If you have ever wondered whether Bausch + Lomb offers real value at its current price, you are not alone. Investors watching this well-known eye health company have seen some interesting movements this year, and many are debating whether now is the moment to get in, hold tight, or step aside. With shares last closing at $14.71, the stock has dipped by 5.2% over the last month and is down 18.3% so far this year. That said, compared to the broader market’s volatility and ongoing sector changes, it’s natural to question if these weaker figures merely reflect market jitters or if there’s a hidden opportunity here.

Longer-term performance shows Bausch + Lomb is still trailing, losing 22.0% over the past year and 3.8% over the last three years. But here is what is turning heads among value-minded investors: by traditional valuation methods, Bausch + Lomb is considered undervalued in five out of six key checks, earning a value score of 5. That is not easy to come by, especially in the current environment where many stocks screen as pricey or fully valued.

So, what is behind the contradiction between declining stock price and a compelling value score? Recent volatility could be tied to shifting attitudes in the healthcare and pharmaceutical industries, as well as investor perception around global demand for eye care. But to truly figure out if Bausch + Lomb is a bargain, it is important to dig into the details of how its value is judged. Here is a look at the six tests analysts often use to size up valuation, and after that, a deeper way to assess what the numbers are really saying.

Why Bausch + Lomb is lagging behind its peers

Approach 1: Bausch + Lomb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s dollars. This method helps investors assess whether the stock market price is justified by the business’s potential to generate cash in the years ahead.

For Bausch + Lomb, the 2 Stage Free Cash Flow to Equity model starts with the most recent Free Cash Flow, which stands at -$97.4 Million, and uses available analyst estimates to project growth over the next several years. Notably, projections show Free Cash Flow growing significantly, with estimates reaching $465 Million in 2026 and $851 Million by the end of 2029. Beyond this period, Simply Wall St extends those projections by forecasting steady, albeit somewhat slower, annual increases.

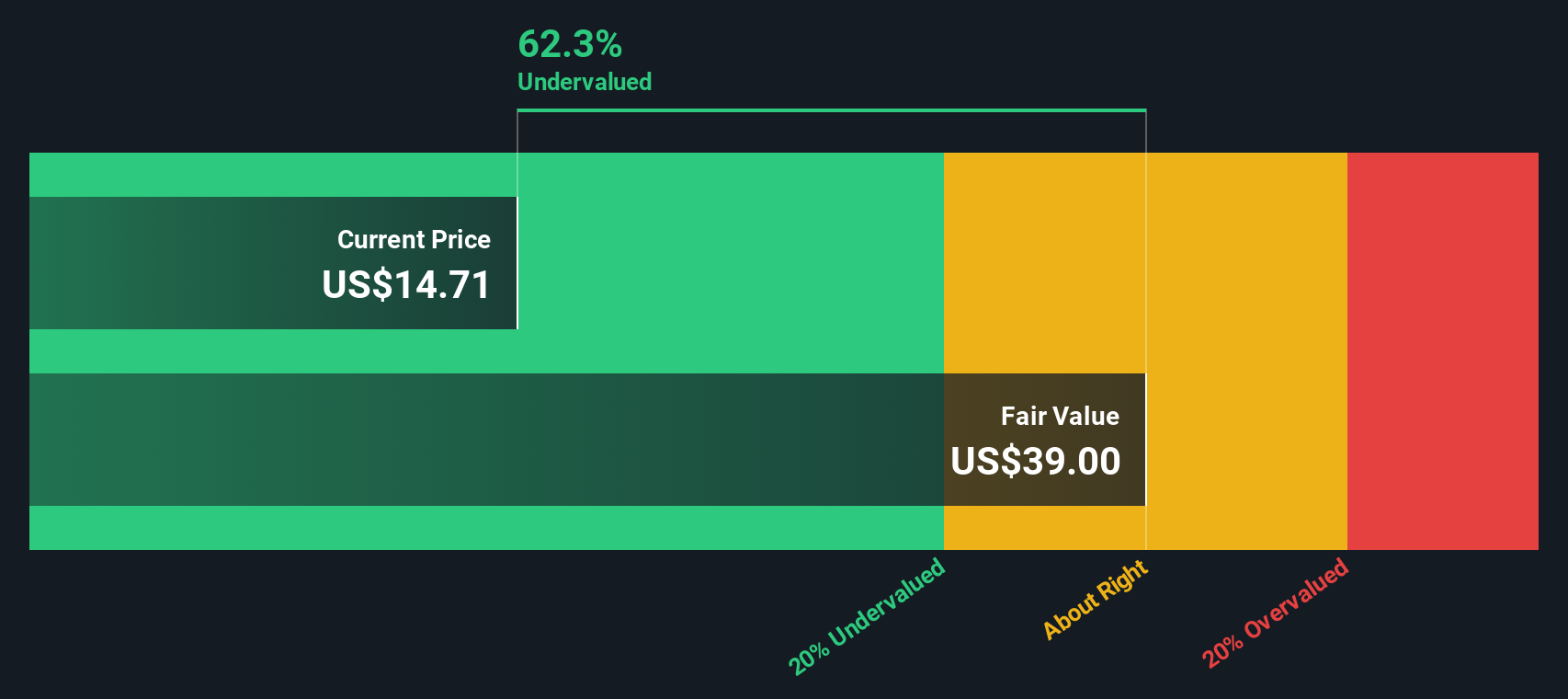

Based on these calculations, the DCF model arrives at an intrinsic fair value of $39.00 per share. This implies a substantial discount, with the current share price of $14.71 indicating the stock trades roughly 62.3% below its intrinsic value according to this valuation.

If these cash flow projections hold, Bausch + Lomb appears strikingly undervalued based on future earnings potential.

