The European rail sector contributed 247 billion euros to the EU economy and supported 3.16 million jobs in 2023, a new Oxford Economics study shows. Equivalent to 1.4% of EU GDP and larger than Greece’s economy, CER says the findings confirm rail as “an economic powerhouse” but also highlight “the cost of failing to achieve the long-strived-for shift to rail.”

A new Oxford Economics study has quantified the annual economic footprint of Europe’s railways: 247 billion euros. That figure is taken from 2023 and is equivalent to 1.4% of EU27 GDP, and larger than the entire economy of Greece. The research, commissioned by the Community of European Railway and Infrastructure Companies (CER), argues that rail is not only the lowest-carbon mode of mass transport, but also one of the continent’s most important economic sectors.

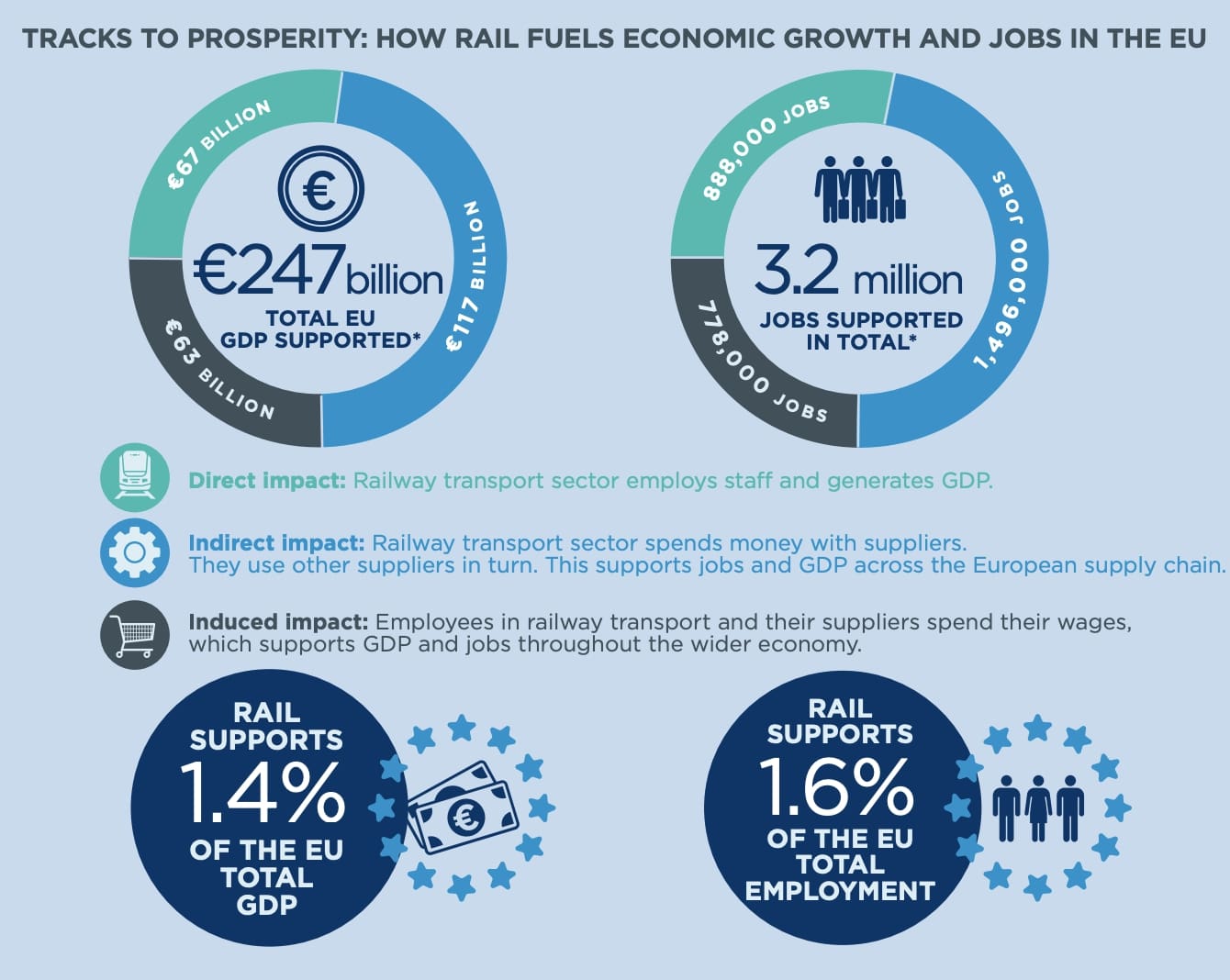

A visual breakdown of the report’s findings in graphics. © Oxford Economics, The Economic Footprint of Railway Transport in Europe (study for CER, September 2025)

