The global economy in 2025 is defined by a “muddling through” dynamic: growth is tepid, uncertainty is pervasive, and traditional macroeconomic anchors like fixed income and cyclical equities have lost their luster. Elevated tariffs, delayed policy responses, and geopolitical tensions have created a fragmented landscape where investors must prioritize resilience over speculation. In this environment, defensive equities and inflation-linked assets have emerged as critical tools for capital preservation and income generation.

The Macro Backdrop: Stagflation Risks and Policy Lags

Global growth forecasts have been slashed to 2.8% in 2025 and 3% in 2026, with major economies like China, Brazil, and Russia contributing less to expansion than anticipated [1]. The U.S. effective tariff rate now exceeds levels seen during the Great Depression, compounding supply chain bottlenecks and slowing trade flows [4]. Meanwhile, the Federal Reserve’s delayed rate-cut cycle has left investors with fewer traditional safe havens, pushing capital into sectors with inelastic demand and stable cash flows [2].

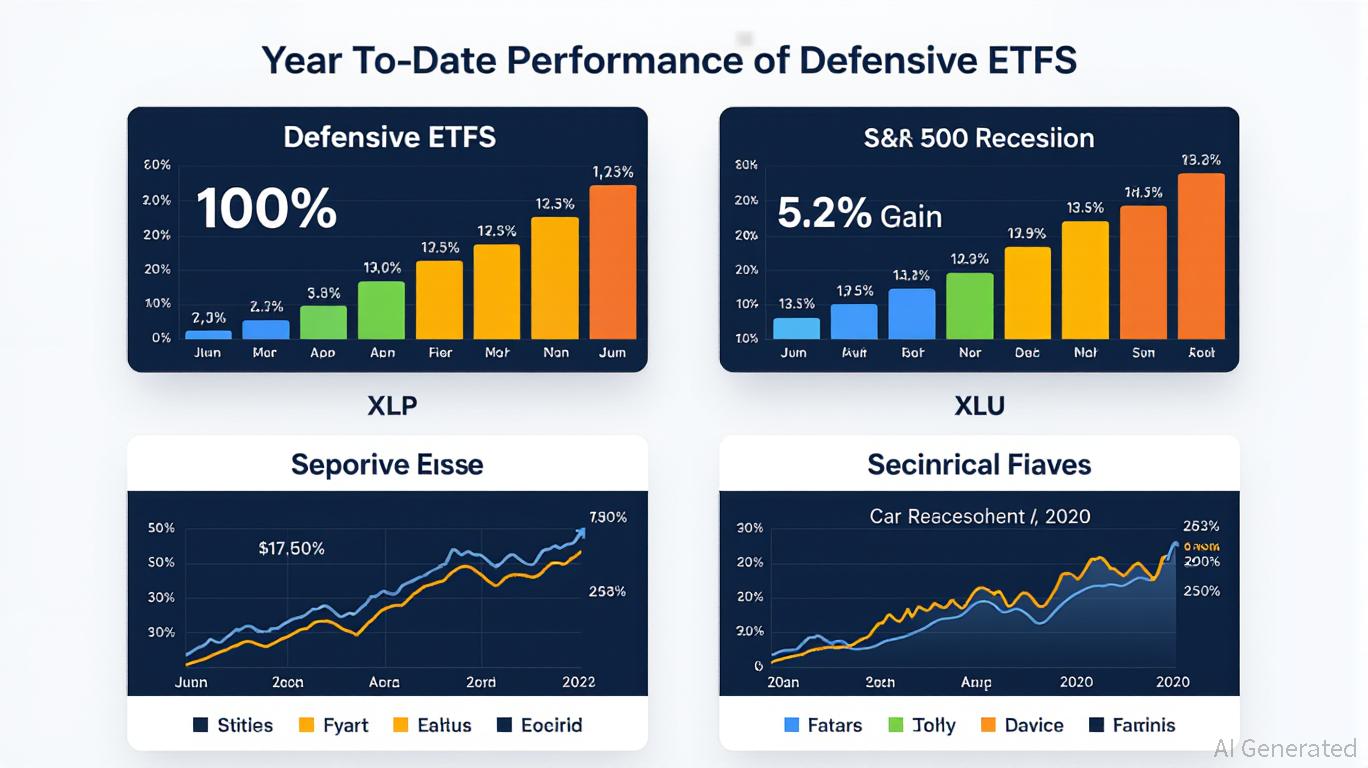

Defensive equities—particularly in consumer staples, utilities, and healthcare—have surged as a result. The Utilities Select Sector SPDR ETF (XLU) has gained over 10% year-to-date, functioning as a “bond proxy” in a low-yield environment [2]. Similarly, consumer staples and healthcare ETFs have outperformed the S&P 500, which has seen cyclical sectors decline by 7.9% in 2025 [1].

