If you have been watching China Petroleum & Chemical lately, the question of what to do next with the stock is probably top of mind. Maybe you have noticed its share price sliding over the last month, dropping 7.5%, and wondered whether this is a warning sign or an opportunity. Interestingly, despite a negative return of 10.6% over the past year, the stock still sits on a notable 108.7% return over five years. That long-term performance stands out, even as short-term moves suggest changing investor sentiment and possibly shifting risk perceptions in the energy sector.

Recent market developments, especially swings in global energy prices and shifts in policy, have shaped how investors view companies like China Petroleum & Chemical. Much of the recent volatility may be reflecting these broad market themes rather than anything specific to the company itself. This creates a fascinating setup, where the stock’s valuation could be out of sync with its potential.

So, how does the company actually look in terms of valuation right now? Using six classic valuation checks, China Petroleum & Chemical scores a 3, indicating it’s undervalued in half of the key categories analysts commonly watch. That mixed score might explain some of the back-and-forth in the stock’s recent trading, but it also sets up an opportunity for a closer dive.

Up next, we will break down those different valuation methods and see how China Petroleum & Chemical stacks up against industry benchmarks. Stay tuned, because beyond the typical checks, there is an even better way to judge whether the stock is really undervalued right now.

Why China Petroleum & Chemical is lagging behind its peers Approach 1: China Petroleum & Chemical Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s value. In other words, it projects how much money China Petroleum & Chemical can generate in future years and calculates what that is worth right now, considering the time value of money.

For China Petroleum & Chemical, the latest reported Free Cash Flow (FCF) is CN¥21.9 Billion. Projections show annual FCF climbing to CN¥47.9 Billion by 2027. Estimates for the next decade are extrapolated from these analyst figures. Over the next ten years, FCF is expected to remain robust, though the pace of growth is set to moderate based on current projections.