A visual breakdown of the report’s findings in graphics. © Oxford Economics, The Economic Footprint of Railway Transport in Europe (study for CER, September 2025)

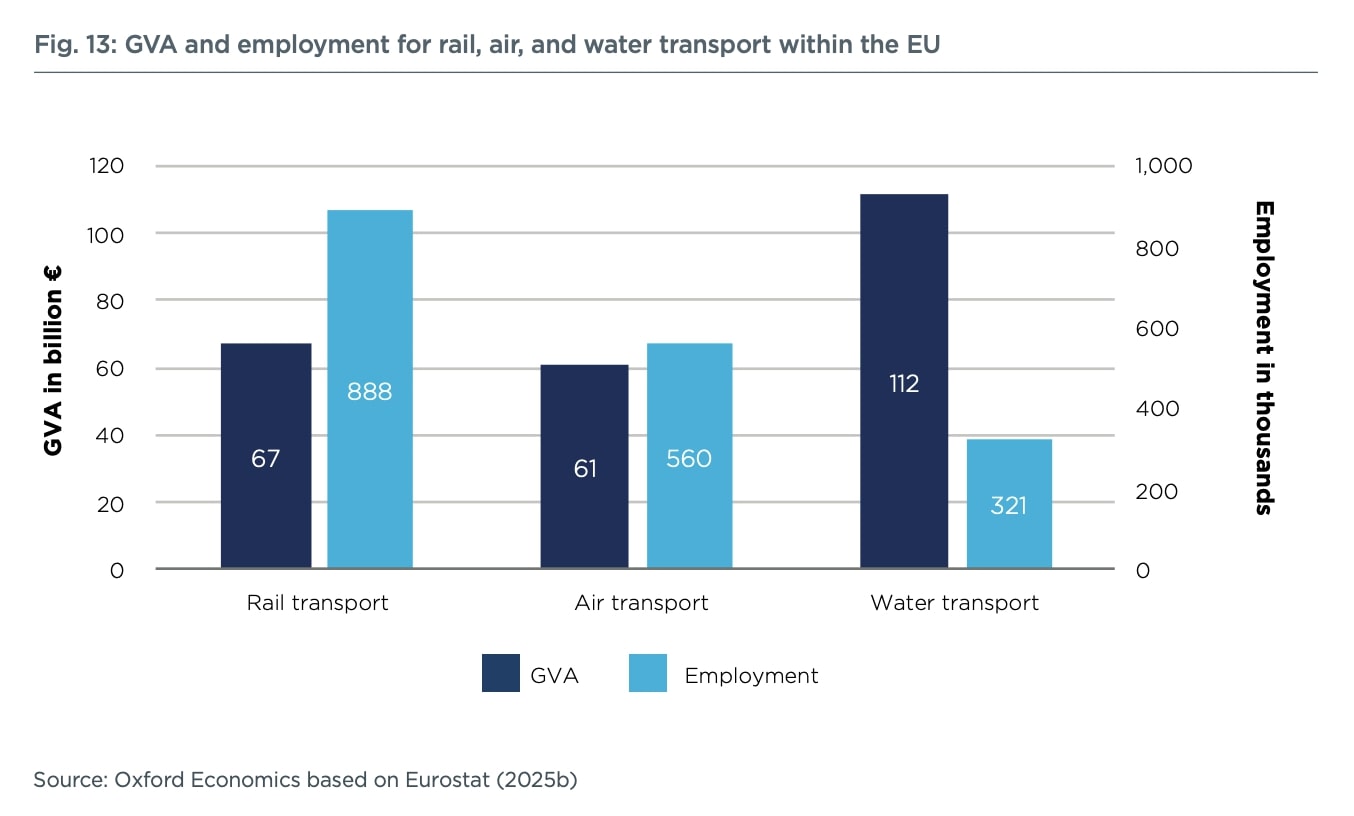

Railway transport itself directly contributed 67 billion euros of gross value added (GVA) to the EU27 economy in 2023, according to the study. Its supply chain generated a further 117 billion euros, while employee spending added 63 billion euros. Together, this 247 billion euro contribution surpasses Greece’s GDP of 225 billion euros, placing rail alongside some of Europe’s mid-sized economies. In contrast to air and water transport, rail’s direct GVA of 67 billion euros is higher than air’s 61 billion but lower than water’s 112 billion, while its 888,000 direct employees match the combined workforce of the two sectors, showing rail’s labour intensity compared with its more visible competitors.

Indeed, on employment, rail supported about 3.16 million jobs across the EU last year, or 1.6% of total employment. That is more people than the entire workforce of Ireland. Every direct job in rail apparently supports 2.6 jobs elsewhere in the economy, the study says, while each euro of direct value added generates 2.7 euros more in other sectors.

Which industries need rail the most?

The report also spells out which industries depend most heavily on rail. These include R&D and technical testing, wholesale trade in machinery and equipment, and construction. Rail’s contribution also extends beyond commerce, the study says: it is recognised as strategically crucial for defence mobility, able to shift troops and equipment rapidly across Europe. It notes that rail provides secure, efficient and high-capacity logistics for sectors such as manufacturing, energy and defence, and that the EU’s Military Mobility Initiative is designed to clear infrastructure and regulatory bottlenecks so forces can move swiftly in times of crisis.

Gross value added and employment per transport sector. © Oxford Economics, The Economic Footprint of Railway Transport in Europe (study for CER, September 2025)

Gross value added and employment per transport sector. © Oxford Economics, The Economic Footprint of Railway Transport in Europe (study for CER, September 2025)

That’s as this strategic dimension is gaining new weight in Brussels. In its draft 2028–2034 long-term budget, the European Commission has proposed a ten-fold increase in Military Mobility funding, from around 1.7 billion to 17 billion euros, alongside a doubling of the Connecting Europe Facility for transport. Both measures show that the EU sees dual-use rail upgrades as being at the heart of Europe’s security and competitiveness agenda.

