This article is part of a series called North Carolina’s Gas Blow Out. See the rest of this series as well as other resources on SACE’s Fossil Gas Hub.

Is Duke Energy setting itself up to become a gas empire by overestimating pipeline capacity needs for its power plants and setting the stage to build its own LNG facility? If so, what are the implications of that, in addition to higher electric bills for us?

This one will get a bit wonky, but bear with us. We contend that:

Duke may be overestimating peak burn gas needs and the firm pipeline transportation needed for its proposed new plants

Duke is also setting the stage to build its own liquefied natural gas (LNG) storage facility, and

Duke’s new contract with Transco allows 70% of its contracted capacity to continue all the way down to Transco’s Gulf Coast pooling station near LNG export facilities

Peak Burn Overestimation

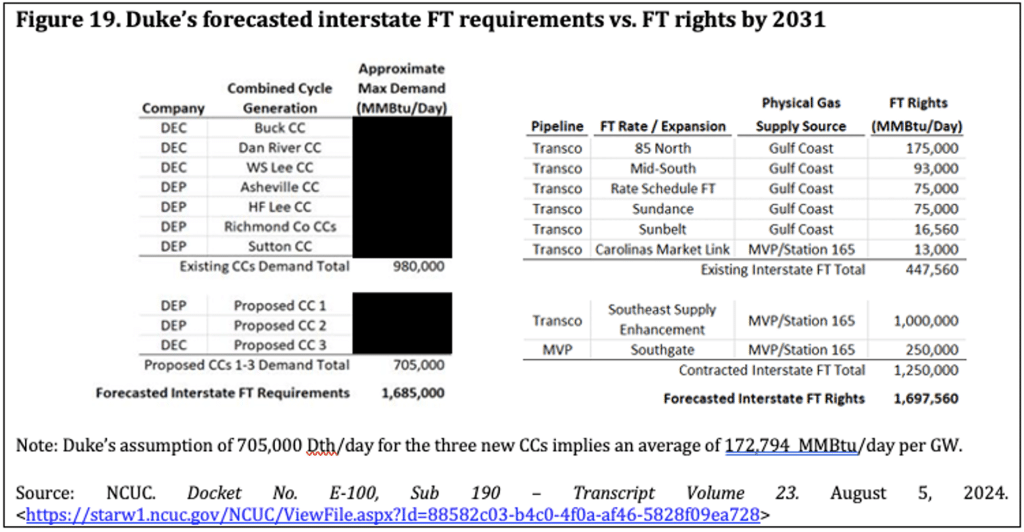

In Duke Energy’s 2022 Carbon Plan Integrated Resource Plan (CPIRP), Duke presented the following redacted table in rebuttal testimony.

From this table, we glean that Duke is estimating that its three planned new combined cycle gas-fired power plants (two in Person County, NC and one in Anderson County, SC) will require 705,000 dekatherms (Dth) per day of firm gas pipeline transportation capacity. We know that the plants are 1,360 MW each, totaling 4,080 MW. Therefore, we deduce that Duke is estimating that each new CC requires 172.79 Dth per MW, which means each plant will require 172.79 Dth per day per MW to run at peak burn (running at maximum capacity), which is a very rare occurrence.

What about the existing fleet? We know from this table that the seven existing combined cycle plants have a maximum demand of 980,000 Dth per day. Elsewhere in the CPIRP, we find the winter capacity of those plants:

Buck CC 718 MW winter

Dan River CC 718 MW winter

WS Lee CC 809 MW winter

Asheville CC 560 MW winter

HF Lee CC 1054 MW winter

Richmond Co CC (Smith) 1,250 MW winter

Sutton CC 719 MW winter

Total 5,828 MW

The existing fleet, which ranged in age when the table was filed from 3 to 21 years old, would therefore require an average of 168.15 Dth per day per MW for peak burn. So Duke is suggesting that three brand new “highly efficient” combined cycle plants will actually be less efficient than the existing fleet average? By comparison, Dominion Energy in South Carolina has contracted for 385,000 Dth per day on a Kinder Morgan pipeline project for a 2,200 MW combined cycle plant proposed for Canadys, SC. This equates to 147.73 Dth per MW — a much more logical estimate.

