Several recent developments have put Antero Resources (AR) in the spotlight. The company is seen benefiting from growing US LNG demand, new project launches, and surging natural gas needs driven by technology and AI data centers.

See our latest analysis for Antero Resources.

Despite a stretch of modest share price movement, Antero Resources has quietly posted a 1-year total shareholder return of 11.1%. That positive overall performance has come as the company captured interest from institutional investors and benefited from rising demand in the LNG and natural gas sector. This signals momentum may be building as technological and infrastructure trends drive the industry forward.

If you want to see what else is setting the pace in the energy world, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Antero Resources is trading at a discount given its growth prospects and improving fundamentals, or if recent gains mean the market has already factored in all that future upside.

Most Popular Narrative: 22.8% Undervalued

Antero Resources is trading at $33.32, while the most widely followed narrative pegs its fair value much higher. This difference highlights the ongoing debate over what powers the company’s potential and whether the market is overlooking key drivers.

Antero’s strategic focus on liquids-rich production and firm transport capacity to premium Gulf Coast and export markets enables it to realize higher prices than in-basin peers. This supports net margins and free cash flow growth even as domestic pipeline constraints persist.

What makes this valuation tick? One assumption is a future profitability level rarely achieved in the sector, fueled by aggressive growth in key financial metrics. Ready to discover which fundamental shifts could justify such a big gap between the share price and this fair value?

Result: Fair Value of $43.14 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent regulatory pressures and the global shift toward clean energy could quickly challenge the optimistic case for Antero Resources moving forward.

Find out about the key risks to this Antero Resources narrative.

Another View: Comparing Market Multiples

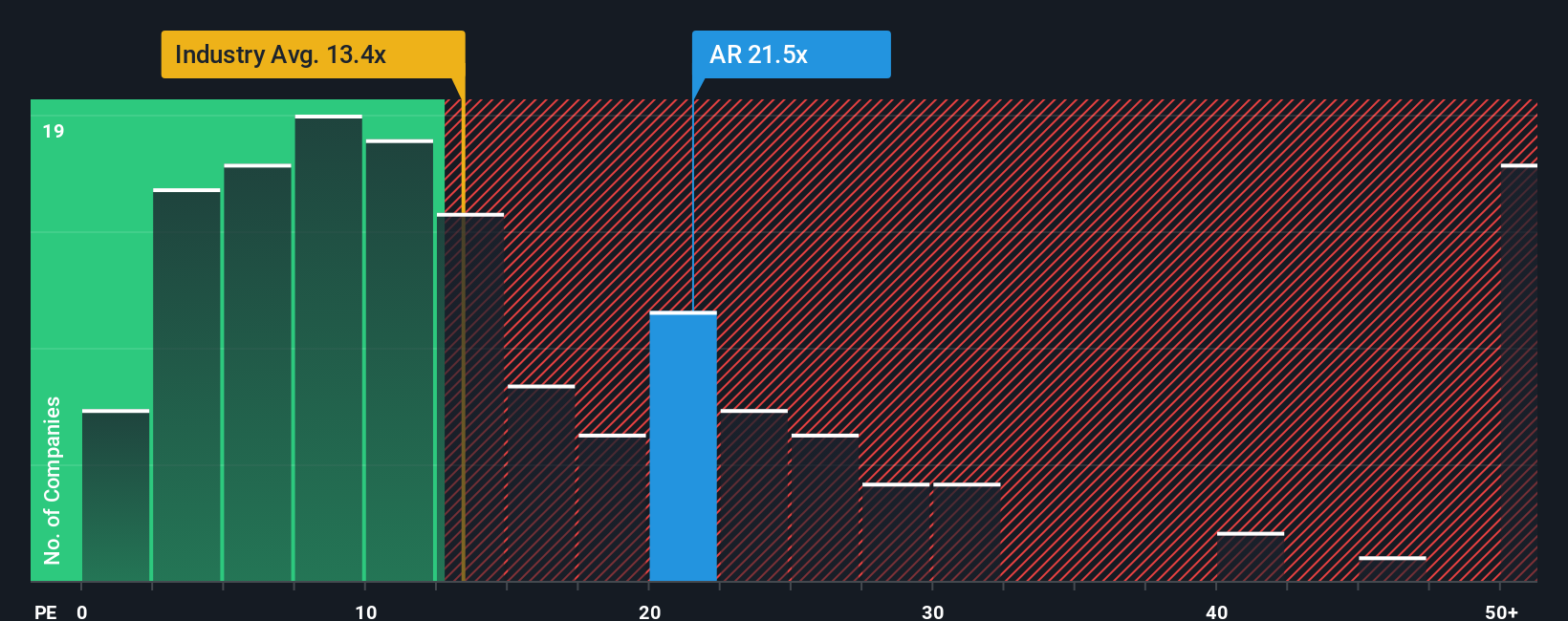

Stepping back from the analyst fair value, Antero Resources is currently trading at a price-to-earnings ratio of 21.5x. That is noticeably higher than the US Oil and Gas industry average of 13.1x and also above the calculated fair ratio of 18x. This elevated multiple suggests that investors may be pricing in greater growth or profitability than peers, but it could also expose the stock to valuation pressure if expectations are not met. Is the market being too optimistic about Antero’s outlook, or is there something unique that justifies the premium?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:AR PE Ratio as at Oct 2025 Build Your Own Antero Resources Narrative

NYSE:AR PE Ratio as at Oct 2025 Build Your Own Antero Resources Narrative

If you see the numbers differently or want to dig deeper on your own terms, you can put together your own analysis in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Antero Resources.

Looking for more investment ideas?

If you want an edge in today’s market, seize the chance to find stocks with qualities that match your strategy by using tailored screeners on Simply Wall Street.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com