NGL almost always provided a positive note for midstream companies in 2024, as the sector struggled with low prices for natural gas.

In second-quarter 2025, however, the midstream sector may have experienced NGL as too much of a good thing.

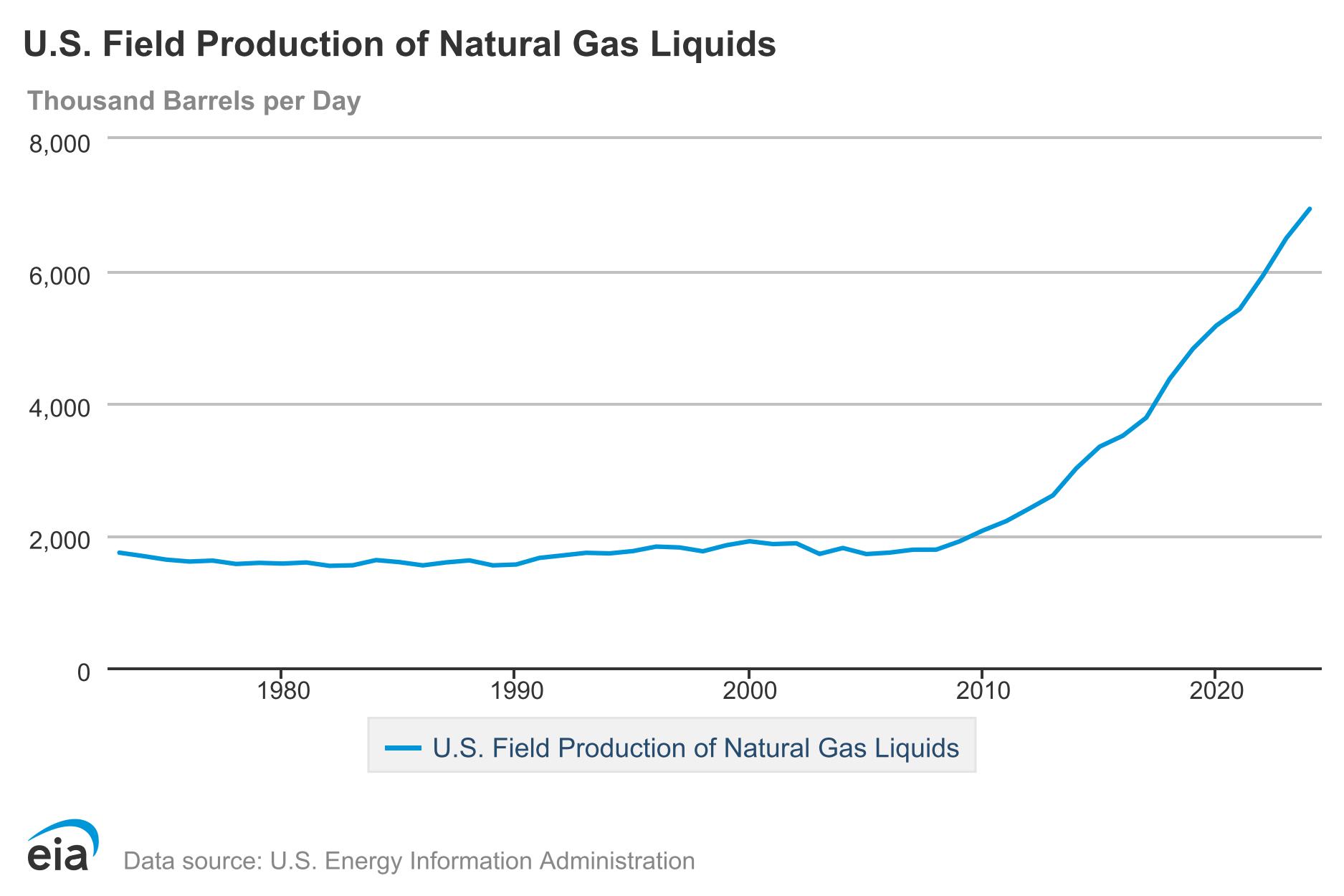

The 2025 NGL market has continued a decades-long buildout. NGL production in the U.S. and Canada “has been on a tear, tripling from a combined 2.8 MMbbl/d in the early 2010s to 8.3 MMbbl/d in 2025,” RBN said in an analyst note.