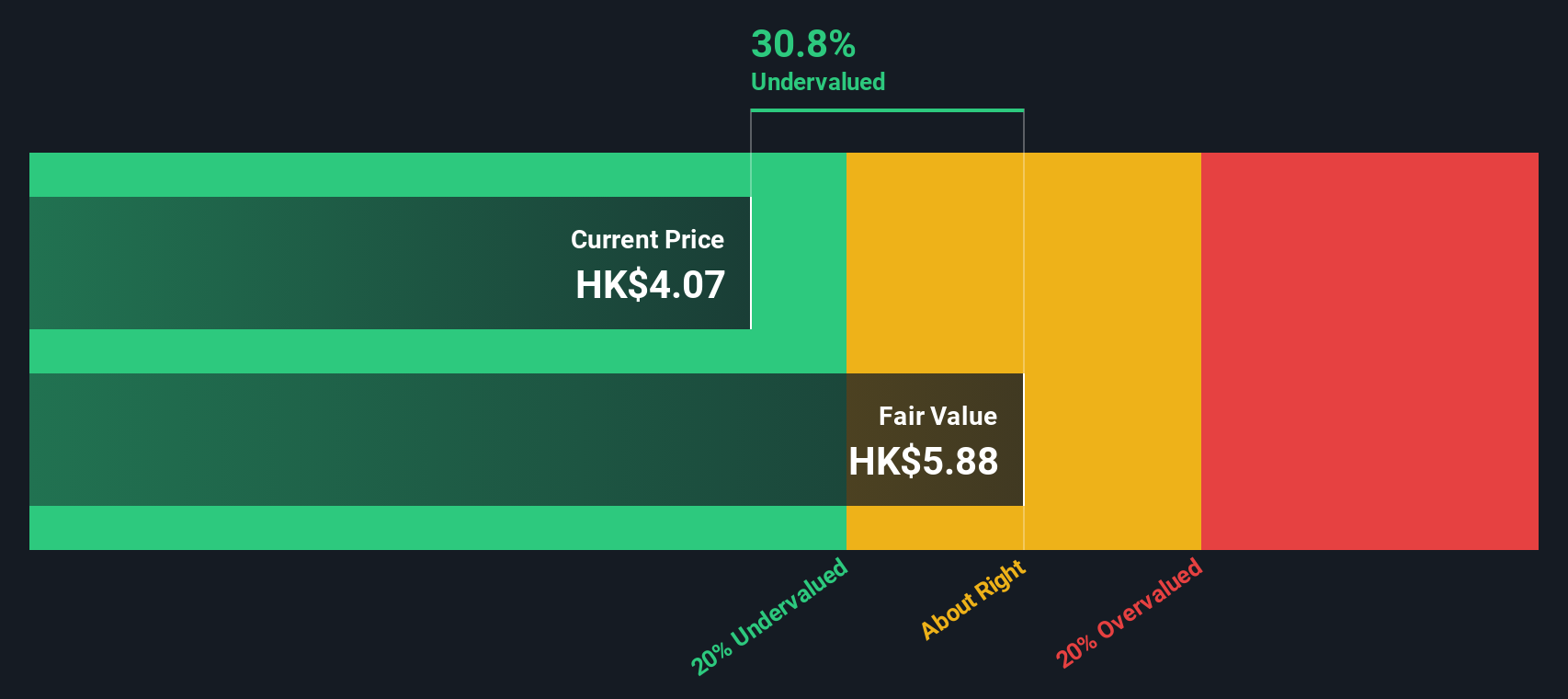

Using this two-stage DCF analysis model, the intrinsic value comes out to HK$5.88 per share, which is about 30.8% above the current share price. This significant margin suggests the stock is trading well below what its underlying future cash flows would imply.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for China Petroleum & Chemical.  386 Discounted Cash Flow as at Sep 2025 Our Discounted Cash Flow (DCF) analysis suggests China Petroleum & Chemical is undervalued by 30.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks. Approach 2: China Petroleum & Chemical Price vs Earnings

386 Discounted Cash Flow as at Sep 2025 Our Discounted Cash Flow (DCF) analysis suggests China Petroleum & Chemical is undervalued by 30.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks. Approach 2: China Petroleum & Chemical Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred metric for valuing established, profitable companies like China Petroleum & Chemical because it directly relates the company’s share price to its per-share earnings. It gives investors a quick sense of how much they are paying for each unit of earnings and helps assess whether the stock is priced fairly based on performance.

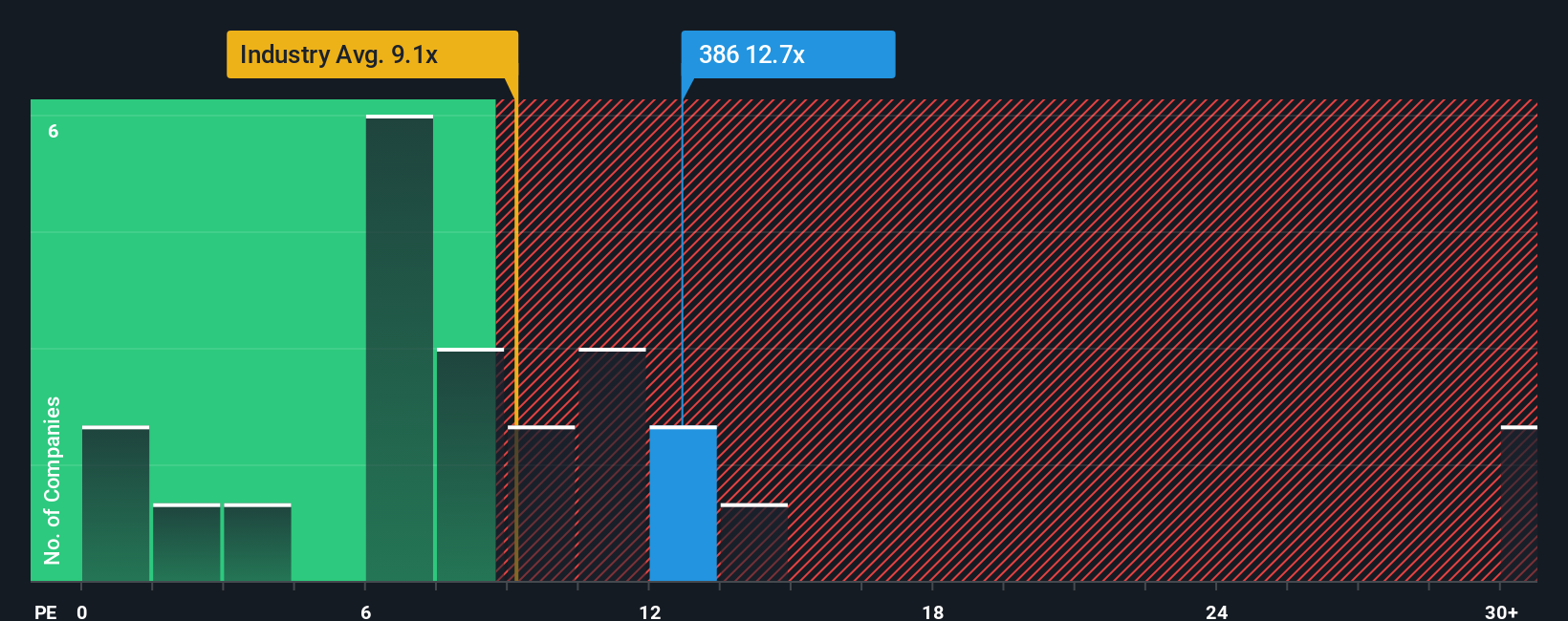

A “normal” or “fair” PE ratio can vary between companies and industries, largely depending on expectations around growth and the risks involved. Higher growth prospects or lower risk typically justify a higher PE, while the opposite pushes fair multiples down. In China Petroleum & Chemical’s case, the current PE ratio stands at 12.7x. This is just below the oil and gas industry average of 12.8x and well above the peer group average of 8.1x, suggesting the market ascribes it a moderate premium compared to its direct competitors, but not compared to the broader sector.

