①The IMF and the Bank of England have successively warned that global stock markets, driven by AI optimism, are approaching valuation levels reminiscent of the dot-com bubble peak. A sudden reversal in market sentiment could lead to tighter financial conditions and risks to economic growth; ②Fed officials and tech giants remain relatively calm, referring to the AI boom as a “benign bubble,” which is incomparable to the internet bubble of 25 years ago.

Just as the technology and utilities sectors of the U.S. stock market once again drove indices to new highs on Wednesday, the IMF and the Bank of England simultaneously issued warnings. Against the backdrop of continuously rising valuations, market sentiment could suddenly “reverse sharply.” Meanwhile, Fed officials remained relatively calm, emphasizing that the so-called “AI bubble” does not pose a threat to financial stability.

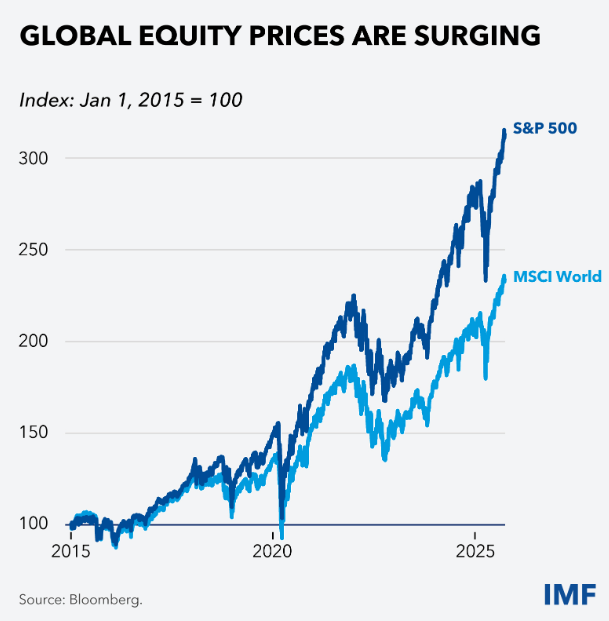

In a speech on Wednesday previewing next week’s IMF and World Bank annual meetings, IMF Managing Director Kristalina Georgieva stated that favorable financial conditions have supported the resilience of the global economy so far this year. Optimism about artificial intelligence’s potential to boost productivity has fueled a surge in global stock prices.

(Source: IMF)

(Source: IMF)

However, Georgieva shifted her tone, emphasizing that the resilience of the global economy has yet to face a true test. Worrying signs suggest that such a test may be imminent — a surge in global gold demand, with tariff impacts yet to materialize.

The IMF Managing Director added: “As for the accommodative financial environment — it has masked but not reversed weak trends in areas like job creation. History tells us that such market sentiment can suddenly reverse.”

She warned that current market valuations are approaching levels seen during the internet boom 25 years ago. If a sharp correction occurs, tightening financial conditions could weigh on global growth and expose economic vulnerabilities.

Coincidentally, the Bank of England also specifically addressed the valuation risks of AI-related stocks in the U.S. market in the minutes of its monetary policy meeting released on Wednesday.

The Bank of England noted that the cyclically adjusted price-to-earnings (CAPE) ratio of the U.S. stock market has approached levels seen 25 years ago, comparable to the peak of the dot-com bubble. Under several metrics, stock market valuations appear elevated, particularly for tech companies focused on artificial intelligence.

The minutes pointed out that this situation, combined with the increasing concentration in market indices, makes the stock market particularly vulnerable to shocks should market expectations regarding the impact of AI become less optimistic.

The Bank of England also mentioned recent significant default events in the U.S. credit market (subprime auto lender Tricolor and auto parts group First Brands), noting that these events confirm some of the risks previously highlighted by the policy committee, including high leverage, weak underwriting standards, opacity, and complex structures. Meanwhile, credit market spreads, which measure the interest rate differential between high-risk and safe borrowers, have fallen to “near historic lows.”

However, as the parties directly involved in the discussion, neither the Federal Reserve nor the U.S. tech community is concerned about stock valuations.

San Francisco Federal Reserve President Mary Daly stated this week that an artificial intelligence bubble would not pose a threat to financial stability.

She noted that economically, the current situation is more inclined to be described as a “good bubble.” Such a bubble can attract substantial investment, and even if investors do not achieve all the returns anticipated by early enthusiastic supporters, we will not end up with nothing. It will leave behind some productive outcomes.

NVIDIA CEO Jensen Huang also refuted on Wednesday, stating that the current artificial intelligence boom is fundamentally different from the internet bubble 25 years ago. This is because companies like Microsoft, Google, and Meta possess far greater financial strength compared to notorious dot-com bubble-era firms such as pets.com.

Editor/Joryn