Klarna, the Swedish buy-now-pay-later pioneer is reviving plans to float in the US at a valuation of up to $14 billion, Reuters reports.

The company hit pause on IPO plans in April after President Trump’s trade tariffs rocked global markets. A previous attempt to go public stalled in 2021.

The shares sold in the offering could be priced at between $34 and $36 as early as this week, the sources said. This would represent a sharp drop from the valuation of close to $50 billion Klarna was aiming for in 2021 and down from more than $15 billion earlier this year.

Klarna declined to comment. Filings earlier this month showed that its second-quarter revenue rose 20 per cent from a year earlier on a like-for-like basis to $823 million, while adjusted operating profit was up $1 million to $29 million.

The financial regulator has approved the London Stock Exchange to operate a new type of a private stock market, created to win more business from private firms and inject new life into the UK stock market.

The system is called Pisces, the “private intermittent securities and capital exchange system”.

Julia Hoggett, chief executive of the London Stock Exchange, said: “This new market demonstrates our commitment to the creation of a genuine funding continuum from the private to public markets so that businesses in the UK and around the world can be effectively supported across all stages of their growth.”

Emma Reynolds, economic secretary to the Treasury, said: “’This government is committed to working with the regulators and business to enhance our capital markets offering, supporting economic growth, and putting more money in working people’s pockets.”

Disposable income for 60 per cent of UK households fell last month as result of rising inflation, Asda’s latest income tracker showed, with all households likely to feel the squeeze as the Bank of England expected inflation to rise to 4 per cent.

Middle-income families (£41,000 gross annual earnings) have seen the first drop in spending power in two years, down 1.6 per cent in July, while for lower-income households it fell 11.1 per cent. Higher-earning households remain more insulated, with income growth still outpacing rising costs.

Inflation has risen to 3.8 per cent in July, up from 1.7 per cent in September last year, driven by increases in essential living costs. The cost of essentials, such as food, drink, and transport, have risen 5.1 per cent year on year.

Thousands of pensioners have claimed back more than £10,000 after being overcharged tax on their pension withdrawals, HMRC figures obtained by Royal London through a freedom of information request showed.

Around 60,000 pension savers claimed refunds in the 2023-24 tax year, 20 per cent up on the previous year, Royal London’s data showed. About 11,700 pensioners claimed back £5,000 or more, including 2,400 who were given refunds in excess of £10,000. The average refund was worth £3,342, which was £280 more than 2022-23.

Pension freedoms, which came into force from 2015, gave over-55s options over how to use their defined contribution pension pot. Generally, people can take up to 25 per cent of their pension as a tax-free lump sum, with the rest taxed as income.

However, an “emergency” rate is applied to pension withdrawals, with HMRC assuming it will be the pensioner’s monthly income for the rest of the tax year. This means that people could be overcharged if they make one-off withdrawals.

CHRIS RATCLIFFE/BLOOMBERG/GETTY IMAGES

Some of the UK’s biggest retailers have started the week deep in the red after Deutsche Bank warned that its “fear index” is pointing to “growing consumer concerns”.

Analysts at the German bank said they are now “taking a more cautious view on the UK consumer” with the jobs market weakening, inflation ticking up again and people worried about tax rises in the autumn budget.

In response to that, Deutsche expects Britons, particularly those on lower incomes, to rein in their spending on things such as clothes and home improvements.

As a consequence the analysts have cut both Associated British Foods, the Primark owner, and Wickes, the DIY retailer, to “sell”. Kingfisher, the B&Q owner, has been downgraded to “hold”.

Wickes shares have been the hardest hit, down 8.4 per cent to 202p this morning, while AB Foods shares have fallen 4.2 per cent to £22.16. Kingfisher has dropped 4.2 per cent to 269½p.

Senior officials from Britain, Germany, France are due to meet their counterpart from Iran in Geneva today to discuss demands that the Middle Eastern country revive nuclear inspections and diplomacy or face the reimposition of sanctions that were lifted under a 2015 deal.

The three European countries, known as the E3, have threatened to trigger the “snapback” of sanctions at the United Nations Security Council by October 18, when a now largely defunct nuclear deal struck 10 years ago between Tehran and major powers expires.

Iran is still angry about the bombing of its nuclear facilities by the US and Israel, the E3’s allies.

Francois Bayrou, the French prime minister

SHUTTERSTOCK

France’s leading CAC 40 share index fell 2 per cent this morning as political uncertainty deepened and the minority government looked likely to be ousted next month.

