But blindly following them has its pitfalls. By the time their trades become public, the entry price may have changed. And what works for their portfolio, risk profile, or horizon may not suit retail investors.

Ashish Kacholia is a classic case in point this year. Despite his reputation as one of Dalal Street’s sharpest stock pickers, several of his bets have struggled in 2025. Some names are down as much as 40%, raising eyebrows.

Read on to know more.

Who is Ashish Kacholia?

Known for uncovering lesser-known small and mid-cap companies with high growth potential, Ashish Kacholia has earned the title of ‘Big Whale’ among market watchers.

Starting out in the 1990s, he built a reputation for backing emerging companies that later turned into multibaggers. Today, his portfolio is closely tracked by both seasoned investors and retail traders eager to spot the next breakout story.

Here are some of his portfolio stocks that have struggled so far in 2025, and could be candidates for a rebound.

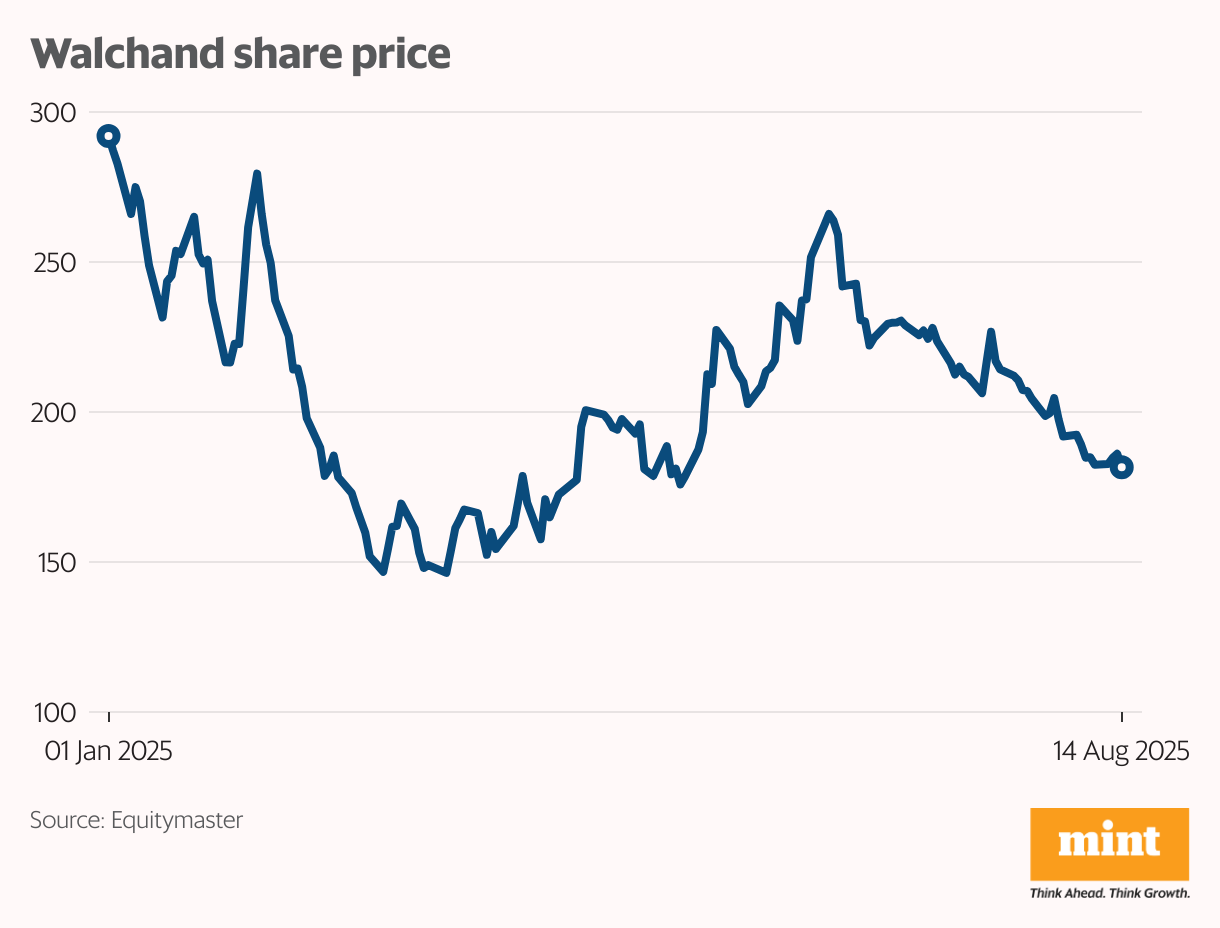

#1 Walchandnagar Industries

Walchandnagar Industries, with a legacy of over a century in heavy engineering, continues to operate across hi-tech manufacturing, engineering products, and project execution. Its business spans heavy engineering, foundry and machine shop, and other niche services.

As of June, Kacholia held around 2.6% in the company, valued at approximately ₹320 million. Despite this backing, the stock has struggled to hold ground through 2025.

Operationally, the company ended FY25 with an order book of ₹9.1 billion, boosted by fresh orders worth ₹2.5 billion. A standout win was a record-setting 64-metre HF kiln order, the longest of its kind worldwide. Heavy engineering made up 77% of FY25 revenues, followed by foundry & machine shop at 14%, while exports remained modest at just 4%.

