How does Wandsworth have such low council tax while still providing their council services so well?

by FlyWayOrDaHighway

How does Wandsworth have such low council tax while still providing their council services so well?

by FlyWayOrDaHighway

11 comments

For the record I’m not a Wandsworthian

Demographics. Fewer low-waged, elderly people, ill people and children to make demands on housing, hospitals and schools. A young and affluent local population also means fewer defaults on council tax payments, and more payments to the council ie fees for parking permits and planning permissions. Also the infrastructure there is Edwardian and later – Georgian and Victorian architecture in more historic parts of London is a drain (sometimes literally) on public resources. Sometimes you also have to give local executives their due – Wandsworth has had continuity of strategy and aligned leadership (unlike my own borough of K&C).

Wandsworth and Westminster get substantially more central government finds per head than virtually anywhere else. Back in the ’90s when we still had the poll tax. The Tories increased VAT from 15% to 17.5% to finance a £150 cut in the poll tax. Which allowed the two boroughs to get rid off poll tax.

Other income streams

Leaner, efficient teams and a commitment to keep council tax low, which also translates to low corruption rate. They also have the benefit of strong commercial income over other councils.

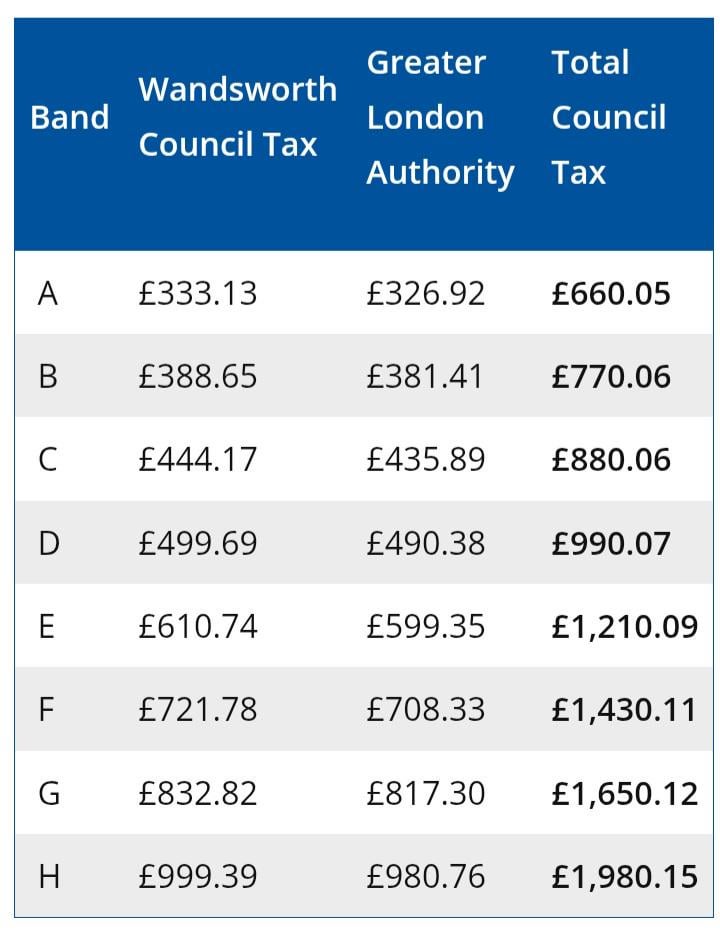

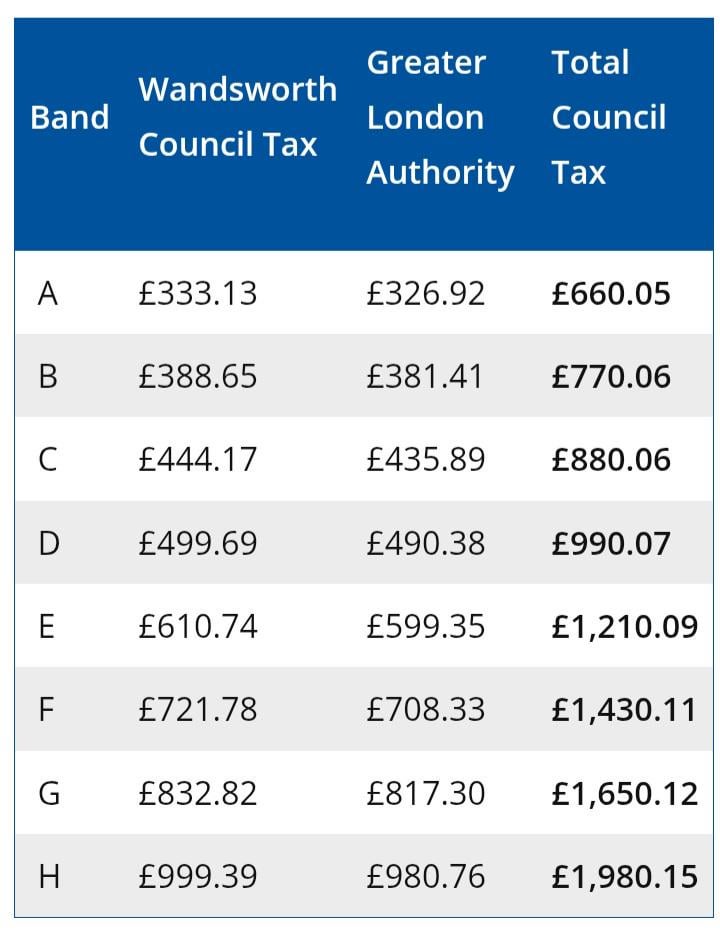

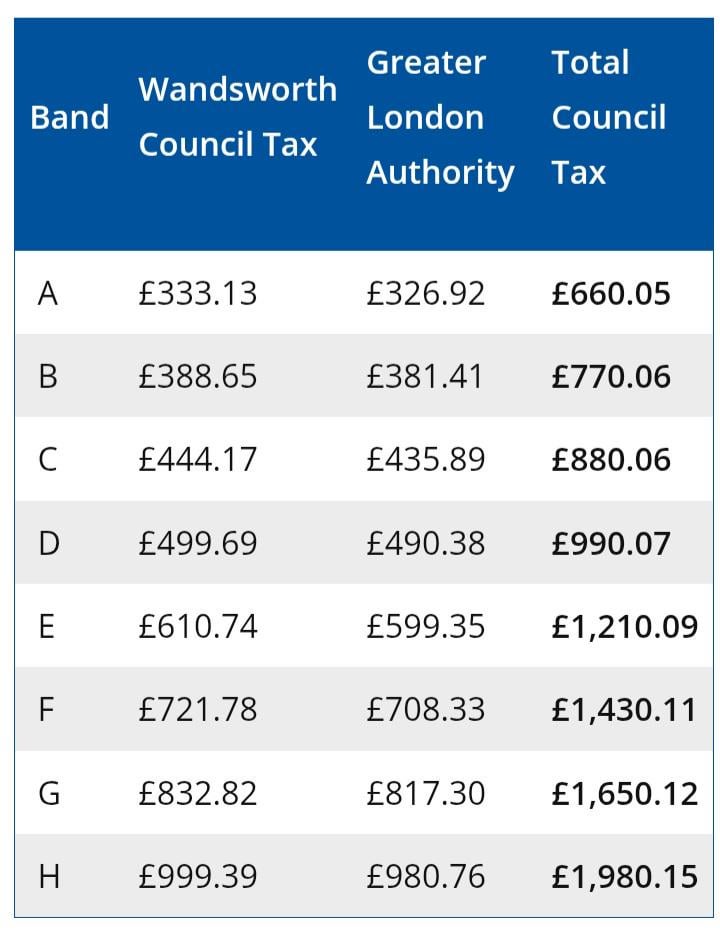

I’m in Kent in a band B and my council tax is more than double the band B in Wandsworth.

There council services are awful. Most things are outsourced like libraries and leisure centres.

Because for the last 12 years it’s had a special funding regime that’s given it loads of money from central government. Nothing to do with being “lean” or “efficient”.

“Wandsworth Council’s finance officer has confirmed that it is reliant on the Labour government extending special funding protections that should have ended a decade ago – or face the prospect of council tax bills doubling or even trebling in coming years.

