Created on September 17, 2025

Not Hot in America

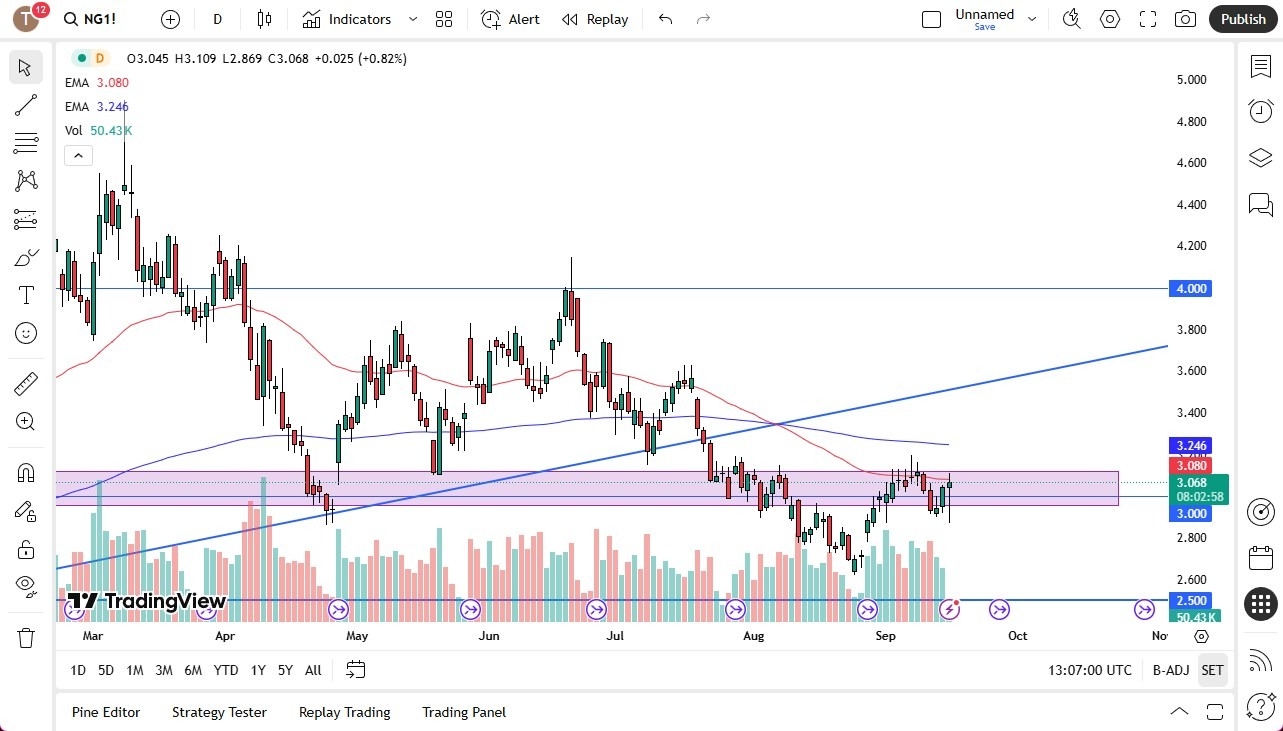

And of course, we haven’t seen much in the way of extreme heat in the United States for a while. So that drives down the need for electricity. Another thing that you need to keep in mind, though, is if the US economy does roll over, it will drive down the need for electricity anyway. So that might put a little bit of a damper on natural gas this winter. But on the whole, natural gas does fairly well in winter contracts. And like I said, we’re about 10-ish days or so from rolling over into the November contract. So, you should start to see it perk up a bit. It would not be a surprise to see one more dip right here. And then I think at that point we might be done. We’ll just have to wait and see. That could have been the beginning of the Tuesday session. Maybe that was it. Volume is basically normal. There’s nothing erratic about volume.

So, I think this is a very dangerous market at the moment, but I am starting to think to the upside. Basically, I’ve gone from bearish to neutral, knowing that I’ll be bullish here in a few weeks, regardless. So good price action for the day if you’re bullish. The 200 day EMA above could be the signal if we break above it, that it’s time to get a little bit more aggressive to the upside. If we do break down from here, there is a gap right around $2.75 that could be a target.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.