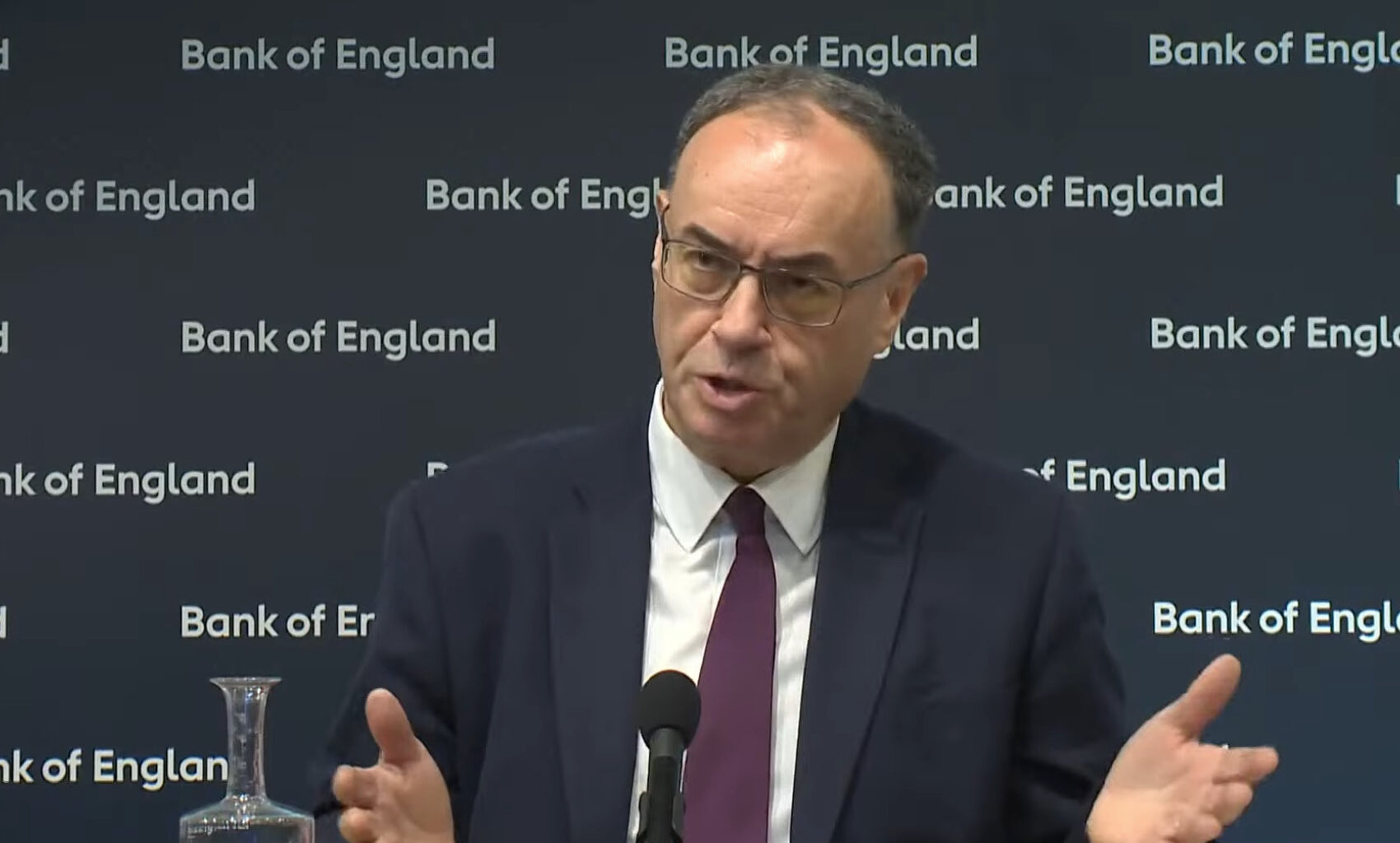

Bank of England Governor Andrew Bailey suggested that stablecoins need insurance to cover for operational risks such as cyberattacks. In an opinion piece published in the Financial Times, he added that the digital currencies should be backed by risk free assets and freely exchangeable with other forms of money, not just via crypto exchanges. The central bank is planning to publish a discussion paper on the topic soon.

While many central bankers oppose stablecoins, Governor Bailey said he recognizes their capability to drive innovation and it would be wrong to oppose them on principle.

He doesn’t believe deposits and lending residing within the same banking entity is the only option, saying “The system does not have to be organised like this.” He can envision stablecoin issuers and non bank lenders coexisting alongside banks. However, he has concerns about credit creation that he expressed in July.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Bank of England