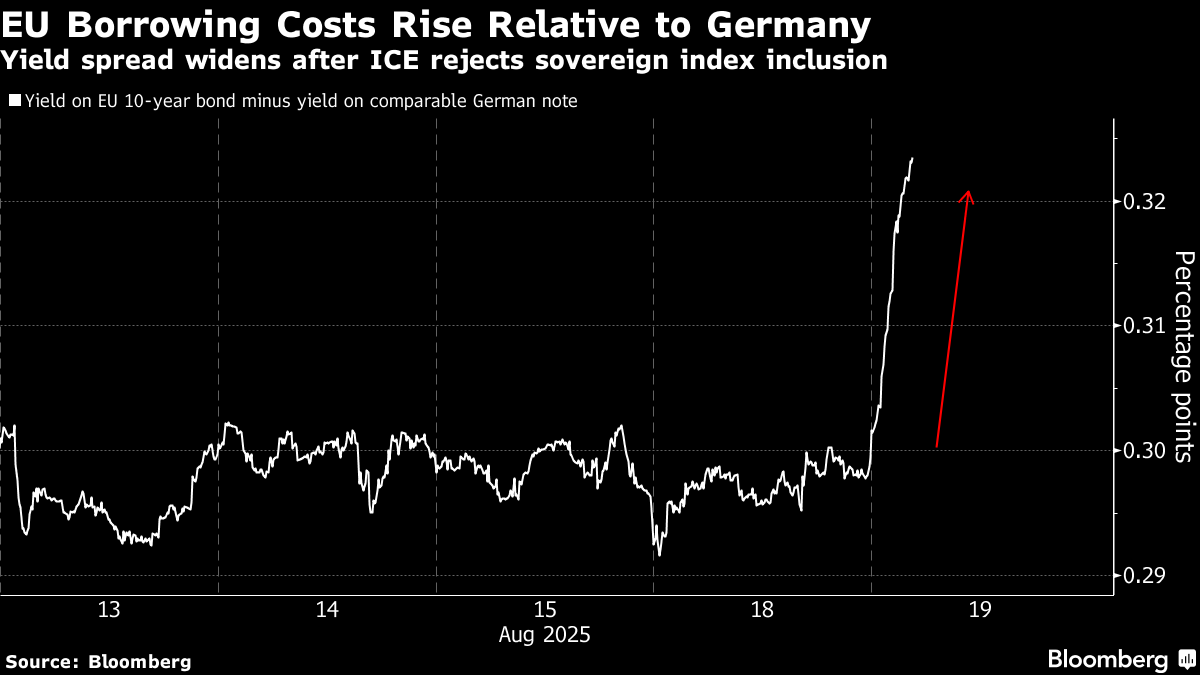

EU bonds fell after the Bloomberg report. The yield on 10-year EU notes rose four basis points, lagging every other European government bond market.

The EU is currently treated as a supranational issuer by major index compilers, which officials cite as a key reason why its borrowing costs are higher than those of European governments with similar ratings. It has been lobbying to change its classification.

While “some stakeholders continued to support” updating ICE’s definition of a sovereign issuer to include the EU, others said the bloc does not meet the “common understanding of ‘sovereign,’” the notice said. “Even supporters of the change commented that the EU is something neither/nor, something of a sub-sovereign or supra-sovereign agency rather than a typical sovereign entity.”

The debate around reclassifying the EU is contentious: the bloc is politically divided on many traditional hallmarks of sovereignty, including joint debt issuance itself. At the same time, several investors have publicly backed including EU securities in government indexes.

As well as ICE, MSCI Inc., S&P Global and Bloomberg Index Services Limited (BISL) have also turned down similar proposals, though it’s possible they will revisit the question. BISL is a subsidiary of Bloomberg LP, the parent of Bloomberg News.

The EU’s campaign for sovereign status has included efforts to improve the liquidity of its bonds, such as enticing banks to provide better pricing and creating a repo facility. Derivatives exchanges are also vying to create a futures market for EU debt: ICE itself launched a contract last year, while Deutsche Börse AG’s Eurex will unveil its offering in September.

If eventually realized, broad inclusion in key sovereign bond benchmarks could have the biggest impact.

An EU survey of investors in 2023 found index inclusion was “the single-most important remaining step in order for EU bonds to trade and price similarly to European government bonds.”

©2025 Bloomberg L.P.