Company Logo

Key market opportunities in banking IT solutions include AI and machine learning adoption, heightened demand for personalized experiences, cloud infrastructure, and open banking APIs. Growth is driven by smartphone penetration, digital transformation partnerships, and innovations in customer service, cybersecurity, and core banking systems.

Information Technology (IT) Solutions for the Banking Market

Information Technology (IT) Solutions for the Banking Market

Dublin, Sept. 25, 2025 (GLOBE NEWSWIRE) — The “Information Technology (IT) Solutions for the Banking Market Report 2025” has been added to ResearchAndMarkets.com’s offering.

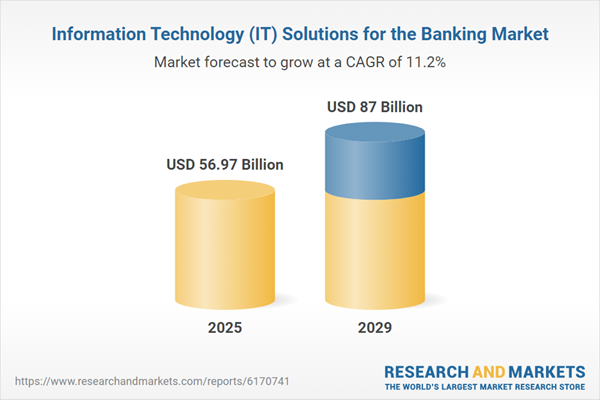

The information technology (IT) solutions for the banking market continues to experience significant growth, with projections suggesting an increase from $51.97 billion in 2024 to $56.97 billion in 2025, reflecting a compound annual growth rate (CAGR) of 11.5%. This historic growth is attributed to the rise of online banking platforms, increasing cybersecurity threats, and heightened customer expectations for digital services, as well as the widespread adoption of mobile devices and stricter regulatory requirements.

Looking ahead, the IT solutions market for banking is expected to reach $87 billion by 2029, growing at a CAGR of 11.2%. This anticipated growth is driven by expanding adoption of AI and machine learning, increased demand for personalized banking experiences, and the integration of cloud-native infrastructures. Trends such as advancements in AI-powered customer service, blockchain integration, biometric authentication, and cloud-based core banking systems further support this positive outlook.

A key driver of this growth is the increasing penetration of smartphones, which facilitates the accessibility of banking IT solutions through mobile applications. For instance, according to Uswitch, the UK reported 71.8 million mobile connections at the start of 2022, highlighting an increased mobile presence that underpins the need for robust banking IT solutions.

Leading companies in the market are forging strategic partnerships to enhance technological capabilities and expedite digital transformation. For example, in January 2025, DXC Technology teamed up with Thought Machine, combining their respective strengths in industry expertise and cloud banking platforms to modernize banking systems for smaller institutions, enhancing service offerings and compliance.

In alignment with this trend, Accenture acquired Percipient’s digital twin technology in January 2025, aimed at modernizing banking systems in the Asia Pacific region by leveraging digital twin technologies and enhancing cloud and AI solutions.