MidOcean Energy, backed by EIG, has agreed to acquire a 20% stake in PETRONAS’ Canadian LNG assets, including the North Montney joint venture and LNG Canada project. The deal expands MidOcean’s role across the LNG value chain and secures long-term offtake potential.

(P&GJ) — MidOcean Energy, an LNG company managed by EIG, has agreed to acquire a 20% interest in PETRONAS’ Canadian upstream and LNG assets.

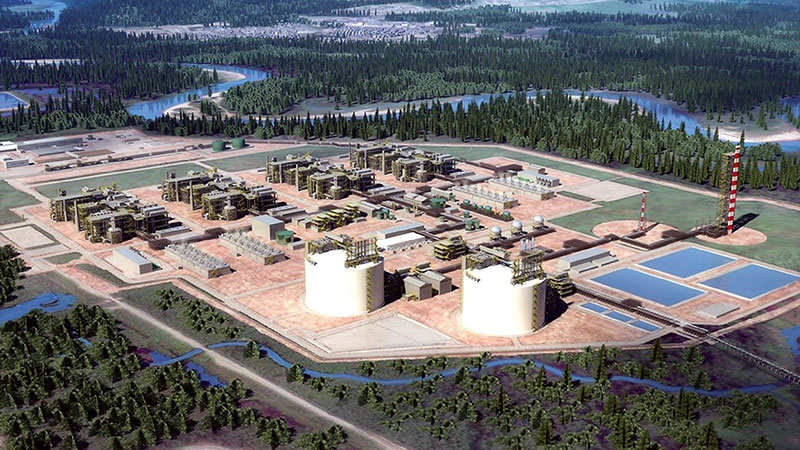

The deal includes stakes in the North Montney Upstream Joint Venture (NMJV) and the North Montney LNG Limited Partnership (NMLLP), which holds PETRONAS’ 25% share in the LNG Canada project.

LNG Canada, the country’s first LNG export terminal, shipped its first cargo earlier this year and is considered a cornerstone project for supplying Asian markets at competitive costs. The NMJV spans more than 800,000 gross acres and holds an estimated 53 trillion cubic feet of reserves and contingent resources.

Upon closing, MidOcean will gain exposure across the LNG value chain, from upstream development in the North Montney to liquefaction and export through LNG Canada. The deal also secures MidOcean about 0.7 MTPA of LNG offtake, with growth potential if LNG Canada moves ahead with a second phase.

“This transaction marks an important milestone in MidOcean’s growth journey,” said R. Blair Thomas, MidOcean Chairman and EIG CEO. “We are proud to join PETRONAS in its efforts to deliver reliable, low-cost LNG to global markets.”

De la Rey Venter, CEO of MidOcean, added: “This investment is a clear reflection of our conviction in the future of LNG and its long-term role to help deliver global energy security and to underpin a practical and affordable energy transition.”

The transaction is expected to close in the fourth quarter of 2025, pending regulatory approvals.