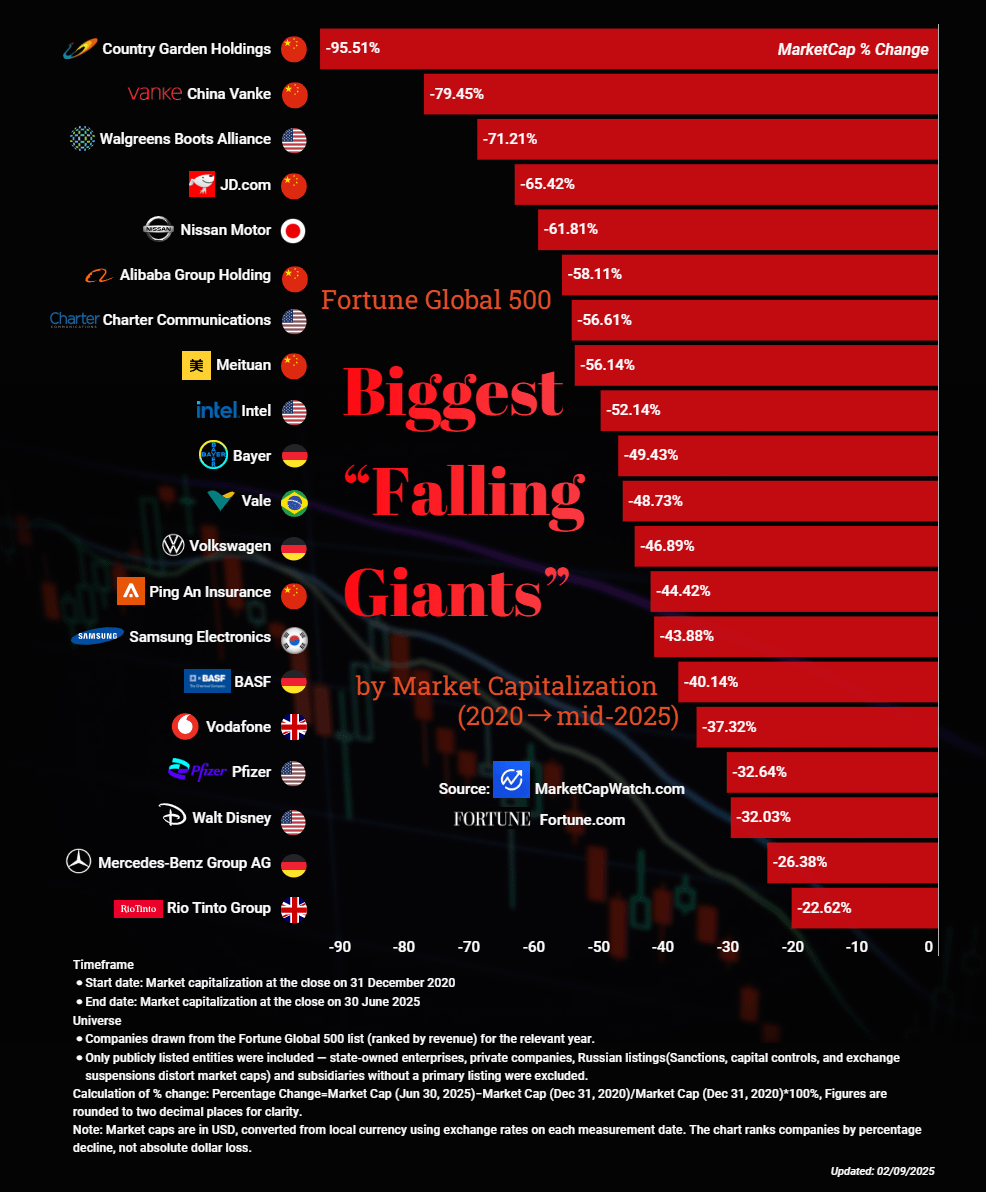

This chart highlights large, well‑known companies from the Fortune Global 500 whose market capitalizations have fallen the most over the selected period, illustrating significant value erosion among global corporate leaders.

Only publicly listed entities were included — state‑owned enterprises, private companies, Russian listings(Sanctions, capital controls, and exchange suspensions distort market caps) and subsidiaries without a primary listing were excluded.

Data source:

- Market capitalization data: MarketCapWatch

- Company universe and revenue ranks: Fortune Global 500

Posted by Proud-Discipline9902

![[OC]Biggest ‘Falling Giants’: Fortune Global 500 Companies With the Sharpest Market Cap Drops (2020 → Mid‑2025)](https://www.europesays.com/wp-content/uploads/2025/09/w0oy1m4hfvmf1-986x1024.png)

9 comments

What about revenue change %?

Strange to see Alibaba on there, when online sales skyrocketed during Covid and they have become a major player in AI. They must have been massively overvalued before, because they’re doing very well.

Walgreens was just gross incompetence and greed by executive leadership. Did the Boots merger, didnt get their promised relocation to Switzerland to avoid taxes and then made the front line employees make up the 1 billion dollar difference they promised shareholders. Talent left in droves and now they’re going private equity to be sold for scrap.

**That chart is misleading. You are missing significant US publicly listed companies. The ones I know off the top of mind**

**Target (TGT)**

It was #117 on Fortune Global 500 in 2020

It’s Market Cap on December 31, 2020 was $88.4B

It’s Market Cap on June 30, 2025 was $47.19B

It’s % change is **-46.62%**

**Dollar General (DG)**

It was #460 on Fortune Global 500 in 2020

It’s Market Cap on December 31, 2020 was $51.52B

It’s Market Cap on June 30, 2025 was $25.37B

It’s percentage change would be **-50.76%**

*Edit: Found another one*

**United Parcel Service (UPS)**

It was #129 on Fortune Global 500 in 2020

It’s Market Cap on December 31, 2020 was $145.56B

It’s Market Cap on June 30, 2025 was was $88.47B

It’s percentage change would be **-39.22%**

Stop upvoting everything so mindlessly

It’s wierd you say 2020->2025 but then say the start date is dec31 2020 so you really aren’t including any of 2020.

Also makes me question if there is an intended narrative given Covid started in January of 2020 and did all kinds of things to the markets.

Buy thr BABA dip folks. BRICS is coming and BABA has invested the most into AI in the Chinese market.

It’s wild that Intel had managed to lose 50% market value in the biggest hardware boom there had ever been. In this time, both AMD, ARM and especially Nvidia have done extremely well.

[https://youtu.be/thS_VY-rNdg?si=njNdfV7WgWh3KtbX](https://youtu.be/thS_VY-rNdg?si=njNdfV7WgWh3KtbX)

I want to see this since January.

Comments are closed.