See our latest analysis for Eversource Energy.

This recent momentum for Eversource Energy feels like a real turning point, especially since the stock had generally lagged over the longer term. With a 1-year total shareholder return of roughly 14% and a sharp 13% jump in the last month, it seems investor optimism is building again as sentiment around utility stocks improves.

If you’re keen to spot fresh momentum elsewhere, now is the perfect chance to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares now trading just above average analyst price targets, investors have to wonder: is Eversource Energy truly undervalued at these levels, or has the recent rally already captured future growth prospects?

Most Popular Narrative: Fairly Valued

Eversource Energy’s last close at $71.79 sits just above the fair value estimate of $70.77 from the most-followed narrative, suggesting shares now trade in line with consensus fair value. This proximity has sharpened focus on the company’s next big earnings and operational catalysts.

Positive legislative and regulatory developments, such as the passage of Senate Bill 4 in Connecticut and constructive rate case outcomes in both New Hampshire and Massachusetts, are enhancing visibility for cost recovery and capital deployment, supporting long-term earnings and cash flow stability.

Curious what financial forces are putting a ceiling on the upside here? The narrative hinges on several ambitious projections, from future margin gains to regulatory windfalls, but which assumptions really drive the fair value calculation? Unlock the full story for a closer look at the numbers behind this crucial valuation call.

Result: Fair Value of $70.77 (ABOUT RIGHT)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, regulatory setbacks in Connecticut or delays in key asset sales could quickly undermine these optimistic earnings forecasts for Eversource Energy.

Find out about the key risks to this Eversource Energy narrative.

Another View: Discounted Cash Flow Model Tells a Different Story

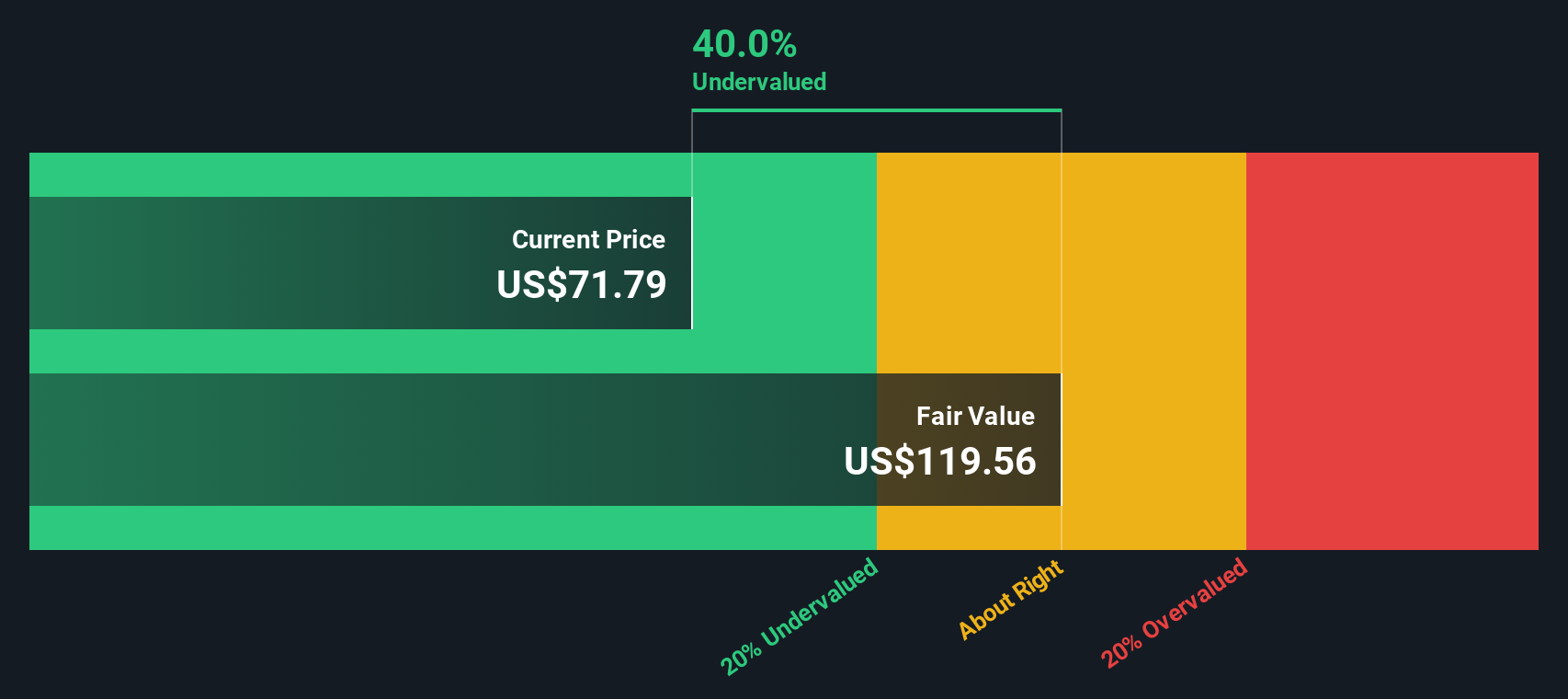

While analysts see Eversource Energy as fairly valued based on future earnings estimates and price targets, our SWS DCF model suggests a different outlook. The DCF analysis values the stock much higher, indicating it could be significantly undervalued at current prices. Could the market be overlooking long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

ES Discounted Cash Flow as at Oct 2025

ES Discounted Cash Flow as at Oct 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eversource Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Eversource Energy Narrative

If you see things differently or want your own angle on Eversource Energy, you can dig into the data yourself and build your own story in just a few minutes with Do it your way.

A great starting point for your Eversource Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors like you know that finding the next big opportunity means going beyond the obvious. Don’t settle for the usual. Take control and hunt for your advantage with these powerful investment screens on Simply Wall Street:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Eversource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com