Italy hits back at French PM’s ‘fiscal dumping’ claim • FRANCE 24 English

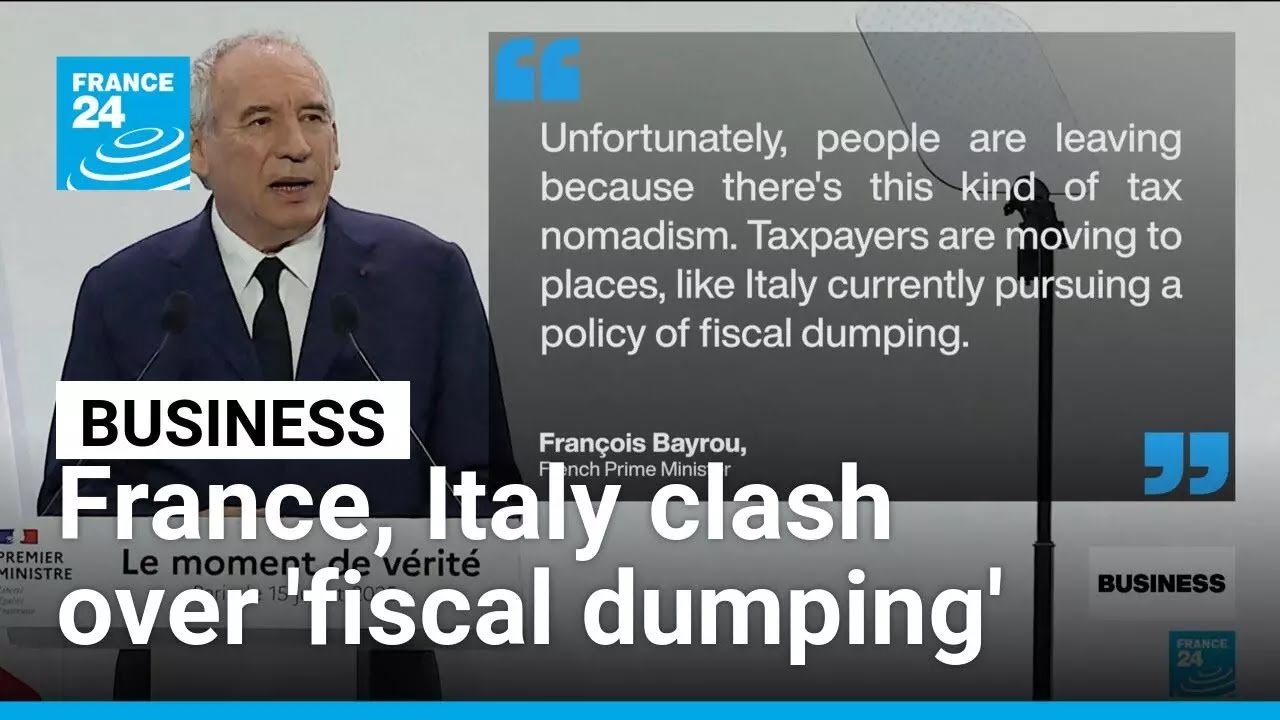

Business means Yukaroy here on the set. Great to see you, Yuka. Now, let’s uh get our right eye to business then. The French Prime Minister, France Beeru, has begun what is a crucial week after he put his job on the line over next year’s budget. I’m sensing the vote of confidence is the issue here. He’s also spotted around with the neighbors in Italy. Tell us all about this. Well, the French prime minister uh pointed to the fact that a lot of national debt in Europe is held by foreign investors and accused Italy of pursuing a policy of fiscal dumping, a practice of lowering taxes that attract foreign business. He said this as he defended his unpopular plan to cut 44 billion euros in public spending as part of next year’s budget, while also ruling out the idea pushed for by the left of introducing a new tax on the country’s wealthiest individuals. Luke Shger has more. With the idea of shedding 44 billion euros from France’s public spending, it’s no wonder Franswis Bau has finance on his mind. But laying the blame for wealthy taxpayers leaving France for elsewhere has rubbed feathers the wrong way in Rome. Unfortunately, people are leaving because there’s this kind of tax nomadism. Taxpayers are moving to places like Italy currently pursuing a policy of fiscal dumping. Fiscal dumping when highw worth taxpayers are drawn to establish tax residency in specific places through fiscal incentives is a controversial issue in the European Union. Italy for instance has a flat tax on such individuals worldwide assets and earnings. one grown doubled to €200,000 in 2024, which for Italian leader Georgia Maloney shows France’s claims are unfounded. The Italian economy is attractive and is performing better than others thanks to the stability and credibility of our nation. Italy does not apply policies of unjustified tax benefits in order to attract European companies. Melan in turn blamed what she called European tax havens for drawing resources away from Italian coffers. Other EU nations like low to no tax and Pandora or corporate friendly Hungary or Bulgaria for instance are all attractive for local tax residency and a stark contrast to France’s notoriously high taxes with its opposition now calling for a levy on the ultra rich as well as Paris seeks to grapple with public debt at 114% of GDP. France divorce Luke Trego with that report. Let’s have a quick look at the day market action now. French stocks slumped last week after the prime minister called for a vote of confidence. The Kakahond ended the day flat though on Monday around 7 7,700 points. That’s still about a percentage lower than before the prime minister made that surprise move. Germany’s tax rose by about half a percentage point and London’s Footsie was little changed. US markets are closed for the Labor Day holiday market. The uh Indian Prime Minister Narendra Modi met with the Russian President Vladimir Putin on the sidelines of a regional summit taking place in China. This comes just after Donald Trump’s steep tariffs on Indian exports kicked in. Steep tariffs indeed. Last week, Washington doubled its uh levies on a range of Indian goods coming to the United States to 50% as it sought to punish India for buying more Russian oil and weapons. On Monday, the US president said that on his truth social platform that India had quote offered to lower its tariffs on American goods to zero, adding that the move came late. Now, the