Historical Resilience: Lessons from Past Downturns

Defensive sectors have historically outperformed during economic stress. During the 2008 financial crisis, the S&P 500 fell 38%, while consumer staples (XLP) and healthcare (XLV) rose by 20% and 25%, respectively [5]. In 2020, utilities (XLU) and healthcare (XLV) showed minimal declines, with XLV dropping just 0.4% compared to the S&P 500’s 11.2% loss [2]. This pattern underscores the value of sectors tied to essential goods and services, which remain in demand regardless of economic conditions.

The low-volatility nature of these sectors further enhances their appeal. ETFs like XLP and XLU have beta values below 1, meaning they experience smaller price swings than the broader market [2]. For example, Walmart (WMT) and WEC Energy (WEC) have demonstrated consistent performance during past recessions, offering stability in turbulent times [5].

Inflation-Linked Assets and Alternatives: Hedging Stagflation

Inflation-linked assets are gaining traction as a hedge against stagflation risks. Treasury Inflation-Protected Securities (TIPS) with five-year maturities now offer a real yield of 1.9%, outpacing core CPI projections of 3.3% by year-end 2025 [6]. Gold, too, has seen increased allocations, with portfolio managers using it to diversify against dollar weakness and geopolitical risks [7].

Alternatives like infrastructure and structured credit are also attracting attention. These assets provide uncorrelated returns in a fragmented growth environment, with infrastructure benefiting from AI-driven energy demand and government spending on national security [4].

Strategic Recommendations for 2025Defensive ETFs: Prioritize low-volatility funds like XLP, XLU, and the Vanguard Dividend Appreciation ETF (VIG), which combine stability with income [1]. Inflation Hedges: Allocate to TIPS and gold to preserve purchasing power amid rising inflation expectations [6]. International Diversification: European and Japanese equities offer low correlation to U.S. markets and potential growth from fiscal reforms [4]. Quality Bonds: High-grade U.S. government bonds remain attractive as the Fed prepares to resume rate cuts in early 2026 [3]. Conclusion

The “muddling through” economy of 2025 demands a strategic shift toward resilience and diversification. Defensive equities, inflation-linked assets, and alternatives offer a roadmap for navigating uncertainty, leveraging historical performance and current macroeconomic dynamics. As global growth remains fragile and policy lags persist, investors who prioritize stability and income will be best positioned to weather the storm.

Source:

[1] Global Economic Outlook: July 2025 [https://www.spglobal.com/market-intelligence/en/news-insights/research/global-economic-outlook-july-2025]

[2] The Shifting Tides of Investor Strategy: Defensive Sectors [https://www.ainvest.com/news/shifting-tides-investor-strategy-defensive-sectors-inflation-linked-assets-deteriorating-sentiment-landscape-2508/]

[3] 2025 Midyear Investment Outlook: All Eyes on the U.S. [https://www.morganstanley.com/insights/articles/investment-outlook-midyear-2025]

[4] Sector Opportunities for Q3 2025 [https://www.ssga.com/us/en/intermediary/insights/sector-opportunities-for-q3-2025]

[5] Industries That Can Thrive During Recessions [https://www.investopedia.com/articles/stocks/08/industries-thrive-on-recession.asp]

[6] The Shifting Tides of Investor Strategy: Defensive Sectors [https://www.ainvest.com/news/shifting-tides-investor-strategy-defensive-sectors-inflation-linked-assets-deteriorating-sentiment-landscape-2508/]

[7] The Shifting Tides of Investor Strategy: Defensive Sectors [https://www.ainvest.com/news/shifting-tides-investor-strategy-defensive-sectors-inflation-linked-assets-deteriorating-sentiment-landscape-2508/]