However, Simply Wall St’s proprietary Fair Ratio digs deeper. This metric factors in not just sector averages, but also company-specific variables like earnings growth, profit margins, market capitalization, and unique risks. This makes it more tailored to the company’s actual prospects, unlike raw peer or industry comparisons. For China Petroleum & Chemical, the Fair Ratio stands at 14.1x, which is slightly above its current PE.

Because the Fair Ratio is only modestly higher than the actual PE ratio, this suggests China Petroleum & Chemical is trading at about a fair price based on its earnings potential and risk factors.

Result: ABOUT RIGHT

SEHK:386 PE Ratio as at Sep 2025 PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your China Petroleum & Chemical Narrative

SEHK:386 PE Ratio as at Sep 2025 PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth. Upgrade Your Decision Making: Choose your China Petroleum & Chemical Narrative

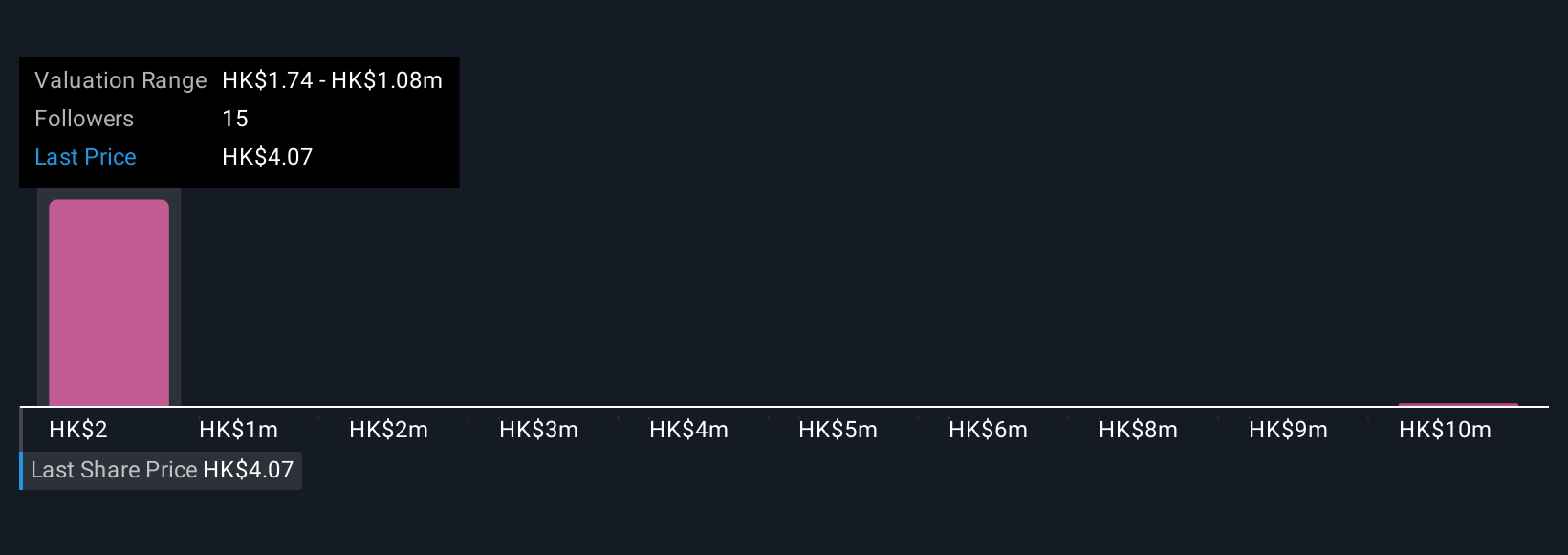

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story, guiding how you see a company’s future and linking that vision to a financial forecast and fair value. Narratives make sense of the numbers through your perspective on revenue, earnings, and margins.

Narratives turn investing into a dynamic and accessible process, allowing you to build and share your view of China Petroleum & Chemical directly on Simply Wall St’s Community page, where millions of investors participate. By matching your assumed fair value to the current price, Narratives help you decide whether it is time to buy or sell, with updates that automatically incorporate the latest news or earnings.

Every investor sees the company differently, so Narratives can range widely. One investor might believe there is strong future growth and set a fair value far above today’s price, while another might expect stagnation and a much lower valuation. As new information arises, Narratives adjust to reflect the changing story, giving you a clear, up-to-date decision tool at your fingertips.

Do you think there’s more to the story for China Petroleum & Chemical? Create your own Narrative to let the Community know!  SEHK:386 Community Fair Values as at Sep 2025

SEHK:386 Community Fair Values as at Sep 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com