Inflation expectations are the essential factor in determining whether rising prices in the economy will be temporary or instead prove enduring.

Ever since inflation spiked during the pandemic, the Federal Reserve has put great effort into restoring price stability—and keeping the public’s expectations of inflation well-anchored.

But now, as the Fed’s independence comes under attack and as investors question the Fed’s 2% inflation target as too low, the central bank has fallen under pressure to cut its policy rate.

The Fed is facing a question: Does it have the credibility not only to cut its policy rate next week but also to reduce it further in the following months, to the long-run neutral rate of 3%, without stoking inflation?

Get Joe Brusuelas’s Market Minute economic commentary every morning. Subscribe now.

As the Fed navigates the supply and demand shocks that are working their way through the economy, any loss in its credibility places these inflation expectations at risk and points toward persistent price increases.

Inflation expectations are currently mixed. The New York Fed’s one-year-ahead inflation expectations stand at 3.2% while the five-year, five-year forward breakeven rate resides at 2.34%.

The one-year figure is well above the Fed’s 2% target and likely indicates some erosion in the central bank’s credibility when it comes to maintaining price stability.

The five-year figure, though, is well within the Fed’s long-run target and supports the Fed’s staying patient as inflation-inducing policies like tariffs and expansionary fiscal policies are implemented.

It’s an unusual challenge for the Fed as it seeks to fulfill its dual mandate of keeping inflation low and maintaining full employment.

Hiring is slowing but inflation is rising as tariffs take hold and as service sector inflation remains elevated. It’s one of those moments where central bankers look to inflation expectations when setting monetary policy.

The idea that any inflation is transitory is not likely to be well received by the public, policymakers and professional investors. Yet calls for rate cuts, even jumbo rate cuts, are predicated on the idea that a tariff-induced increase in the price level will prove transitory.

Adverse shocks

We can expect the central banks among the Western democracies to respond in a relatively uniform manner to the next inflation shock or economic downturn.

Monetary policy has become successful in Western economies because of the increased degree of consistency among the central banks. Knowing how a central bank will respond to an economic event shapes expectations and allows households, businesses and financial markets to make informed decisions.

Analysis of central bank behavior, by Emi Nakamura, Venance Riblier and Jon Steinsson presented at the Jackson Hole Economic Symposium in August, points to the various responses among the central banks to the post-pandemic inflation shock.

That analysis found that the measured approach to the post-pandemic inflation shock by central banks with credible inflation policies was more successful in reducing inflation than the rapid response of banks with less credible policies.

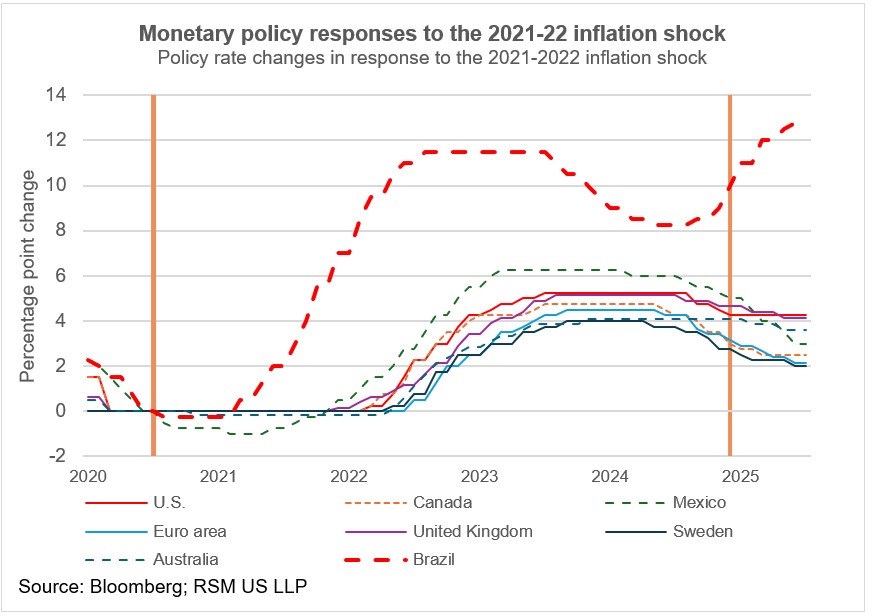

Take the Brazil central bank’s rapid response to the 2021-22 inflation shock to the more gradual response by the central banks in developed economies.

While Brazil’s central bank raised its policy rate by 11.5 percentage points between July 2020 and August 2022, the Federal Reserve waited until March 2022 to begin raising the federal funds rate by 5.25 percentage points by July 2023.

Which strategy worked better?

Inflation shot up higher in Brazil’s developing economy than the developed economies. It then dropped faster in 2022, but then stayed higher through today.

One potential explanation is that the monetary authorities in the quick-response countries like Brazil have less credibility than the monetary authorities in the measured-response countries, the paper’s authors found.

A central bank with low credibility will see inflation expectations rise more in response to an inflationary shock, with inflation expectations a major factor in spending decisions, the authors found.

Today, in the United States, expectations are for inflation to remain in a range of 2.3% to 3.0% in 12 months’ time, with the median of economists’ predictions also forecasting a 3% rate for the next four quarters.

The takeaway

Central banks in the West have made it clear that their policies will be consistent with achieving 2% inflation. This stated goal allows households, businesses and market participants to make informed economic decisions.

The Fed is under political pressure to lower its policy rate at its upcoming meetings. The forward markets are pricing in at least two rate cuts of 25 basis points each at the Fed’s three remaining meetings this year.

These meetings come at a time of extreme uncertainty regarding the direction of the labor market and inflation, which comprise the Fed’s dual mandate.

The Fed has stated that it determines its policy based on data. If prices continue to rise, it will raise the cost of credit. If employment is insufficient, it will lower the cost of credit in order to stimulate investment and spending.