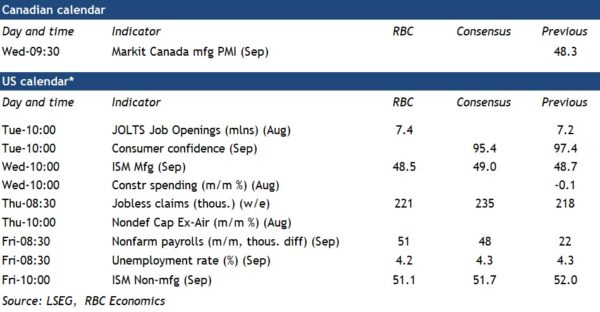

A quiet week for Canadian economic data releases will leave focus on the external backdrop, particularly U.S. labour markets in Friday’s payroll employment report (as well as potential backward revisions.) The data is set for a release on Friday October 3rd – although that release could be delayed if a looming government shutdown on October 1st is not avoided.

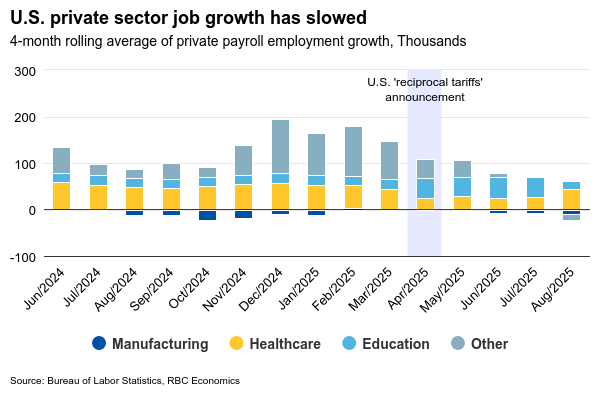

U.S. labour markets have been showing strain from increased trade frictions – employment growth has essentially stalled since “liberation day” in April. While the unemployment rate remained relatively low at 4.3% in August, it has increased over the past two months.

To be sure, part of the softening in employment growth reflects structural trends like stricter immigration policies and an aging population. But the 39,000 average monthly increase in private sector jobs from May to August still marks the slowest four-month growth period since the global financial crisis, excluding the 2020 pandemic lockdowns.

Manufacturing—the sector most exposed to trade headwinds and where cross-border integration with Canada is closest—has led the softening. Jobs in the sector have declined by an average of 11,000 per month since April, with offsets coming largely from persistent expansion in healthcare employment. In September, we expect these trends to broadly continue, with a modest 51k increase in payrolls and the unemployment rate remaining practically unchanged at 4.2%.

Canada’s own monthly labour market report will follow a week after U.S. payrolls. While Canada has largely avoided direct U.S. tariffs through CUSMA-compliant free trade, it remains vulnerable to spillover effects from a contracting U.S. industrial sector due to tightly integrated supply chains.

The Canadian economic backdrop has already softened, with a 1.6% decline in gross domestic product in Q2 and a rise in the unemployment rate over the summer, prompting the Bank of Canada to cut interest rates in September. Still, early Q3 economic indicators have looked better, including an 0.2% rebound in July GDP alongside higher manufacturing production.

The uncertain trade environment has made central banks highly data dependent. Following September rate cuts from both the BoC and the Fed, policymakers will be watching closely for additional signs of economic softening as they weigh their next decisions on Oct. 29th.

Week ahead data watch: