The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

Imperial Petroleum Investment Narrative Recap

To be a shareholder in Imperial Petroleum, you need to believe in the company’s capacity to leverage its expanded fleet amid global trade shifts, and that near-term market volatility won’t outweigh potential gains from new vessel deliveries. The recent preferred dividend news signals a steady approach to shareholder returns, but in light of lower sales and earnings, it does not materially alter the most important catalyst, successful integration and employment of new drybulk vessels, or mitigate the main risk, which remains exposure to short-term charter rate swings.

The company’s September 2025 dividend announcement directly follows its Q2 financial report, where revenue and net income both declined year over year. Maintaining preferred dividend payments during this down cycle offers some reassurance of available liquidity, but the more pressing concern is whether the new ships, delivered on short-term contracts, can help stabilize earnings as freight market conditions shift.

Yet, against this background, investors should be aware that short-term contract exposure in the drybulk fleet may still leave the company vulnerable if…

Read the full narrative on Imperial Petroleum (it’s free!)

Imperial Petroleum’s narrative projects $407.7 million revenue and $177.8 million earnings by 2028. This requires 47.3% yearly revenue growth and a $143.8 million earnings increase from $34.0 million today.

Uncover how Imperial Petroleum’s forecasts yield a $6.00 fair value, a 34% upside to its current price.

Exploring Other Perspectives IMPP Community Fair Values as at Sep 2025

IMPP Community Fair Values as at Sep 2025

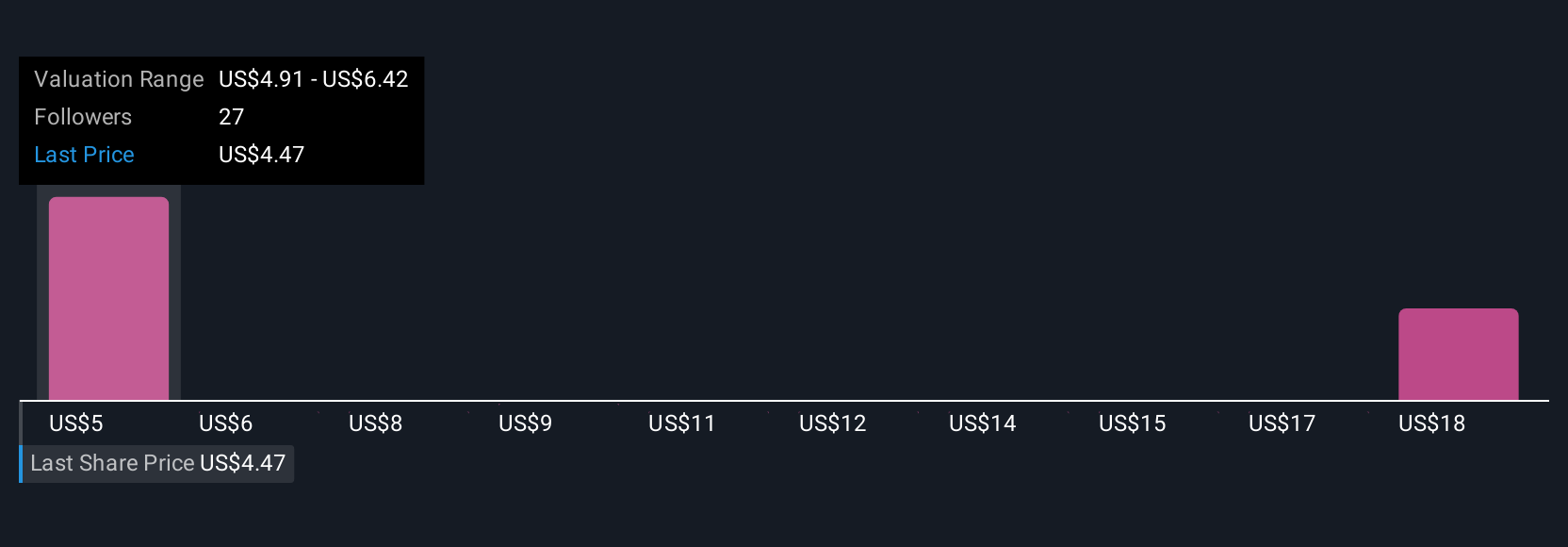

Four individual fair value estimates from the Simply Wall St Community for Imperial Petroleum range from US$4.91 to US$19.99 per share. While views vary, many focus on whether the new fleet and charter rates can offset declining revenues, explore these perspectives to see how others interpret risk and opportunity.

Explore 4 other fair value estimates on Imperial Petroleum – why the stock might be worth just $4.91!

Build Your Own Imperial Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Imperial Petroleum?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com