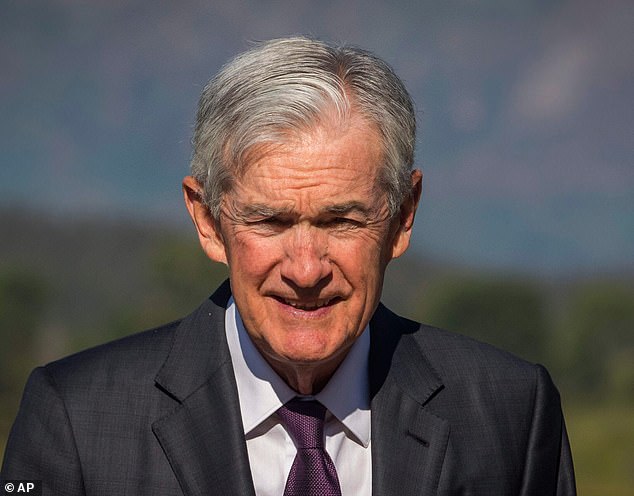

Jerome Powell, the high priest of central banking, has spoken. And it’s a ‘Yes’. Well, at least that’s what the financial markets understood from the US Federal Reserve chairman’s comments at the Jackson Hole Symposium on the future direction of interest rates.

Wall Street equity traders certainly took Powell’s remarks as the strongest hint yet.

They sent the Dow Jones index roaring up more than 2 per cent to pass 45,700 while the Nasdaq Composite jumped 1.9 per cent to nearly 21,500 points on hopes that a rate cut will trigger confidence in business activity, kick-starting another wave of takeovers and mergers.

The best show of euphoria was from the S&P 500 index which, within minutes of his speech, was just 40 points away from crossing 6500 for the first time in history.

The bond markets were equally optimistic about where rates are heading, with yields falling on the hope that the central bank chairman and his colleagues will now endorse a reduction in interest rates at September’s meeting.

So too did the betting markets, with traders now putting the probability of a Fed reduction at 90 per cent compared with the 75 per cent that they had indicated before Powell’s remarks.

Change of direction: Most pleased of all by Jerome Powell’s remarks will be President Donald Trump, who for months has been demanding that the Fed trim rates

The Fed has not cut rates since December owing to worries about higher inflation at a time when other central banks have been trimming – the European Central Bank has cut back four times while the Bank of England has gone for three.

Most pleased of all by Powell’s remarks will be President Donald Trump, who for months has been demanding that the Fed trim rates, branding Powell a ‘numbskull’ and calling on him to resign for not leading the charge.

Yet the Fed has repeatedly defied him, leaving rates unchanged at the last five meetings. The first signs of internal dissent came at the July meeting when two governors did call for a cut because of worries over the loosening labour market.

This was Powell’s final Jackson Hole speech before he steps down next May, and he got his own back at Trump by giving a robust and elegant speech without any hint of rancour.

He was also upbeat about the US economy which has shown resilience, despite ‘sweeping changes’ to economic policy, such as uncertainty created by Trump’s tariffs and the clampdown on immigration which has led to more job vacancies.

It was when speaking about the Fed’s dual mandate – to hold inflation to the 2 per cent target while maximising employment – that Powell gave the game away over interest rate cuts, albeit in the most subtle fashion. ‘Upside risks to inflation had diminished,’ he said ‘but the unemployment rate had increased by almost a full percentage point, a development that historically has not occurred outside of recessions.’

What he meant, of course, is that because the balance of risk is shifting, a shift in policy would be appropriate.

That’s more of a ‘Yes’ than a ‘No’.

The slowing powerhouse

Germany is heading back into the danger zone. The revised figures for the second quarter show that GDP shrank by 0.3 per cent – a sharper fall than original estimates. The export-led economy has been affected by Trump’s tariffs but also by higher energy costs.

Yet, there are some positive signs: recent surveys show an uptick in August, with the private sector and manufacturing output reporting their best growth in more than three years. Let’s hope so, for a return to growth in Europe’s industrial powerhouse is good for us all.

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.