For example, Energy Transfer reported record NGL volumes in the second quarter, but its EBITDA for NGL fell by $100 million from the same period in 2024. Enterprise Products Partners reported second quarter NGL gross operating margins of $1.3 billion for 2025, the same as 2024.

ONEOK reported an 18% increase in NGL volumes across all its basins in the second quarter compared to from the first quarter. The company also reported smaller price differentials in marketing and lower fee rates in the MidContinent.

“Permian NGL supply growth has tempered while pipeline and dock infrastructure expansions now outpace supply,” said Oren Pilant, an analyst for East Daley Analytics (EDA), in an email to Oil and Gas Investor. “The industry is entering an overbuilt market, creating pressure on dock fees and introducing downside risk to recontracting across the value chain.”

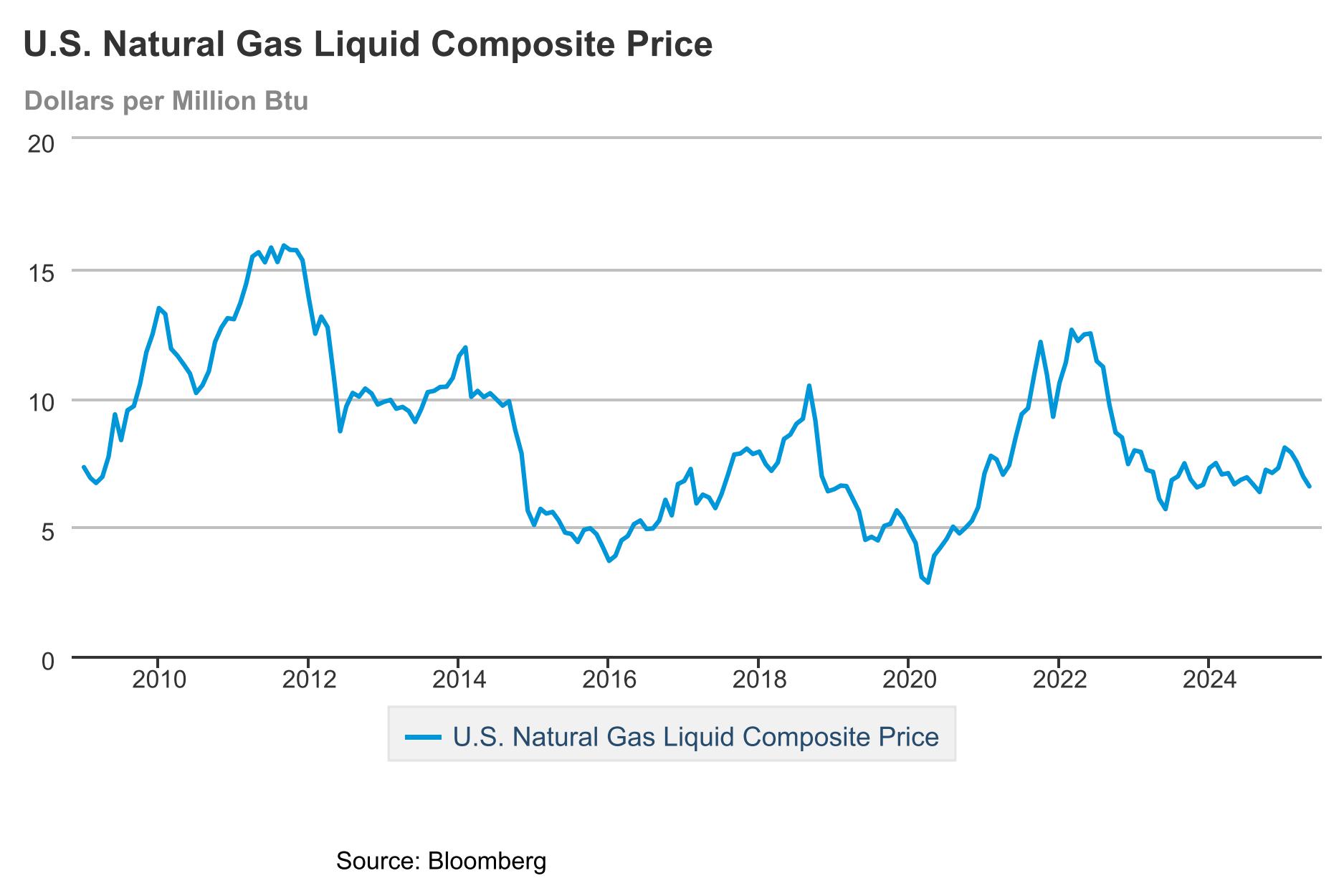

Prices held steady in 2023 and 2024 after hitting near-record highs in 2022. The trend since the start of 2025, however, has been downward. The composite price for NGL in January was $8.07/MMBtu, according to the U.S. Energy Information Administration (EIA). The price in May, the most recent month recorded by the EIA, is $6.57/MMBtu.