Walchandnagar has laid out a capex plan of ₹8.4 billion to modernise key machinery, of which ₹3.8 billion has already been deployed, with the rest expected by Q3FY26. In March, the company also acquired a 60% stake in Aicitta Intelligent Technology, marking a strategic entry into intelligent automation.

#2 Fineotex Chemical

Fineotex Chemical, a specialty chemicals manufacturer, has built a strong reputation in textile auxiliaries and performance chemicals while diversifying into construction, water treatment, fertilizers, leather, and paints. Its portfolio spans over 470 formulations, ranging from dyeing and finishing solutions to hygiene and cleaning products.

Kacholia owned about 2.7% in the firm as of June, a stake valued at nearly ₹765 million. Despite its diversified product base, Fineotex’s stock has remained under pressure in 2025.

In FY25, the company reported income of ₹5.6 billion, broadly flat year-on-year, while net profit slipped to ₹1.1 billion from ₹1.2 billion in FY24 as higher brand-building costs weighed on margins. Return ratios moderated, with ROCE at 23.6% and ROE at 18.3%, reflecting a larger capital base following recent fundraises.

Fineotex operates three manufacturing facilities in India and Malaysia, with a total capacity of 104,000 MTPA, and utilisation at 64% as of Q1FY26. Capacity expansion is in progress, with the first phase of its Ambernath plant—adding 18,000–20,000 MTPA—expected by end-FY26. The company has global partnerships with Eurodye-CTC (Belgium) and HealthGuard (Australia), alongside R&D collaborations in India and Malaysia. To fuel growth and potential acquisitions, it raised ₹3.4 billion via preferential allotments.

#3 Zaggle Prepaid Ocean Services

Zaggle Prepaid Ocean Services sits at the intersection of fintech and SaaS, offering digital platforms that help corporates, SMEs, and startups manage employee spending and vendor payments. With over 50 million prepaid cards issued, it is the largest issuer in India and a growing force in spend management.

Kacholia held a 2.2% stake in Zaggle as of June, valued at around ₹1.23 billion. Despite strong operating performance, the company’s shares have been under pressure this year, falling 32% from ₹550 to ₹368.

In FY25, Zaggle expanded aggressively, introducing an AI-powered chatbot (RazBot), corporate credit cards, and a vendor management platform, Zoyer. It counts Tata Steel, Persistent, and Hiranandani among its clients, and has banking partnerships with Kotak, IndusInd, Axis, SBI, and Yes Bank.

Financial performance has been robust: in Q4FY25, revenue jumped 51% year-on-year to ₹4.1 billion, adjusted EBITDA rose 40% to ₹380 million, and net profit climbed 67% to ₹320 million. Its Propel platform was the standout driver, with 91% revenue growth.

Zaggle has also struck alliances with global players such as VISA for forex cards, and domestic firms like Wipro and PNB MetLife for employee benefits. Its M&A activity includes acquiring a 98% stake in Span Across IT Solutions and a 26% stake in Mobileware Technologies.

#4 Balu Forge Industries

Balu Forge Industries, a precision engineering company, is best known for its forged crankshafts and a wide portfolio of finished and semi-finished components. Its offerings include railway wheels, clutches, hydraulic motors, hooks, and brake parts, with capabilities aligned to evolving emission norms and next-gen energy vehicles.

As of June, Kacholia held a 1.6% stake in the company, valued at about ₹1.14 billion. The stock has faced selling pressure in 2025, even as the company reported strong growth.

In FY25, revenue surged 71%, and Q1FY26 continued the momentum with a 58% rise, driven by demand from railways, defence, oil & gas, and commercial vehicles. Balu Forge exports to more than 80 countries and supplies over 25 global OEMs. Its machining capacity stands at 32,000 MTPA, while forging capacity is being scaled up to 72,000 tons through new facilities in Belgaum.

To support expansion and R&D, the company raised ₹5 billion in September 2024 through equity and warrants, and shifted to NSE’s main board, broadening its investor base. Looking ahead, it aims to deepen its footprint in railways and defence while moving into advanced alloys and specialised materials.

#5 Safari Industries

Safari Industries has grown into one of India’s top luggage makers, operating across hard and soft luggage segments. Hard luggage—polypropylene and polycarbonate—is manufactured at its Halol, Gujarat plant, while most soft luggage is imported. Its brand portfolio includes Safari, Magnum, Genius, Genie, and the casual premium line Urban Jungle.

Kacholia held a 1.8% stake in Safari as of June, valued at around ₹1.86 billion.

Financially, Safari generated ₹17.7 billion in revenue in FY25, up from ₹15.5 billion in FY24. Net profit, however, declined to ₹1.4 billion from ₹1.8 billion as margins came under pressure. Hard luggage accounted for 54% of revenues, with soft luggage making up 46%.

The company has built a wide distribution base spanning retail outlets, CSD, B2B and B2C channels, and leading e-commerce platforms such as Amazon and Flipkart. Its future strategy is centred on scaling hard luggage, premium positioning, and direct-to-consumer channels via its digital storefronts safaribags.com, genietravel.com, and urbanjungle.shop.

Conclusion

A stock’s decline may reflect short-term headwinds or broader market sentiment, but it can also reveal deeper business challenges.

Investment gurus can highlight promising opportunities, but blindly following their portfolios is risky. The smarter approach for investors is to go beyond marquee names, analyse fundamentals and governance, and ensure alignment with personal goals and risk appetite.

Guru-backed stocks are a useful starting point, but prudent investing demands independent judgment.

Happy Investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com