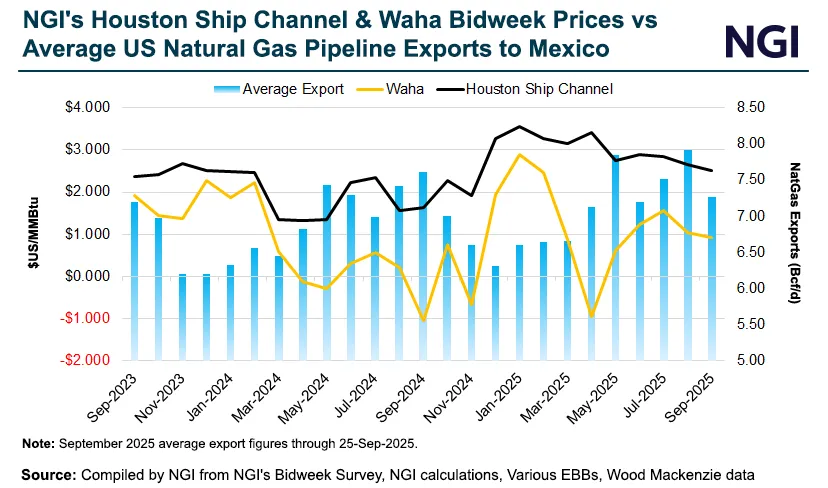

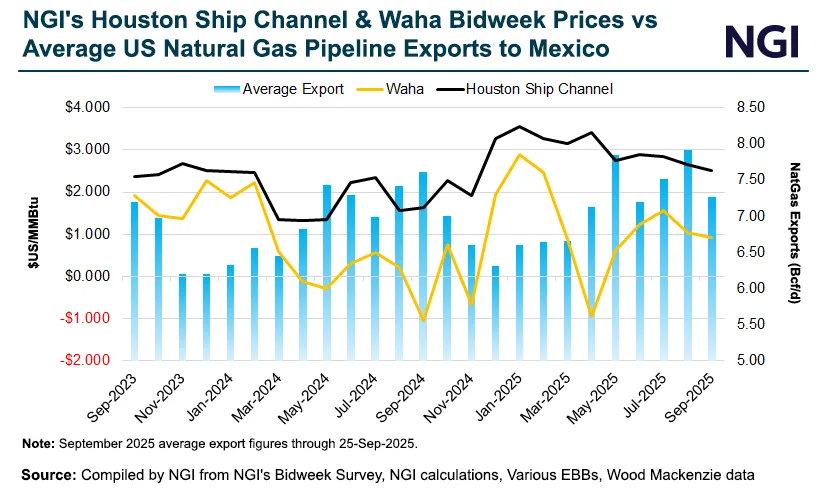

Mexico’s imports of U.S. natural gas have dipped so far in September after a record-setting summer of cross-border flows.

Expand

At A Glance:

Mexico imports rebound after pipeline curbsWaha trades negative on outages, constraintsCFE pushes new supply options