Three main opposition parties said they would not back a confidence vote which prime minister Francois Bayrou announced for September 8 over his plans for sweeping budget cuts.

Shares of French banks BNP Paribas and Société Générale fell 6.2 per cent and 5.2 per cent respectively.

The wider European Stoxx 600 index fell 0.7 per cent — UK and German stock markets were also lower — after President Trump said he was firing Federal Reserve governor Lisa Cook, sparked a flight from US assets. Doveish comments from US Fed chairman Jerome Powell took the index within striking distance of an all-time high on Friday.

London’s leading stock market has opened sharply lower this morning on concerns about the impact of President Trump attempts to interfere with the independence of the US Federal Reserve.

The FTSE 100 fell 69 points, or 0.7 per cent, to 9,252.18 after closing at a new high of 9,321.40 on Friday after a five-day winning streak. Overnight Wall Street stocks ended lower and markets in Asia were lower.

Bunzl was the biggest riser, up 4.78 per cent after the distributor of workplace products reported a fall in interim profits due to cost challenges in its largest business in North America, but resumed its £200 million share buyback, which it had paused in April.

Gold miners rose as investors bought safe haven assets after Trump said he was firing Fed governor Lisa Cook. The price of the precious metal rose 0.2 per cent to $3,372.20 an ounce. Fresnillo and Endeavour Mining gained 1.78 per cent and 1.02 per cent, respectively.

B&Q owner Kingfisher and Primark owner AB Foods fell 4.77 per cent and 3.46 per cent respectively after a gloomy outlook for UK consumers from Deutsche Bank, particularly for DIY spending. British American Tobacco lost 2.2 per cent after its chief financial officer stepped down immediately.

Vacancies for entry-level jobs in the UK have dropped to their lowest level in five years in a further sign of a cooling labour market and falling demand for young lower-paid staff in the wake of government tax hikes.

The latest survey data from Adzuna, a jobs-matching search engine, showed vacancies across the economy had declined by 1.24 per cent in the three months to July to 865,000, reversing gains made in the previous three-month period and corroborating official data showing a steady fall in advertised jobs over the past two years. Mehreen Khan, our economics editor has more here.

Eric Lombard said: “This is a risk that is in front of us”

SHUTTERSTOCK EDITORIAL

Eric Lombard, the French finance minister, hinted that there was a risk the International Monetary Fund would have to intervene in the economy if prime minister François Bayrou’s minority government falls next month.

He told France Inter radio when asked about comments by other politicians that a collapse of Bayrou’s government could result in the IMF having to intervene in France’s finances. Lombard said: “This is a risk that is in front of us.”

Bayrou’s minority government looked increasingly likely to be ousted after three main opposition parties said they would not back a confidence vote which Bayrou announced for September 8 over his plans for sweeping budget cuts.

France’s shares were set to open sharply lower and French government bonds were sold off. Futures on France’s CAC40 index were down 1.2 per cent. The yield of the 10-year bond rose 2 basis points in early trading to around 3.51 per cent, its highest since March. When a bond’s yield rises, its price falls.

The embattled UK engineering consultancy has been dealt a further blow after its Middle Eastern suitor cut the value of its takeover approach. John Wood Group said Sidara would be reducing its April proposal of 35p a share to 30p, bringing a price tag of about £242 million down to £207 million.

The board of Wood, which employs about 35,000 people on projects in industries including oil and gas, said it would still “be minded to recommend” the reduced terms to its shareholders.

Shares in the Aberdeen business have been suspended since May because it could not meet a deadline to publish audited accounts. An independent review carried out by Deloitte found material weaknesses in the financial culture, with Wood likely to have to restate numbers for 2022 and 2023 as well. The Financial Conduct Authority is investigating the situation.

The Takeover Panel has already agreed to several extensions for Wood and Sidara to reach an agreement, with the next one due to expire on Thursday.

The FTSE 100 distributor of workplace products has reported that interim pre-tax profits fell 10 per cent to £250.1 million in the six months to the end of June, down from £279.4 million over the same period last year. Revenue over the period was a fraction lower at £5.76 billion. Operating profit in the US, the group’s largest business, fell 14.7 per cent.

In other corporate news:

British American Tobacco: The tobacco giant has announced that Soraya Benchikh is “stepping down” as chief financial officer immediately. Javed Iqbal, who is currently director, digital and information, will take on the role of interim chief financial officer.