Speaking at a Finance Committee meeting this week, Ms Murray revealed that Wandsworth is still benefiting from “transitional protection” introduced when the Conservative government last reformed local authority funding in 2013. She admitted the council is now desperately campaigning for similar special treatment under Labour’s upcoming Fair Funding Review to avoid a financial catastrophe…

…

Wandsworth’s reputation for fiscal responsibility and the lowest council tax in London has been built on more than a decade of special government protection that has shielded it from the funding reality faced by other councils. ”

Also this was literally the second result on google

https://putney.news/2025/07/05/wandsworth-confesses-without-special-deal-council-tax-bills-could-triple/

Wandsworth doesn’t have to care for as many economically inactive people (pensioners, children, homeless, long-term sick etc) as most other boroughs, the demographics skew towards wealthy, working age people. Croydon council, by comparison, has the opposite problem – it’s effectively declared bankruptcy repeatedly despite crap services and council tax bands twice as high. This is because it has the opposite situation, a lot of poorer residents relying on the council to provide services for them and relatively few well-off net contributors.

Personally I think this needs to change as it places the least burden on those most able to pay, while creating a postcode lottery of public services which can trap people in poverty. Labour have announced plans to address this, but I fear they will just make a general attempt to direct funding North, rather than targeting more deprived areas within cities.

Think it’s history. Wandsworth has a lower percentage of social housing than similar boroughs.

Low debt. Lots of councils ‘invested’ a lot in real estate which didn’t turn a profit and left them with a ton of debt to service. Wandsworth did not.

Comments are closed.