If you’re tuning in to Saab stock, you’re in good company. Investors have watched the company’s share price chart an extraordinary run over the past few years, and the intrigue continues. Whether you’re wondering if it’s finally time to lock in those gains or considering jumping on the momentum, Saab’s performance probably has your full attention.

Let’s take a quick look at the scoreboard. Shares have soared 150.9% over the past year and an eye-popping 774.3% over five years. Even the past three years put most stocks to shame, with returns topping 555.8%. Shorter-term, it’s been more of a mixed bag: down 1.2% this past week, up a robust 10.2% in the last month, and up a remarkable 143.6% year-to-date. These numbers tell a story of both spectacular long-term growth and some natural short-term volatility.

Much of Saab’s momentum ties in with rising demand for defense technology worldwide, as recent geopolitical developments have put the spotlight back on the sector. The market’s response suggests a heightened appetite for companies that can offer both innovation and resilience in uncertain times.

With such a blockbuster run, though, the big question shifts from growth to value. Can Saab still deliver, or are all the good times already baked into the price? By traditional valuation checks, Saab doesn’t score as undervalued; its value score sits at 0 out of 6 possible checkmarks. But those are just numbers from the surface.

Up next, we’ll break down those valuation methods and explore what they actually reveal about Saab’s investment story, before circling back to what might be the most insightful way to judge its worth.

Saab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Saab Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them to today’s value. This provides an intrinsic share price based on those long-term expectations.

For Saab, the latest twelve months of Free Cash Flow are SEK 5.77 billion, with annual projections showing continued growth. Analyst forecasts cover the next five years, predicting Free Cash Flow to reach SEK 4.71 billion by 2027. Beyond that, Simply Wall St extrapolates out to ten years, expecting FCF to climb as high as SEK 5.40 billion by 2035. All projections are in Swedish Krona (SEK).