Indian government has not confirmed it has cut tariffs for the United States and Prime Minister Narendra Modi has been defiant with a public show of solidarity with Russia’s Vladimir Putin. At the Shanghai Cooperation Organization Summit, China’s President Xiinping presented his vision for a new global economic order that prioritizes the global south. A defined response of course to Mr. Trump’s trade war. And uh finally, Yuka has something to tell us about um labuboos. I’m intrigued. What are they? Yeah, Laboo. I don’t First of all, did I say it correctly? Laboo. You said it correctly. And I don’t blame you if you’ve never heard of laboo. Well, they are uh elflike creatures that have exactly nine teeth and their dolls have taken the world by storm with 10 million of them sold every month. It’s made by PopMart, a Hong Kong listed company. Uh and its shares skyrocketed last month after its revenue jumped 200% year-on-year in the first half of this year, all thanks to the Labubu phenomenon. But the plush toy is pricey and limited nature has given rise to a shadow market with the knockoff version hitting European markets. These are coming off has more. This furry half monster half rabbit doll has gotten buyers across the world into a frenzy. The Laboo is sold in blind boxes with customers not knowing which doll model they will get. The tour has quickly gone viral over social media. Even celebrities have succumbed to the trend. Rihanna, tennis star Naomi Asaka, and Madonna even made it her birthday cake. But Leubu is released in limited quantities. In Berlin, people queue for 7 hours to purchase one. And in Paris, customers take part in a prize draw for the chance to collect their labu. It creates a certain rarity and also exclusivity. So once we have one, we’re happy. Oh my god. But a counter fate cousin is on the rise, the lufu. With 10 million sold per month, the number of fakes keeps multiplying. Accessible on the internet, in unofficial shops, and at street markets, lufu stalls are drawing a lot of customers. Priced at €10 each, these lufus are half the price of the official labu. A bargain for street vendors who are importing them from abroad. Alerted to the counterfeat craze, customs officers have tightened controls on fake Labubu imports. This summer alone, at least three major shipments were seized in France. This warehouse stores some 91 boxes containing over 20,000 lfufus which do not comply with the European safety standards. We realized there were counterfeit based on the packaging alone. They’re transported in bulk, which is not the case for real labubus. And then there’s the quality of the product. You can see that it’s actually a product that can be dangerous. It breaks easily and then it can become a danger to children if they use it. While customers face the risks of fakes, the battle for the market between labus and lufus is far from over. I believe I saw some fake labus or lufus over the weekend. Fantastic stuff. Laboos, beware of the fakes. That’s all we can say. Yuka, thank you very much indeed. Yuk back more business of course as we go through the evening here on France

Italy has rejected claims by French Prime Minister François Bayrou that Rome is pursuing a policy of “fiscal dumping” to attract foreign business and investment. The spat comes as Bayrou faces a likely collapse of his government over an unpopular budget plan, in which he aims to cut €44 billion in public spending. Also in this edition: Labubus, and their knock-off cousins Lafufus, are taking Europe by storm.

