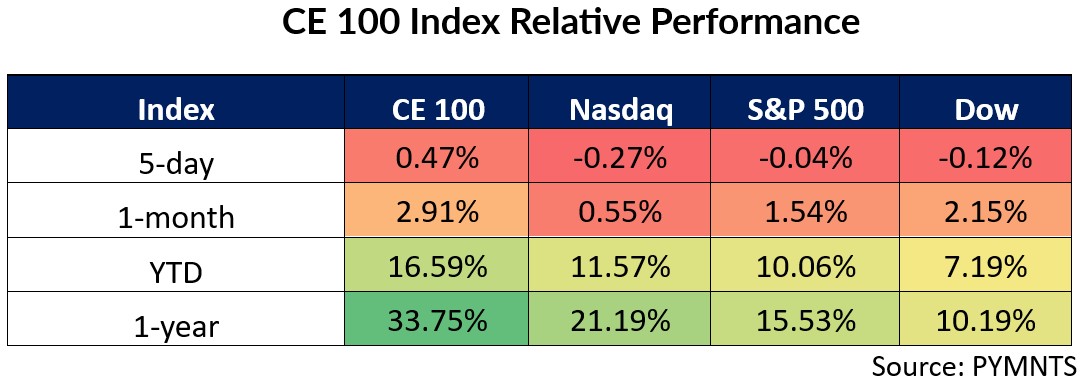

Headed into the Labor Day weekend, the CE 100 Index managed to post a 0.5% gain, in contrast to the slides seen across all broader benchmarks such as the Nasdaq and the S&P 500.

The Enablers segment proved to be the leader this past week, as the pillar rose 4.1%.

MongoDB and Snowflake Soar

MongoDB rallied more than 44% in the wake of earnings. The company reported total revenue of $591.4 million, up 24% year over year (YoY). Of that, subscription revenue accounted for $572.4 million, marking a 23% increase, while services revenue rose 33% to $19 million. The company’s Atlas cloud platform continues to be the growth engine: Atlas revenue grew 29% YoY and contributed 74% of total Q2 revenue. The firm added 2,800 new customers, bringing the total to over 59,900 customers at the end of July.

Also within that group, Snowflake advanced 21.3%. Snowflake delivered product revenue of nearly $1.1 billion, reflecting 32% YoY growth. Overall revenue for the quarter reached $1.1 billion, also up 32% YoY. On the enterprise front, Snowflake underscored strong customer metrics: 654 customers now generate over $1 million in trailing 12-month product revenue.

BNPL Momentum Continues

As PYMNTS reported, in the Pay and Be Paid segment, which added 0.5%, Affirm’s results indicated sustained momentum in the buy now, pay later space. Affirm notched new highs across several business lines in the June quarter. Gross merchandise volumes soared 34% to $10.4 billion. Revenues gained 33% to $876 million. In detailing growth with the Affirm Card, the company said that card gross merchandise volume grew 132% to $1.2 billion. Active cardholders grew 97% to 2.3 million. In-store spending on those cards grew 187% YoY. During the conference call with analysts, CEO Max Levchin said that “growth is accelerating, and we are firing on all pistons.” Affirm shares were up 11.3% on the week.

Among other payments names, text-to-pay platform Authvia has integrated Visa’s real-time money movement capabilities into its core offering. The collaboration with Visa Direct allows for real-time disbursements across industries such as healthcare, automotive services, insurance and gig economy platforms with a single text message. According to the release, the integration expands Authvia’s TXT2PAY capabilities to include real-time outbound payouts to eligible Visa cards in select market, allowing businesses to issue refunds, insurance settlements, payments, incentives and reimbursements to consumers with no need for requiring physical checks, apps or portal logins. Visa shares gained 0.5%.

Mastercard and Circle partnered to enable the settlement of Circle’s USDC and EURC stablecoins for acquirers in the Eastern Europe, Middle East and Africa region. The collaboration will facilitate digital trade across emerging markets by allowing acquiring institutions to get their settlement in USDC or EURC and then use those stablecoins to settle with merchants, the companies said, as Mastercard shares lost 0.6%.

Separately, within the Shop pillar, which lost 1.3%, Ocado shares gave up 5.9%. Walmart shares were slightly positive. Walmart is offering support to encourage U.K. and European businesses to use its online marketplaces to sell to customers in the Americas.

Walmart will host a UK Walmart Seller Summit in London next week. This event will offer manufacturers and exporters access to insights, hands-on guidance and connections with merchants that can assist in their cross-border growth, the company said.