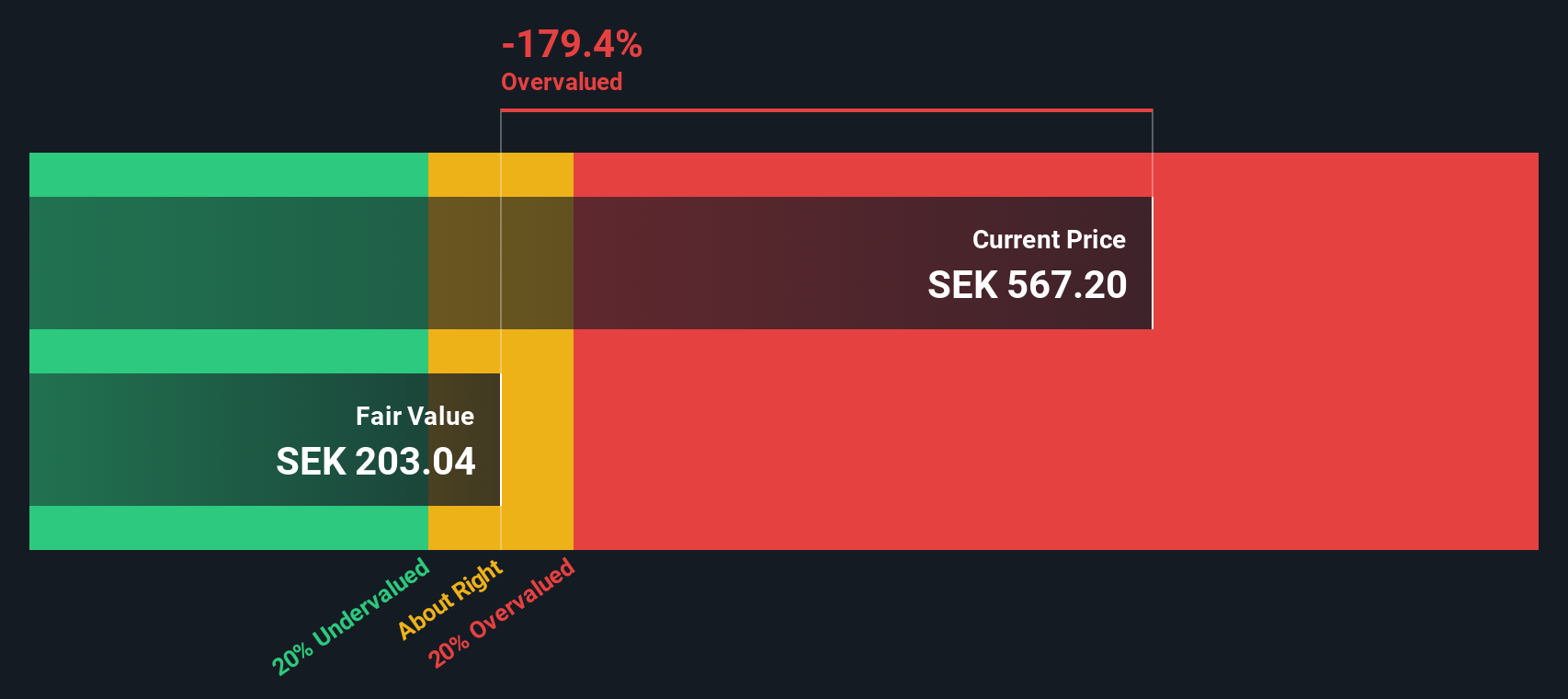

After crunching the numbers using a two-stage Free Cash Flow to Equity model, Saab’s estimated intrinsic value is SEK 203.04 per share. When compared to the current market price, this suggests the stock is a striking 179.4% overvalued. Despite robust growth in cash flows, the market price appears to far exceed what the underlying business presently justifies.

Result: OVERVALUED

SAAB B Discounted Cash Flow as at Oct 2025

SAAB B Discounted Cash Flow as at Oct 2025

Our Discounted Cash Flow (DCF) analysis suggests Saab may be overvalued by 179.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Saab Price vs Earnings

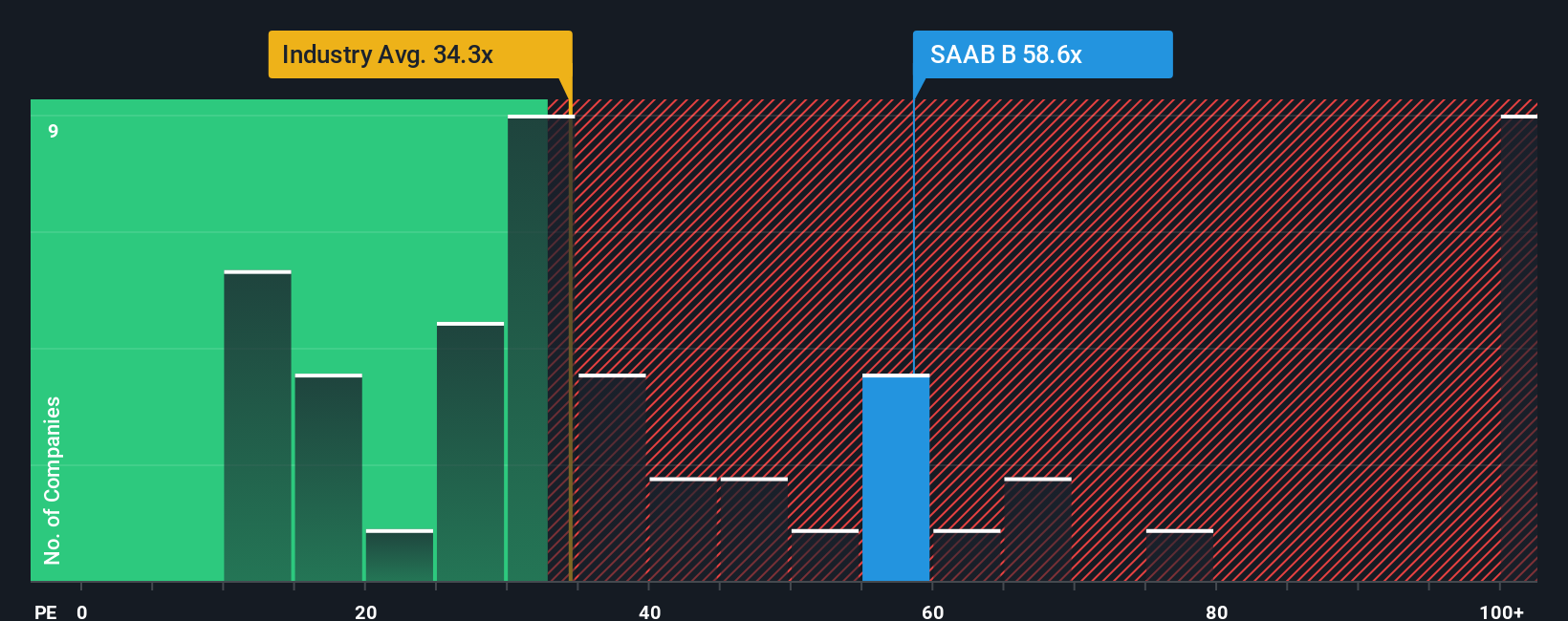

The Price-to-Earnings (PE) ratio is a popular tool for valuing profitable companies, as it relates what investors are currently willing to pay for each unit of Saab’s earnings. It’s a straightforward way to gauge whether the market is pricing in reasonable growth and profitability, or expecting too much too soon.

What makes a “fair” PE ratio can vary. High growth companies often command higher multiples as investors are willing to pay up for future expansion, while higher risk or slower-growth firms usually trade at more moderate ratios. Other factors, like profit margins and market size, also feed into what the market considers a normal or justified multiple.

