(Bloomberg) — Shell Plc said the performance of its oil and gas trading operation recovered in the third quarter, after struggling with geopolitical volatility in the previous period.

The division’s performance was significantly higher for gas and higher for oil in the quarter, the company said Tuesday in a statement ahead of earnings results later this month.

It’s a bounce back for a business that’s often one of the energy giant’s biggest profit boosters. Chief Executive Officer Wael Sawan had linked unusually poor trading results in the second quarter to market swings driven by geopolitics rather than supply-demand fundamentals, leading Shell to dial back risk.

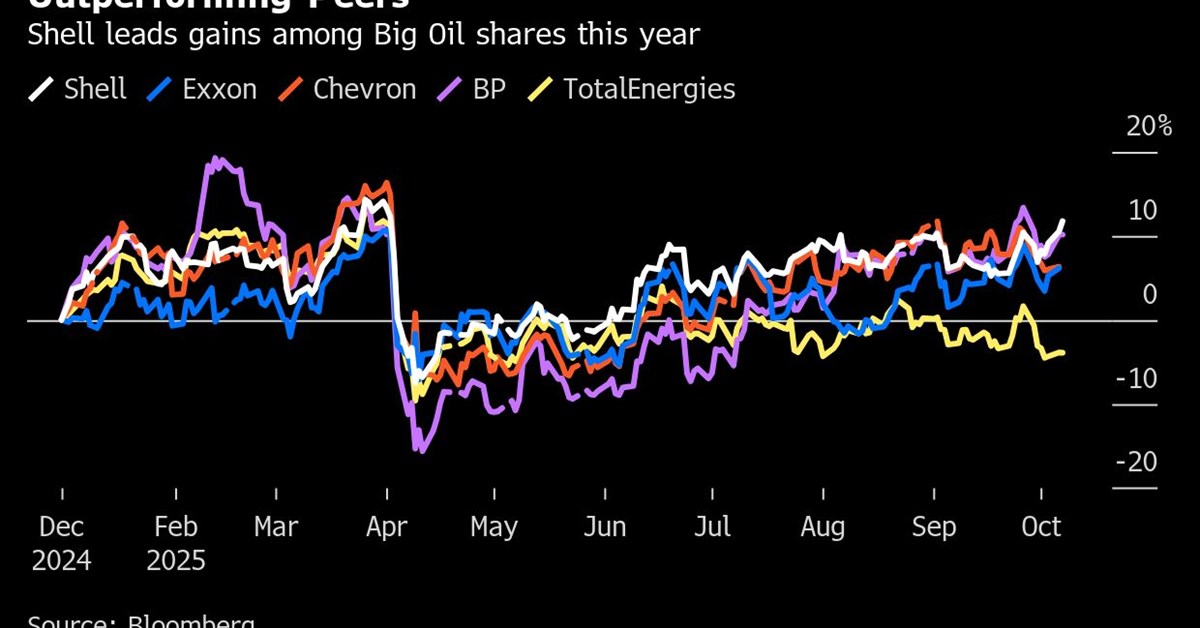

Shell’s shares rose as much as 2.3% in London on Tuesday, the most in two months. The stock’s 12% gain this year is now the best performance among the largest oil and gas companies.

“We see this as a strong update from the company,” RBC analyst Biraj Borkhataria said in a note on Tuesday. He highlighted “better trading” performance in the July-September period following the “disappointing” trading result in the previous quarter.

Borkhataria also noted Shell’s increased LNG liquefaction volumes rising to between 7 million and 7.4 million metric tons, up from 6.7 million in the prior quarter. Shell’s oil and gas output climbed to as much as the equivalent of 1.89 million barrels a day, within previous guidance range.

Underlying operating expenses in oil and gas exploration and production could exceed the previous quarter by up to $500 million, Shell said.

Trading Improvement

The improved trading outlook follows a period of relative stability in oil prices. Brent crude futures traded mostly within a narrow band between $65 and $70 a barrel in the third quarter, giving traders more predictable spreads to exploit. Average prices in the quarter were up by more than $2.

While the third quarter was not without volatility, the preceding period saw a short-lived war in the Middle East — the world’s oil heartland — and wide ranging announcements of tariffs by US President Donald Trump’s administration.

Shell is among the first so-called supermajors to update investors guidance on quarterly results, giving a little more visibility for how the sector at large fared.

Its peers also struggled with volatility in the second quarter. And while Shell’s update suggests an improvement for energy trading, the International Energy Agency says the oil market is on the cusp of oversupply that might pressure prices. TotalEnergies SE announced a reduction in share buybacks last month with an expectation of Brent crude trading in a lower range.

Refining margins also improved for Shell. That echoes Exxon Mobil Corp.’s update on Monday, which projected a $300 million to $700 million profit boost from stronger fuel-making margins.

Chemicals Woes

Not all divisions are rebounding. Shell’s chemicals unit is expected to lose money in the third quarter.

The chemicals unit has been a drag on Shell’s performance for some time, and the company has said it’s exploring partnerships in the US and selective closures in Europe. Sawan in July pledged to turn around the chemicals business, which he said has been suffering from one of the most protracted industrywide slumps in a long time.

Wael SawanPhotographer: Samsul Said/Bloomberg

Wael SawanPhotographer: Samsul Said/Bloomberg

Major chemical producers have announced closures or have idled capacity in Europe, including Dow Inc. and Exxon, partly as high energy costs in the region make it less competitive. Shell completed the sale of its Singapore chemicals plant earlier this year.

Biofuels Writedown

Shell also took $600 million in new impairments tied to the suspension of its biofuels plant in Rotterdam, bringing total writedowns at the site to roughly $1.4 billion. The project, which was put on hold last year pending a cost review, would have been one of Europe’s biggest plants for renewable diesel and sustainable aviation fuel. Shell has been shedding low-carbon businesses to boost profitability.

Rival BP Plc is also forgoing construction of a biofuels plant in the Netherlands to focus on oil and gas production.

Sawan has spent the past two years seeking to cut costs, improve reliability and shed underperforming assets in an effort to close a valuation gap with Shell’s US rivals.

(Adds shares in fourth paragraph, comment from analyst in fifth and a chart)

©2025 Bloomberg L.P.