Source: Coinbase; Compiled by Golden Finance

The pursuit of yield has returned to the crypto market, but with it comes risk. We analyzed various yield strategies.

Key Takeaways

Secured loans = Low-risk yield: Over-collateralized, agent-managed loan yield targets are approximately 1-2% (BTC), while retaining principal and asset exposure.

“Market-neutral” strategies = Higher yields, higher risks: Futures basis (~4-8%) and covered call writing (~2-8%) introduce leverage, exchange rate, funding/volatility, execution, and upside cap risks.

“Market-neutral” strategies = Higher yields, higher risks: Futures basis (~4-8%) and covered call writing (~2-8%) introduce leverage, exchange rate, funding/volatility, execution, and upside cap risks.

Professional management is critical: Institutional oversight, collateral control, execution, reporting, and compliance are essential for safely accessing crypto yields.

Secured Loans and Market-Neutral Trading

In the cryptocurrency space, the pursuit of yield has heated up again. The last cycle ended painfully, with companies like BlockFi and Celsius far exceeding prudent limits due to immature risk and operational management, ultimately leading to their collapse. As demand rebounds, some participants may repeat past mistakes. For investors, it is crucial to understand how yields are generated and the risks that underpin them when pursuing such opportunities.

Secured loans offer investors a way to generate yield while safeguarding principal and gaining exposure to the superior performance of core assets. Their collateral structure provides stability and transparency, enhancing their appeal to institutional portfolios.

Other “market-neutral” strategies, such as futures basis trading and covered call writing (an investment strategy involving holding an asset while selling call options on that asset to collect premiums and enhance returns or reduce holding costs), can also boost returns. However, each strategy carries distinct risks: basis trading is vulnerable to funding volatility and questionable exchange rate exposure, while covered call writing limits upside participation during significant market rallies. These methods can play a role in a broader toolkit, though their pros and cons contrast sharply with low-risk secured loans.

Secured Loans: Returns with Built-in Risk Control

Expected Return (BTC): 1-2%

Secured lending involves loaning assets (e.g., BTC, ETH, or stablecoins) to institutional borrowers – overcollateralized and typically managed by third-party agents (e.g., Coinbase Prime).

Unlike trading strategies, agency lending is passive and non-directional, with risks mitigated through counterparty quality and collateral management. Key features:

Fully Collateralized: Daily margining and high-quality collateral overcollateralization reduce credit risk.

No Market Risk: Regardless of market movements, the loan preserves the risk profile of your original investment.

Operational Simplification: Agents handle collateral, custody, and compliance matters.

No Mark-to-Market Losses: Lending positions are returned in the same asset and notional amount as the original loan.

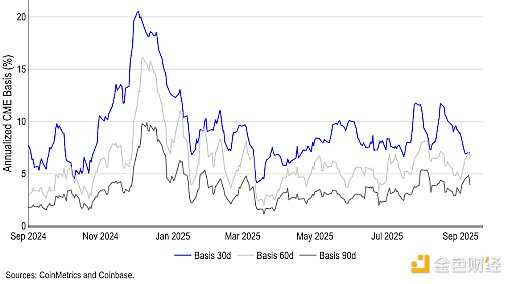

Futures Basis: Yield Correlation with Market Sensitivity

Expected Return (BTC): 4-8%

Basis trading refers to capturing the spread between spot prices and futures prices by going long on one asset and short on another. While this may seem risk-free at first glance, there are indeed some risks in practice:

Leverage and margin risk: Sudden price movements may trigger liquidation.

Exchange risk: Funds may need to be held on offshore exchanges (e.g., perpetual futures), increasing operational risks and potential default risks.