Currently, Saab’s PE stands at 58.6x, which is well above the Aerospace & Defense industry average of 47.1x and also higher than the average among direct peers at 33.0x. This premium suggests the market expects stronger growth or lower risk from Saab compared to its competitors.

To dig deeper, Simply Wall St’s “Fair Ratio” model calculates the multiple Saab should trade on, factoring in fundamentals like earnings growth prospects, profitability, industry trends, business size and specific risks. This approach goes beyond simple peer or sector comparisons, providing a more tailored estimate that reflects Saab’s unique qualities and outlook. According to this method, Saab’s fair PE is estimated at 44.4x, significantly below its current level.

Compared to its actual ratio, Saab’s shares appear overvalued on this basis, with investors paying a sizeable premium to both fundamentals and what the company’s profile warrants.

Result: OVERVALUED

OM:SAAB B PE Ratio as at Oct 2025

OM:SAAB B PE Ratio as at Oct 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Saab Narrative

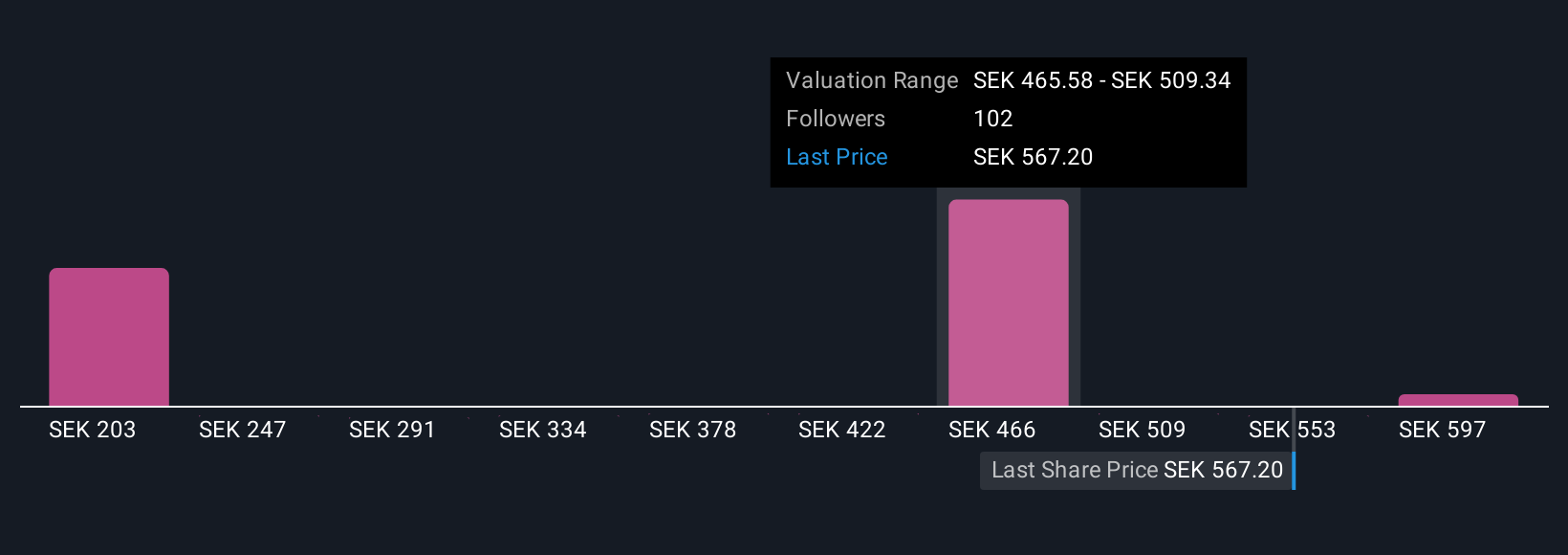

Earlier, we mentioned that there’s an even better way to understand valuation. Let’s introduce you to Narratives. In simple terms, a Narrative is your chance to put a story behind the numbers by combining your view on Saab’s future (or any company) with the financial forecasts and fair value estimates you think are most realistic.

This approach connects the dots. You start with what you believe about Saab and the industry, map it to future revenue, earnings and margins, and instantly see what a “fair” price should be. Narratives go beyond static analysis and are available right now to all users inside Simply Wall St’s Community page, making them an easy and powerful tool used by millions of investors.

With Narratives, you can decide when to buy or sell Saab by comparing the fair value from your own forecasts (or the community’s) to the current price. Narratives update automatically as new data, earnings, or news arrive, adapting your investment story to fresh information in real time.

For Saab, bullish Narratives expect AI and global defense trends to drive revenues to SEK 600 per share, while more cautious, risk-focused Narratives see a fair value as low as SEK 374. This shows there are always multiple, dynamic viewpoints on where the company should trade.

Do you think there’s more to the story for Saab? Create your own Narrative to let the Community know!

OM:SAAB B Community Fair Values as at Oct 2025

OM:SAAB B Community Fair Values as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com