#Bayrou #Meloni #fiscaldumping

Read more about this story in our article: https://f24.my/BP1H.y

🔔 Subscribe to France 24 now: https://f24.my/YTen

🔴 LIVE – Watch FRANCE 24 English 24/7 here: https://f24.my/YTliveEN

🌍 Read the latest International News and Top Stories: https://www.france24.com/en/

Like us on Facebook: https://f24.my/FBen

Follow us on X: https://f24.my/Xen

Bluesky: https://f24.my/BSen and Threads: https://f24.my/THen

Browse the news in pictures on Instagram: https://f24.my/IGen

Discover our TikTok videos: https://f24.my/TKen

Get the latest top stories on Telegram: https://f24.my/TGen

16 comments

Europe is crumbling. Will the EU survive?

italy two world war France side you complain what

I mean yeah… there's Belgium and Netherlands that are fiscal paradises until now for decades… but France suddenly decide that ITALY! Is the "bad guy in the room"… all while the Baguette government is about to fall apart and the baguette economy with it.

Italy have already overtaken France… but evidently French government is a bit upset by being looked down like they did for all these years since the last time we overtake them…

Just, this time could be actually definitive.

Italy is right,

dont fight in front of the neighbors..everybody looses!

This pm is done saying this as a person living in America what a mess that le pen will take advantage of and will seek to topple macron before 2027 guess it is now only Germany and uk now which I don’t mind

The French are big lossers.

Commenting on another nation because of your poor fiscal policies.

West is naive, here is the deal, save and immigrate to Europe, claim benefits (tax free) and work online, get paid in crypto or home country and pay 0 tax. At 65 move "home" with all money saved and a steady base pension (tax free) from Europe…

The Netherlands and Ireland are Europe's leading tax havens. The Netherlands has been called out several times for suspicious financial transactions involving organized crime and national politics, and no one in Brussels makes decisions about them!

Lmao cry more

Typical, let's complain that people who can, are leaving countries that steal more of their wealth and moving where taxes are lower. Governments produce nothing and they are not charities either, with all the money they have stolen at gun point. EU counties could cut takes and eliminate regulation to foster investment, innovation and grow, but they's rather die. Pretty soon they are going to adopt the Soviet model of not allowing citizens to leave and/or not letting them take their assets when they do leave. There are good reason why the wealthy are feeing to the United States and the UAE.

Hey, this must be the reason why Jannik Sinner instantly moved to Montecarlo as soon as he made some money in Italy!

The french can't cope with the fact that Italy has a stable government this time around, and France is turning into the new economic and political basket case of europe 😂

If the French dumped the military budget they'd be in the clear. Lets face it.. white flags are soooo much cheaper, don't require feeding or training and don't surrender.. oh 🤔

A german "politican" once accused a swiss politican in a german talkshow of switzerland being a tax oasis.

The swiss politicans response was absolutely brilliant.

"You can only be a oasis if you are surrounded by desert. The solution certainly cant be to turn the oasis into more desert"

In my humble opinion any amount of tax exceeding 20% of the wage is bad.

(including taxes with the promise of later returns such as forced retirement contributions, often they are called social spending, its functionally identical to tax.)

It didn't use to be that big of a problem for "leaders" to tax their population into despair because people were less mobile in the past than they are now.

What happens today is that a very productive person under the age of 40 simply packs their bags and leaves.

I am currently enjoying a tax rate of about 15-20%, and what can I say, most money problems have gone away.

A decent amount of people here are paying less than 10% tax.

I will never go back to living in a 50%+ tax country.

It saddens me that It took me 4 years until I mustered the courage to move.

There is no way to prevent this either other than to reintroduce a system similar to serfdom like some countries, notably North Korea have done.

That this wont lead to prosperity for society should be obvious and it is unlikely that the populations in Europe would accept it without violence.

So any attempt at playing this blame game is going to prove either futile or disastrous.

German for example has, in order to "prevent" people from leaving introduced an "exit" tax.

It certainly didn't stop capital flight, I can tell you that. If anything it accelerated it,

because there are still legal loopholes and people are not waiting for them to be closed.

My recommendation to France and all the other countries would be to work towards reducing taxation to 20%.

Naturally in order to do so the amount of money the state spends has to be reduced.

That this is possible has been proven by Argentina,

unfortunately for Argentina it took 100 years of despair until it was figured out.

I hope that countries like France, Germany and Italy,

don't fall into 100 years of despair before someone figures out that maybe the

Government shouldn't try to micromanage everything and involve itself everywhere.

Only 2400 foreign nationals, mostly from UK, USA, and Germany, have taken advantage of the Italian flat tax on foreign generated income at 200000 euro over 8 years. The number of French citizens is negligible. Bayrou should have mentioned instead Monaco and Andorra, not Italy. Unfortunately he is too afraid to do so. Isn't Macron head of state of Andorra?

Comments are closed.