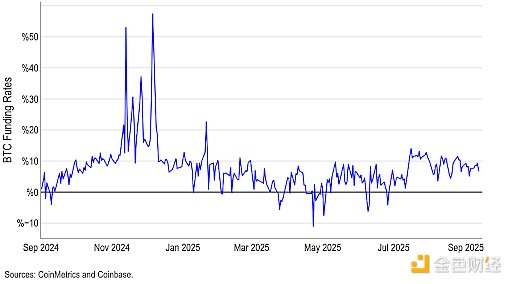

Basis collapse/funding rate volatility: The spread may disappear or reverse, eroding expected profits, especially in perpetual futures with mechanisms like clamping (clamping generally refers to restrictions set to prevent trading risks, such as forced liquidation in leveraged trading).

Operational risk: Executing two-legged trades (a derivatives trading strategy involving simultaneous long and short positions) to maintain a market-neutral exposure can significantly increase slippage risks, eroding arbitrage profits.

Operational risk: Effective fund management across trading venues is crucial for execution quality.

Figure 1: Basis Yield (Annualized) of BTC Spot vs. CME Futures

Figure 2: BTC Perpetual Futures Funding Rate

* Deduct estimated financing costs

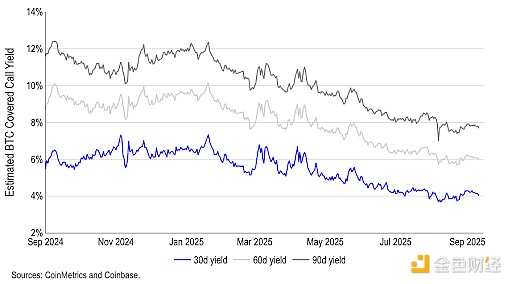

Covered Call: Yield with a Cap

Expected Return (BTC): 2-8%

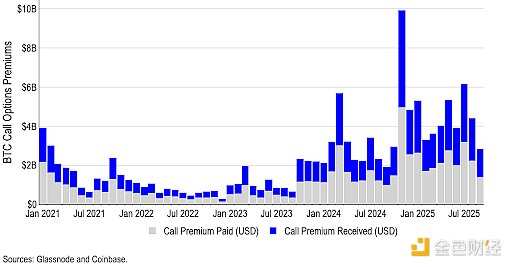

This strategy involves holding an asset (e.g., BTC) and selling call options to collect premiums. While this can enhance returns in a flat market, it introduces an asymmetric return profile:

Limited Upside/Full Downside: If the asset rises while you remain exposed to full losses, gains will be capped.

Volatility Exposure: Structurally, you are short volatility — typically a precarious position in cryptocurrencies.

Liquidity and Execution Challenges: Slippage and mispricing must be carefully managed — especially if the asset is traded or held across multiple platforms (e.g., spot cryptocurrency stored in insured custody).

Operational and Tax Complexity: Managing expirations, wallets, and taxable events requires institutional-grade infrastructure.

Figure 3: Estimated BTC Covered Call Yields Across Different Expirations

Figure 4: BTC Call Option Premiums Paid and Received

The Role of Professional Management in Cryptocurrency Returns

Given the inherent complexity and risks associated with cryptocurrency yield strategies, it is essential to engage a professional team to manage these programs.

For secured loans, partnering with an experienced agency can help investors efficiently scale their operations, maintain strict risk controls, and execute collateral management practices that align with institutional frameworks. Agencies also provide independent oversight, consolidated reporting, and compliance support, ensuring transparency and governance while achieving incremental returns.

Similarly, “market-neutral” strategies (such as futures basis trading and covered call options) require specialized investment managers to effectively navigate liquidity, leverage, and execution risks.

Across all yield-generating approaches, professional management is critical for protecting principal, maintaining visibility of risks, and optimizing returns in a disciplined manner.

Conclusion

The pursuit of returns in the cryptocurrency market has returned, but so have the risks. Futures basis and covered callsOptions StrategyReturns can be enhanced, but each strategy carries operational, market, and leverage risks that must be carefully managed. In comparison, secured loans provide returns while maintaining participation in the principal and core assets. Across all approaches, professional management is essential for controlling risks, ensuring transparency, and optimizing returns. For investors focused on sustainable yields, strict execution and clear transparency are indispensable.