Tactile of FOMC Rate Cut in September Trump “will dismiss director Cook” Vesant “should start cutting 0.5%P” as he seeks to seize Fed control with doves Economic Leadership “Undervaluation of Inflation” Europe, Japan Employment Market Important Consensus Daily “Consideration of Interest Rate Increase in Wage Increase”

![Jerome Powell, chairman of the U.S. Federal Reserve (Fed), walks in Jackson Hole, Wyoming on the 22nd (local time). [AP = Yonhap News]](https://www.europesays.com/wp-content/uploads/2025/08/news-p.v1.20250824.2ab67266a90547e69eba4d713db51d35_P1.jpg) 사진 확대

사진 확대 Jerome Powell, chairman of the U.S. Federal Reserve (Fed), walks in Jackson Hole, Wyoming on the 22nd (local time). [AP = Yonhap News]

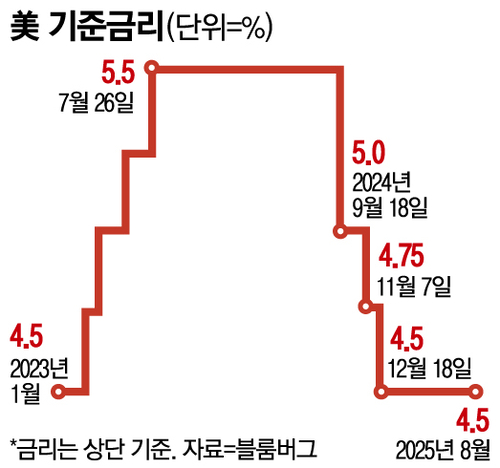

U.S. Federal Reserve Chairman Jerome Powell hinted at a September rate cut aimed at cooling employment at a Jackson Hole meeting, but U.S. President Donald Trump is making his will to take control of the Fed more explicit. Aides are pressing for a big cut (a 0.5 percentage point cut in the benchmark interest rate). Powell, who said he needed more data despite President Trump’s pressure to cut the rate, has changed his mind in a month, sparking a backlash not only from the economics community but also from within the Fed.

President Trump met with reporters at the White House on the 22nd (local time) and said, “If Lisa Cook (Fed) does not resign, I will dismiss him.” This is President Trump’s first reaction since Powell’s speech, which signaled a rate cut. President Trump and his aides are pressuring Cook to resign, saying he committed forgery of documents in the process of getting a mortgage. Initially, there was a view that it was a political gesture to pressure interest rate cuts, but President Trump is poised to push through it.

If Cook steps down, the Fed’s dynamic structure itself will change as four of the seven Fed directors, or half of them, are filled with interest rate cuts. Existing interest rate cuts include Michelle Borman and Stephen Myron, chairman of the White House National Economic Advisory Committee, who will join Christopher Waller.

사진 확대

사진 확대 Even if the Federal Open Market Committee (FOMC) cuts interest rates in September, the market expects a quarter of a percentage point. However, U.S. Treasury Secretary Scott Bessant recently said, “The base rate should be at least 1.5 to 1.75 percentage points lower,” adding, “I think it is possible to cut interest rates continuously, starting with a 0.5 percentage point cut at the FOMC meeting in September.”

On the other side, Powell is leaning toward responding to the job market rather than price instability, raising concerns about inflationary pressure from tariffs.

In an interview with CNBC, Beth Hammack, president of the Federal Reserve Bank of Cleveland, clarified her opposition to Powell’s speech, saying, “As long as inflation remains a threat, we should be cautious about lowering interest rates.”

“I am concerned that if we go to an easing policy stance, we can stimulate inflationary pressure again,” he said. “I think we need to maintain a somewhat tight policy stance to bring inflation back to its target level.” Governor Hamack does not have the right to vote on this year’s FOMC rate decision.

![Jerome Powell, chairman of the U.S. Central Bank (Fed), walks with central bank governors during a break during the Jackson Hole meeting in Wyoming on the 22nd. From left, Bank of England Governor Andrew Bailey, European Central Bank (ECB) Governor Christine Lagarde, Bank of Japan Governor Kazuo Ueda and Powell. [AP = Yonhap News]](https://www.europesays.com/wp-content/uploads/2025/08/news-p.v1.20250824.8c575aca4fee4bb6804775638c525819_P1.jpg) 사진 확대

사진 확대 Jerome Powell, chairman of the U.S. Central Bank (Fed), walks with central bank governors during a break during the Jackson Hole meeting in Wyoming on the 22nd. From left, Bank of England Governor Andrew Bailey, European Central Bank (ECB) Governor Christine Lagarde, Bank of Japan Governor Kazuo Ueda and Powell. [AP = Yonhap News]

There were also voices of concern among experts. “I was surprised by the dovish nature of the speech, which underestimates the inflationary pressures of the economy and overestimates the risk of weakening the labor market,” said Michael Strain of the American Enterprise Institute.

According to Bloomberg, economists such as Anna Wong, Stuart Paul, Eliza Winger and Chris Collins warned that “companies will pass on more tariff costs to consumers,” and that “the Consumer Price Index (CPI) and employment report in August may not support a rate cut in September.”

Powell also did not directly mention a rate cut in his speech, unlike last year, for fear of lingering inflationary pressure from tariffs. At the same meeting a year ago, he declared that the time had come for a rate cut and then took a big cut in September.

In fact, he clarified his commitment to managing long-term inflation in his speech and said he was abandoning the framework he introduced during the pandemic in 2020. At the time, the government temporarily used a strategy to allow inflation to exceed the 2% target, but now it will strengthen price management.

Governors of central banks in Jackson Hole, Wyoming, also agreed with concerns about the job market. Kazuo Ueda, president of the Bank of Japan (BOJ), diagnosed, “The labor shortage has become one of our most urgent economic problems.” “The labor market is expected to remain tight and continue to put upward pressure on wages,” he said, hinting at a rate hike. Earlier in July, at a financial policy-making meeting, Ueda said, “The current real interest rate is very low,” adding, “We will continue to raise policy rates to control the degree of financial easing as the economic and price situation improves.”

Andrew Bailey, president of the Bank of England (BOE), expressed concern that “the UK is facing serious challenges in increasing the potential growth rate due to lower productivity and lower labor participation rates.”

Christine Lagarde, president of the European Central Bank (ECB), said: “The European labor market has proven surprisingly resilient despite inflation shocks and aggressive rate hikes.”