Refresh

Thank you for following our preview analysis this evening. We will be back tomorrow morning when August’s inflation figures are published at 7am. Join us for live reporting and analysis then.

What’s happening with food inflation?

Food has been one of the categories driving inflation higher, and it is an area the Bank of England seems to be concerned about. Food prices are very visible to consumers – it is easy to see when your weekly or monthly supermarket bill is going up.

In July’s report, the cost of food and non-alcoholic beverages rose by 4.9% – the fourth consecutive increase in the annual rate and the highest recorded since February 2024.

“The Food and Drink Federation is forecasting food inflation could reach 5.7% by the end of December and still be running at 3.1% by the end of 2026,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“Higher employer and packaging taxes are being blamed for increasing costs for companies, which they can no longer absorb.”

(Image credit: David Espejo via Getty Images)

When will inflation return to the 2% target?

As we have introduced in our previous posts, inflation is expected to peak at 4% in September’s report (published in October) before gradually falling back after that. It could be some time before it returns to the 2% target, though.

Households brace for impact of inflation

Even if inflation were to sit at around 2% (the Bank of England’s target), it would only take 36 years for the value of your savings to halve.

(Image credit: Tatiana Lavrova via Getty Images)

State pensioners more interested in September CPI report

It is August’s inflation figures that we will get tomorrow. Pensioners will have to wait another month for September’s figures (due on 22 October), which will play a role in setting how much state pension they receive in 2026/27.

Under the triple lock policy, state pension payments are uprated annually in line with inflation, earnings growth, or by 2.5% – whichever measure is highest.

September’s CPI report is the one that is used in the calculation. The wage growth figures used cover the period between May and July. These were published in today’s labour market report.

This year’s triple lock calculation will almost certainly be based on earnings growth, as this came in at 4.7% between May and July (including bonuses), whereas September’s inflation reading is expected to come in at 4%.

A 4.7% increase “would see a full new state pension rise from its current level of £230.25 per week to £241.05 per week from April,” said Helen Morrissey, head of retirement analysis at investment platform Hargreaves Lansdown.

“Those retiring on the basic state pension would see their weekly income increase from £176.45 per week to £184.75.”

(Image credit: Halfpoint Images via Getty Images)

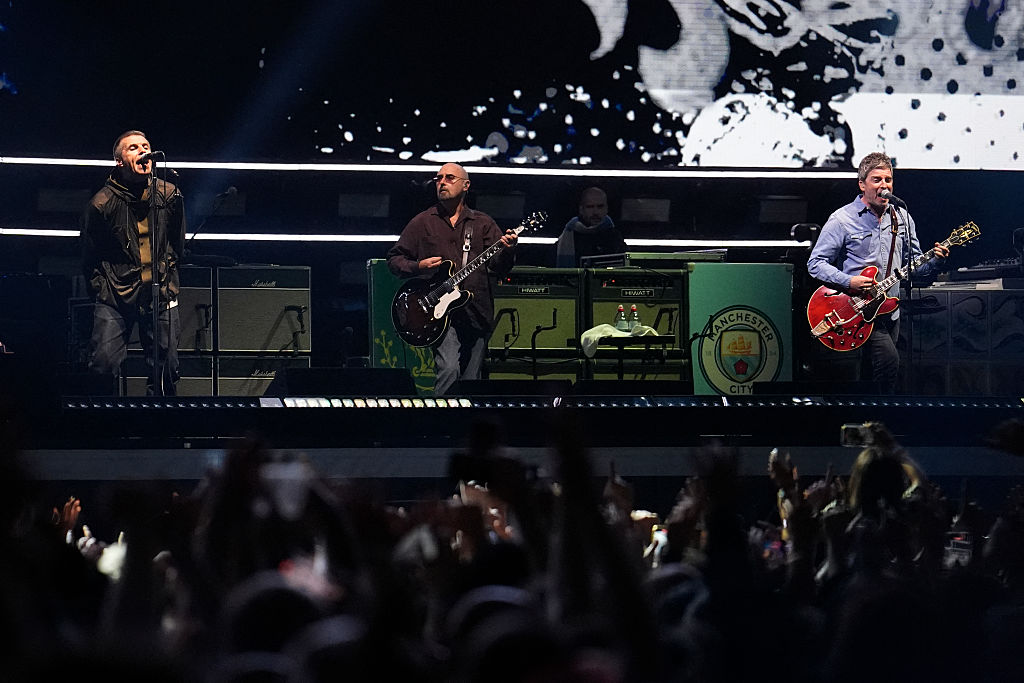

Oasis reunion tour could push hotel prices up

“A jump in food price inflation, a fall in motor fuels last August dropping out of the annual inflation comparison, and hotel prices inflated by an Oasis concert on CPI collection day should more than offset slowing airfare inflation,” said Pantheon’s chief UK economist Robert Wood.

(Image credit: Photo by AFP STRINGER / AFP via Getty Images)

Experts say September rate cut unlikely

The next Monetary Policy Committee (MPC) meeting will take place on 18 September, just one day after August’s inflation report is published. The Bank of England is expected to hold rates at 4%. Economists polled by Bloomberg and Reuters were unanimous in ruling out a September rate cut.

Speaking to MPs earlier this month, the Bank of England’s governor Andrew Bailey said inflation risks had “gone up”. While rates are still on a downward path, he added that there is now “considerably more doubt about exactly when and how quickly we can take those further steps”.

(Image credit: Tupungato via Getty Images)

Oxford Economics: Food and petrol could push inflation higher

Advisory firm Oxford Economics is one of the forecasters that thinks inflation will inch up to 3.9% tomorrow. By comparison, the Bank of England’s forecasts point to a 3.8% reading, which is also what Deutsche Bank, the investment bank, is expecting.

A 3.9% forecast “reflects our view that further upward pressure from food prices and a smaller drag from the petrol category should more than offset the impact of a modest fall in services inflation due to July’s temporary spike in air fares unwinding,” said Edward Allenby, economist at Oxford Economics.

What to expect from tomorrow’s inflation report

The Office for National Statistics will publish August’s inflation report tomorrow morning at 7am, and it is unlikely to make pretty reading. Forecasters think inflation will either hold steady at 3.8% or creep up slightly to 3.9%, before peaking at 4% next month when September’s figures are released.

July’s reading of 3.8%, published last month, was the highest in 18 months. Higher food prices have been a big driver of increases in recent months.

(Image credit: Wong Yu Liang via Getty Images)