Halma: The engineering and technology conglomerate has paid €150 million for Brownline, a provider of advanced gyroscopic locating systems. It will be funded from Halma’s existing facilities. Netherlands-based Brownline made revenue of €37 million in the year to the end of March. It will be a standalone company within Halma, led by its current management team.

Ashtead Technology: Alongside interim results, the Aim-listed provider of subsea equipment for the offshore energy sector has confirmed that it plans to move to a main market listing. The group hopes to complete the move in October.

The dollar and longer-dated US government bonds slid today after President Trump said he was firing Federal Reserve governor Lisa Cook, an unprecedented move that further undermines confidence in the Fed’s independence and US assets.

The dollar fell against a basket of currencies, including the pound which strengthened to $1.3465. The yield on the benchmark US 10-year bonds rose 1.8 basis points to 4.29 per cent. The yield on the 30-year bond rose 3.2 basis points to 4.92 per cent.

Stock markets in Asia followed declines on Wall Street as the news muddied the outlook for Fed policy and stoked uncertainty over prospects for a rate cut next month. Gold touched a two-week high of $3,376.52.

“All of this, tariffs included, is just another reason the US can’t be trusted,” said Bart Wakabayashi, the Tokyo Branch Manager of State Street. “There’s no credibility. That’s the basis of the US being the safest investment in the world. If you’re a responsible investor, it gives you pause.”

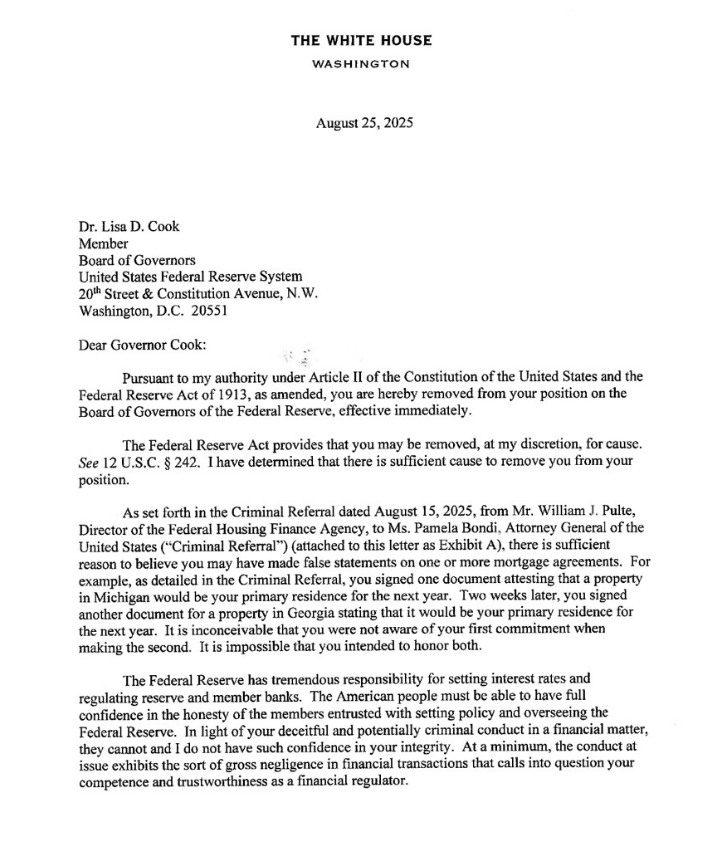

Trump says he has no confidence in Cook’s integrity

President Trump said he was firing Federal Reserve governor Lisa Cook “effective immediately” over alleged improprieties in obtaining mortgage loans, escalating his pressure on the central bank and raising concerns about its independence.

He said in a letter to Cook, the first African-American woman to serve on the Fed’s governing body, there was “sufficient reason to believe you may have made false statements on one or more mortgage agreements”.

Trump claimed Cook indicated on documents for separate mortgage loans on properties in Michigan and Georgia that both were her primary residence.

He wrote: “The American people must be able to have full confidence in the honesty of the members entrusted with setting policy and overseeing the Federal Reserve … I do not have such confidence in your integrity”.

Cook responded through the law office of lawyer Abbe Lowell, saying “no cause exists under the law, and he has no authority” to remove her from the job she was appointed to by former US President Joe Biden in 2022. Her lawyer said that Trump’s “demands lack any proper process, basis or legal authority. We will take whatever actions are needed to prevent this attempted legal action.”

The terms of Fed governors are structured so they outlast the term of a given president, but the Federal Reserve Act does allow removal of a sitting governor for cause. That has never been tested by presidents.