Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Diamondback Energy Investment Narrative Recap

To be a shareholder in Diamondback Energy, you need to believe in the company’s ability to efficiently scale its Permian Basin operations and capitalize on commodity cycles to drive long-term returns. The recent rise in crude oil prices has supported the stock, but this event does not significantly alter the primary short-term catalyst, improving operational efficiency to boost free cash flow, or the most pressing risk, which remains sensitivity to oil price volatility and macroeconomic swings.

Among the recent announcements, Diamondback’s production guidance revision stands out, as it is closely linked to near-term catalysts. The company raised its Q3 2025 oil production targets, highlighting ongoing scale and capital efficiency, yet the outlook still depends heavily on commodity price support and the company’s ability to contain costs as it pursues growth.

However, investors should also be aware that despite the recent boost from commodity markets, the issue of rising operating expenses due to power and water management inflation still looms large for …

Read the full narrative on Diamondback Energy (it’s free!)

Diamondback Energy’s outlook anticipates $15.6 billion in revenue and $4.5 billion in earnings by 2028. This scenario assumes 5.2% annual revenue growth and a $0.7 billion increase in earnings from the current $3.8 billion.

Uncover how Diamondback Energy’s forecasts yield a $180.86 fair value, a 22% upside to its current price.

Exploring Other Perspectives FANG Community Fair Values as at Sep 2025

FANG Community Fair Values as at Sep 2025

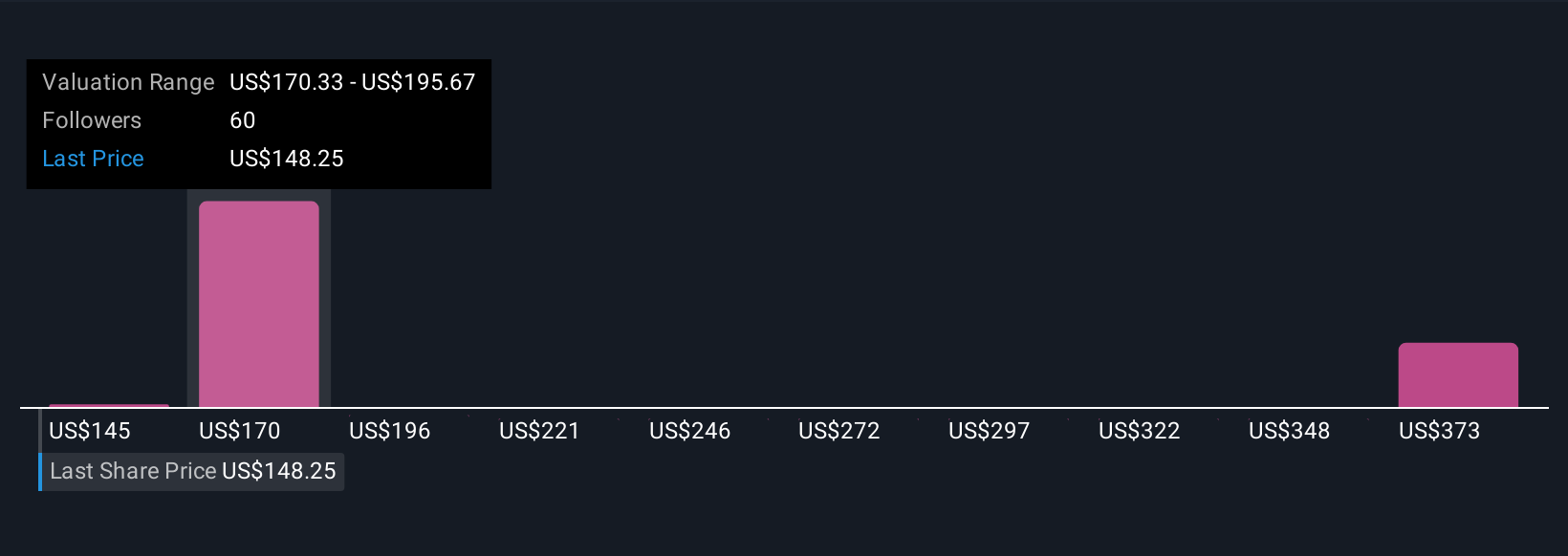

Five private investors in the Simply Wall St Community value Diamondback Energy between US$145 and US$398 per share, showing broad disagreement in forecasts. Against this backdrop, the risk of higher operating expenses from inflation and water disposal costs could weigh on performance over the long term, so you may want to consider these diverse opinions before making any decisions.

Explore 5 other fair value estimates on Diamondback Energy – why the stock might be worth just $145.00!

Build Your Own Diamondback Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com