If Duke is over-contracting for the gas supply for the three combined cycle gas plants, then 1) Duke’s customers are paying for far more gas pipeline capacity than is needed (and pipeline capacity is expensive — we explained just how expensive in this Utility Dive article), and 2) related pipeline projects are much bigger than they need to be. The 25.06 Dth per MW difference times 4,080 MW means that 102,245 Dth per day of the 705,000 Duke says it needs for the three CCs is unnecessary, but it will still be paid for by Duke customers.

Setting the Stage for LNG Storage?

Duke justifies acquiring firm pipeline transportation capacity for the maximum burn (peak load) of all of its combined cycle fleet in the name of reliability, and the NC Utilities Commission agreed in their order approving Duke’s 2022 CPIRP. And all but three of Duke’s existing and proposed CC fleet are also dual fuel — they can burn gas or on-site oil — also for reliability.

And now, in Duke’s 2025 CPIRP, filed on October 1, the Company states that they need to build their own “Enhanced Liquified Natural Gas Storage,” or ELNG. Duke writes, “ELNG would help provide the Companies’ generators with the right amount of fuel at the right time, during either a multiday winter polar vortex or for a few hours on a hot summer evening.” (2025 CPIRP p. 5)

Duke has justified expensive firm pipeline transportation contracts for this same purpose (weather-related reliability) in previous CPIRPs. Now that those contracts have been signed, they are now inadequate? This is also despite the fact that Transco has a 4 BCF LNG storage facility called Pine Needle in Guilford County, Duke subsidiary Piedmont Natural Gas has three LNG storage facilities (Huntersville, Robeson, and Bentonville), and PSNC/Enbridge has an LNG storage facility in Cary and is building an LNG storage facility called the Moriah Energy Center in Person County (close to Duke’s proposed plants).

And yet, Duke seems to want its own. As with firm pipeline transportation, an expensive “ELNG” storage facility would be paid for by Duke customers and seems unnecessarily redundant of both firm transportation and existing LNG storage infrastructure in North Carolina.

Duke’s Farthest Pipeline Delivery Point Is in… Alabama?

The firm transportation contracts that Duke has signed, both older ones and the new ones with Transco and MVP Southgate, are highly confidential, so we the public don’t know whether they are expensive or a bargain. A heavily redacted copy of Duke’s contract for 1 million Dth per day on Transco’s Southeast Supply Enhancement Project (called a precedent agreement) is available on the Virginia Marine Resources Commission website. The VMRC houses what is called the Joint Permit Application for the US Army Corps of Engineers water permit application for the SSEP.

In that redacted contract, we learn that the designated gas receipt points are all reflective of the Marcellus-Utica shale sourcing of the gas (so none of it is sourced in Texas or in the Gulf region), and the delivery points include Duke’s combined cycle plants as expected. But after the last plant delivery point in Anderson County, South Carolina, the contract includes one more delivery point for up to 700,000 Dth per day, or 70 % of the total amount to Transco’s Station 85 Zone 4 Pool in Choctaw County, Alabama. This location is a pooling station where multiple pipelines come together and depart in different directions, including to LNG export facilities.

So this contract that 1) guarantees that Duke will pay Transco a secret amount every month for possibly twenty years (a common precedent agreement length), and 2) is actually paid for directly by Duke electric ratepayers in North and South Carolina — commits Duke ratepayers to pay for expanded pipeline capacity all the way down to and across Alabama.

That Duke ratepayers will be paying for this is outrageous, but it also signals that Duke does not anticipate actually needing up to 70% of the contracted capacity for power burn most of the time. Duke anticipates being able to re-sell some or all of that capacity to other utilities, local gas distributors, and gas marketers, at least some of the time. That is a lot of gas pipeline capacity — enough for 4,730 MW of combined cycle power burn (using Dominion’s figures) – that Duke will control.

A Gas Empire

Duke appears to be over-contracting for pipeline capacity. Duke also seems to be setting the stage for owning LNG storage capacity. Duke can sell a massive amount of pipeline capacity on the capacity release market as far south as the Transco pooling station on the Alabama-Mississippi line. Is Duke becoming something other than an electric utility?

These issues require some serious scrutiny by regulators. The likely outsized and unfair impacts on Duke’s ratepayers are clear (even if we can’t see the contract dollar figures to scrutinize them). But Duke’s growing ability to control a significant amount of the gas (via storage and pipeline capacity) heading from Marcellus-Utica shale down through the Southeast and to the Gulf should concern everyone.