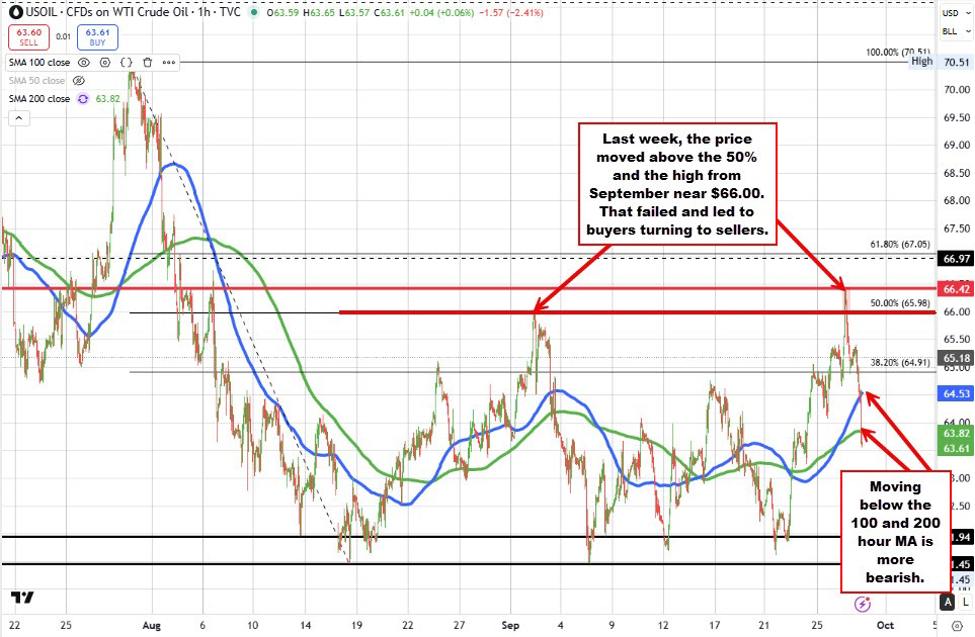

Crude oil prices have extended to a new session low at $63.60, marking a sharp reversal from last week’s highs. The decline has pushed the market back below two important technical markers: first, the 100-hour moving average at $64.52, and more recently, the 200-hour moving average at $63.83. With the price now trading under both of these averages, the near-term bias has shifted more firmly to the downside, and traders will be watching closely to see if sellers can maintain momentum below these broken supports.

For context, recall that just last week crude reached a high of $66.42, which was above the 50% retracement of the move down from the July 30 high to the August 18 low, pegged at $65.98. That retracement level aligned closely with the swing highs from September 2 near $66.00, reinforcing the significance of that resistance zone. The failure to sustain momentum above that area has now turned the spotlight back toward the downside.

On the fundamental side, reports that OPEC may consider a 137,000 barrels per day production hike ahead of its meeting next Sunday are adding pressure to the market. Traders are increasingly viewing the supply backdrop as tilting toward looseness, though the outlook remains clouded by the recurring need to price in geopolitical risk premiums. This push and pull — between an expanding supply picture and ongoing geopolitical uncertainty — continues to define market sentiment and is keeping directional conviction in check.

In summary, with crude oil now trading beneath both the 100-hour and 200-hour moving averages, sellers are tightening their grip. A sustained move below $63.60 would open the door to deeper retracements, while any rebound will need to reclaim the moving averages quickly to shift momentum back to the upside.