For the year, the market has taken hits from two directions. First, major players added projects over the last few years in anticipation of a growing supply of gas and a developing demand overseas, resulting in a temporary overbuild.

But company leaders were already acknowledging this situation in 2024.

The second punch was a surprise.

NGL, particularly ethane, become a preferred weapon in the White House’s trade war with China. The move may, or may not, have resulted in a favorable outcome for the administration, depending on who you ask. But it also eroded trust with the international market.

(Source: Bloomberg)Many projects, one trade war

(Source: Bloomberg)Many projects, one trade war

In a 2024 interview, Energy Transfer (ET) Co-CEO Mackie McCrea told OGI that ET had noted that the production of ethane, LPG and natural gasoline followed the overproduction of natural gas in the Permian Basin, and the U.S. market for the products was not capable of consuming all of it.

“There’s a lot of production in this country, and it cannot be absorbed and consumed in the United States,” McCrea said. “There’s a dire need for LPG growth and natural gas growth throughout the world. So, there’s a significant importance for getting both natural gas and natural gas liquids on the water.”

Many major midstream companies spent the first half of the 2020s developing “wellhead-to-water” NGL systems, in which they owned every point of the NGL development cycle.

Many of the systems have built out, and prices have lowered along the available supply. Meanwhile, overseas demand continues to develop. Several sector leaders took notice during the second quarter.

“The market has fundamentally shifted,” said Jim Teague, co-CEO of Enterprise Products Partners, during his company’s earnings conference call.

Teague pointed specifically to Enterprise’s earnings for LPG. In the second quarter, the company’s gross operating margin declined by $37 million, even though its LPG export volumes rose by 5 MMbbl. At the same time, Teague says competition is increasing.

“There are growing rumors of midstream companies planning to enter the LPG export market,” he said. “However, this space has become increasingly competitive, and the impact is already evident.”

Enterprise and Energy Transfer both had to adjust on the fly to avoid taking casualties in President Donald Trump’s trade dispute with China.

Ethane, the “backbone of U.S. NGL economics,” according to an East Daley Analytics report, became a pawn in the trade war. At different points, exporting ethane to China was prohibited by the U.S. or charged exorbitant tariffs by the Chinese.

Energy Transfer and Enterprise account for all U.S. ethane exports to China. The companies reported the on-again, off-again nature of the trade market caused some difficulties in the first half of 2025.

“We managed to navigate these disruptions,” Teague said. “That said, we’ve been clear about the risk of weaponizing U.S. energy exports. These kind of actions rarely hurt the intended target and often backfire, hurting our own industry more.”

East Daley said in a report that the battle had fundamentally changed the market. Every importer is now served best by finding more than one supplier.

“When exports to China were abruptly restricted, it exposed a structural vulnerability: The world has no credible substitute for U.S. ethane at scale,” the report said. “In a market increasingly shaped by trade policy and shifting alliances, optionality and redundancy are no longer nice-to-haves; they are prerequisites.”

New phase for gas

The NGL sector is entering a phase in which scale alone is no longer enough to guarantee strong margins. Wellhead-to-water networks promise secure revenue, but are now softening prices, while a volatile trade policy continues to be a wild card in the market.

Midstream operators are adapting by tightening costs, diversifying customer bases and pursuing new markets.

If 2024 was defined by the steady lift NGL gave to midstream portfolios, 2025 is proving that those gains come with strings attached. Infrastructure expansions are colliding with slower-than-expected demand growth, export competition is intensifying and political risk is no longer an abstract concern.

Success in this environment requires the ability to turn global uncertainty into an operational advantage, according to EDA. The winners will be those that balance growth with the flexibility to pivot when the market or political background changes.

(Source: Energy Information Administration)

(Source: Energy Information Administration)