China’s travel market advanced 5.5% in 2024 to reach $151.8 billion, a slower pace than many expected. According to Phocuswright’s research report China Travel Market Essentials 2025, the growth highlights both the scale of demand and the ongoing challenges of restoring pre-pandemic momentum. Despite more than 5.6 billion domestic trips, oversupply and subdued economic confidence kept fares and rates from rising.

The structure of the market is distinctive. Domestic suppliers control rail, car rental, online travel agencies (OTAs) and much of the hotel sector, while three state-backed airline groups continue to dominate the skies. International hotel brands are expanding in major cities and beginning to reach lower-tier markets, while Chinese chains still hold the advantage in budget and mid-range properties.

Get a dose of digital travel in your inbox each day

Subscribe to our newsletter below

Outbound travel is strengthening, led by affluent and independent travelers. Although volumes will not return to 2019 levels until 2026, outbound trips are projected to surpass the 155 million benchmark in 2025. Rail and self-drive travel are flourishing, group tours are becoming leaner and more tailored and business travel is constrained by tighter corporate budgets.

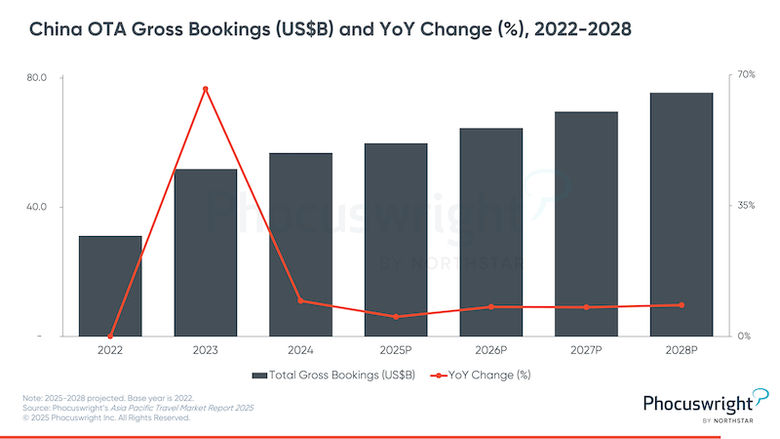

OTAs like Ctrip, Fliggy, Tongcheng, Meituan and Tuniu have invested huge sums in proprietary artificial intelligence engineering and data science, expanded their customer acquisition strategies and reframed their membership programs with aspirational rewards and incentives. In addition to launching tour products for target demographics like solo travelers, seniors and graduates, OTAs are expanding their offline store networks in lower-tier cities to broaden their sales channels and customer bases. Since China reopened in 2023, OTAs have been notable beneficiaries.

Phocuswright’s China Travel Market Essentials 2025

Unlock the full picture of China’s complex travel market in Phocuswright’s China Travel Market Essentials 2025. This new Essentials format delivers top-level takeaways, complete with charts and analysis on the trends, segment highlights and market sizing datapoints that matter most.