A strong post-COVID comeback

The report also shows that after the shock of the COVID-19 pandemic, the rail sector has rebounded strongly. Over the past decade, European rail has improved its productivity by 9.4%, while enabling productivity gains across other industries by providing reliable passenger and freight connections. Today it carries 8 billion passengers annually and transports 378 billion tonne-kilometres of freight on the EU’s 201,000 kilometres of track.

However, it breaks down how traditional bulk commodities are collapsing: coal, lignite and gas rail volumes are down 42% since 2013, chemicals by 32%, and refined petroleum products by 22%, showing the scale of structural change in freight markets.

And the study also warns of stagnation. Rail’s share of passenger and freight transport has not grown in recent years, despite its environmental advantages. Passenger modal share has been stuck at 7% for more than a decade, while freight has slipped from 14% to 12%, a decline that undermines EU targets. Against this backdrop, intermodal freight is the only clear growth story, surging 88% in the last decade on the back of e-commerce and global supply chains.

The cost of failing to push the modal shift

While it is the most energy-efficient transport mode and produces near-zero emissions at point of use, the report concludes that stable investment and supportive policies will be needed to build on its strengths and support Europe’s climate transition.

“For many people, railways have come to represent the green transport mode of choice that Europe should invest in to achieve its decarbonisation ambitions,” said CER Executive Director Alberto Mazzola. “The figures revealed by Oxford Economics in this new study show that beyond its strong sustainability credentials, the rail sector is also an economic powerhouse boosting EU competitiveness, jobs and growth. As the EU reflects on the shape and size of its next long-term budget and a new action plan for high-speed rail, these findings shed new light on the value of railways and the cost of failing to achieve the long-strived-for shift to rail.”

Already have a subscription? Log in.

Or

Want to read this article for free?

You can read one free article per month. Enter your email and we’ll send you a free link to access the full article. No payment required.