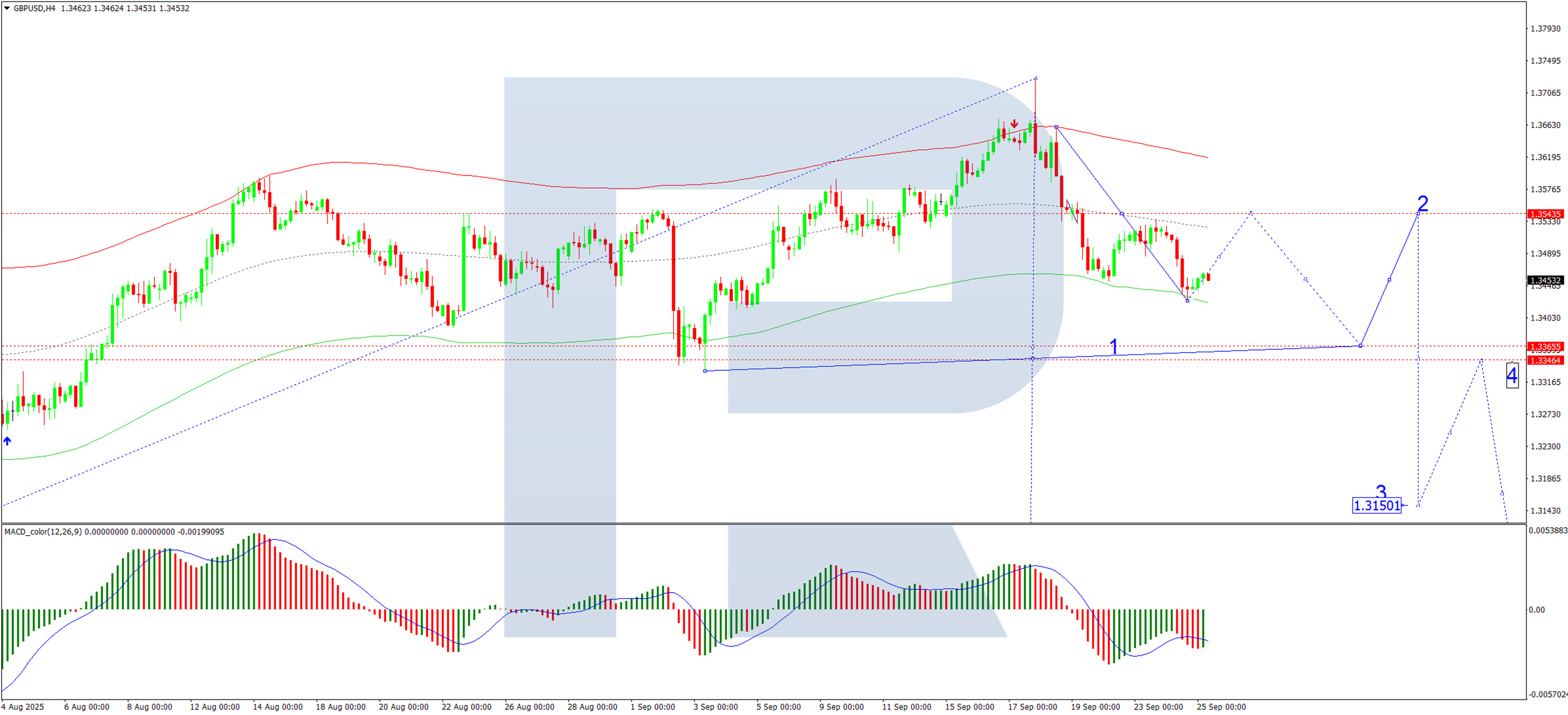

The GBP/USD pair remains under pressure, trading around 1.3460, as it contends with a mix of conflicting factors.

In the UK, Bank of England Governor Andrew Bailey stated that inflation is expected to decline next year but confirmed that the central bank’s policy will remain restrictive. He pointed to a weakening labour market and cautious consumers, whose savings are twice as high as pre-pandemic levels. Bailey acknowledged that interest rates would likely continue to fall but emphasised that the pace of easing would be strictly dependent on incoming inflation data. Read more…

GBP/USD Price Forecast: Seems vulnerable near 50% Fibo. level; US macro data awaited

The GBP/USD pair attracts some buying on Thursday and recovers a part of the previous day’s losses to the 1.3425 region, or a nearly three-week trough. Spot prices hold steady above mid-1.3400s during the early part of the European session amid a softer US Dollar (USD), though any meaningful appreciation still seems elusive ahead of important US macro releases.

The final US Q2 GDP print, along with Durable Goods Orders and the usual Initial Weekly Jobless Claims data, will be published later today. The focus, however, will remain glued to the US Personal Consumption Expenditure (PCE) Price Index on Friday. The latter is seen as the Federal Reserve’s (Fed) preferred inflation gauge and will play a key role in influencing expectations about the future rate-cut path, which, in turn, will drive the US Dollar (USD) and provide a fresh impetus to the GBP/USD pair. Read more…

GBP/USD under pressure as UK inflation risks limit Sterling’s recovery [Video]

The GBP/USD pair has been weighed down by a mix of stubborn UK inflation and a cautious Bank of England, slipping back toward the 1.3450 handle. While the pound struggles to find footing, the U.S. dollar continues to enjoy steady support from firm yields and a slightly higher policy rate, tilting the balance in favor of the greenback. The pair now faces a critical test as price consolidates below a fresh 4H Fair Value Gap, with traders watching whether sterling can stage a recovery or if downside momentum will deepen. Read more…

![GBP/USD under pressure as markets question BoE stance [Video]](https://www.europesays.com/wp-content/uploads/2025/09/GBPUSD-neutral-object-1_Large.png)