Result: UNDERVALUED

BLCO Discounted Cash Flow as at Oct 2025

BLCO Discounted Cash Flow as at Oct 2025

Our Discounted Cash Flow (DCF) analysis suggests Bausch + Lomb is undervalued by 62.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bausch + Lomb Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation metric for healthcare and medical equipment companies, especially when profitability is inconsistent or early growth is prioritized over net earnings. It offers investors a straightforward way to compare how much they are paying for each dollar of company sales, regardless of current profit levels.

Generally, higher growth expectations and lower risk justify a higher P/S ratio. Weaker sales growth or elevated risk typically mean the stock should trade at a lower multiple. These factors should always be weighed when determining what constitutes a “fair” price-to-sales valuation for a specific business.

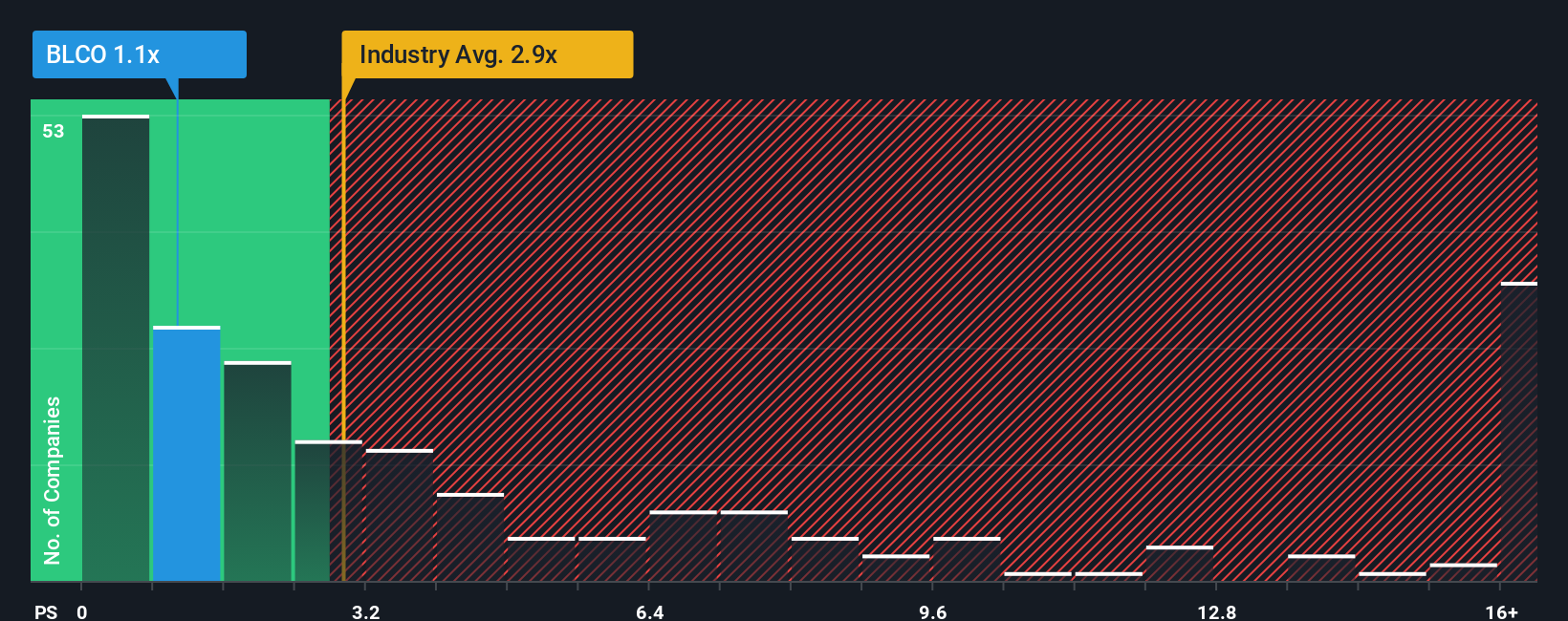

Currently, Bausch + Lomb’s P/S ratio stands at 1.06x. This is notably lower than both the Medical Equipment industry average of 2.93x and the average of its direct peers, which is 2.39x. At first glance, this comparison suggests the stock could be undervalued relative to similar companies.

Simply Wall St’s proprietary Fair Ratio customizes the expected P/S multiple based on Bausch + Lomb’s unique earnings growth outlook, sector, profit margin profile, market capitalization, and risk characteristics. This Fair Ratio settles at 2.35x. It is specifically designed to cut through broad industry averages and provide a more tailored benchmark for each stock, delivering targeted insight for investors seeking a truer sense of value.

Given that Bausch + Lomb’s actual P/S multiple is 1.06x and the Fair Ratio is 2.35x, the stock appears attractively undervalued using this approach.

Result: UNDERVALUED

NYSE:BLCO PS Ratio as at Oct 2025

NYSE:BLCO PS Ratio as at Oct 2025

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bausch + Lomb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company. It connects your view on its future prospects, such as how much it could earn or grow, right through to what you think is a fair price for its shares. Narratives let you turn your opinions and research into a clear financial forecast and fair value that you can easily compare with the current stock price.

Narratives are a free and easy tool on Simply Wall St’s Community page, used by millions of investors to streamline their investment decisions. By linking a company’s story to a fair value and forecast, Narratives help you decide when to buy, hold, or sell. They update automatically when important news or earnings are announced. For example, within Bausch + Lomb’s Community, some investors might forecast a higher fair value based on rapid future growth, while others, taking a more cautious approach, project a lower fair value with slower revenue gains.

This gives you an accessible way to see where you stand, stay informed, and make smarter decisions with every new development.

Do you think there’s more to the story for Bausch + Lomb? Create your own Narrative to let the Community know!

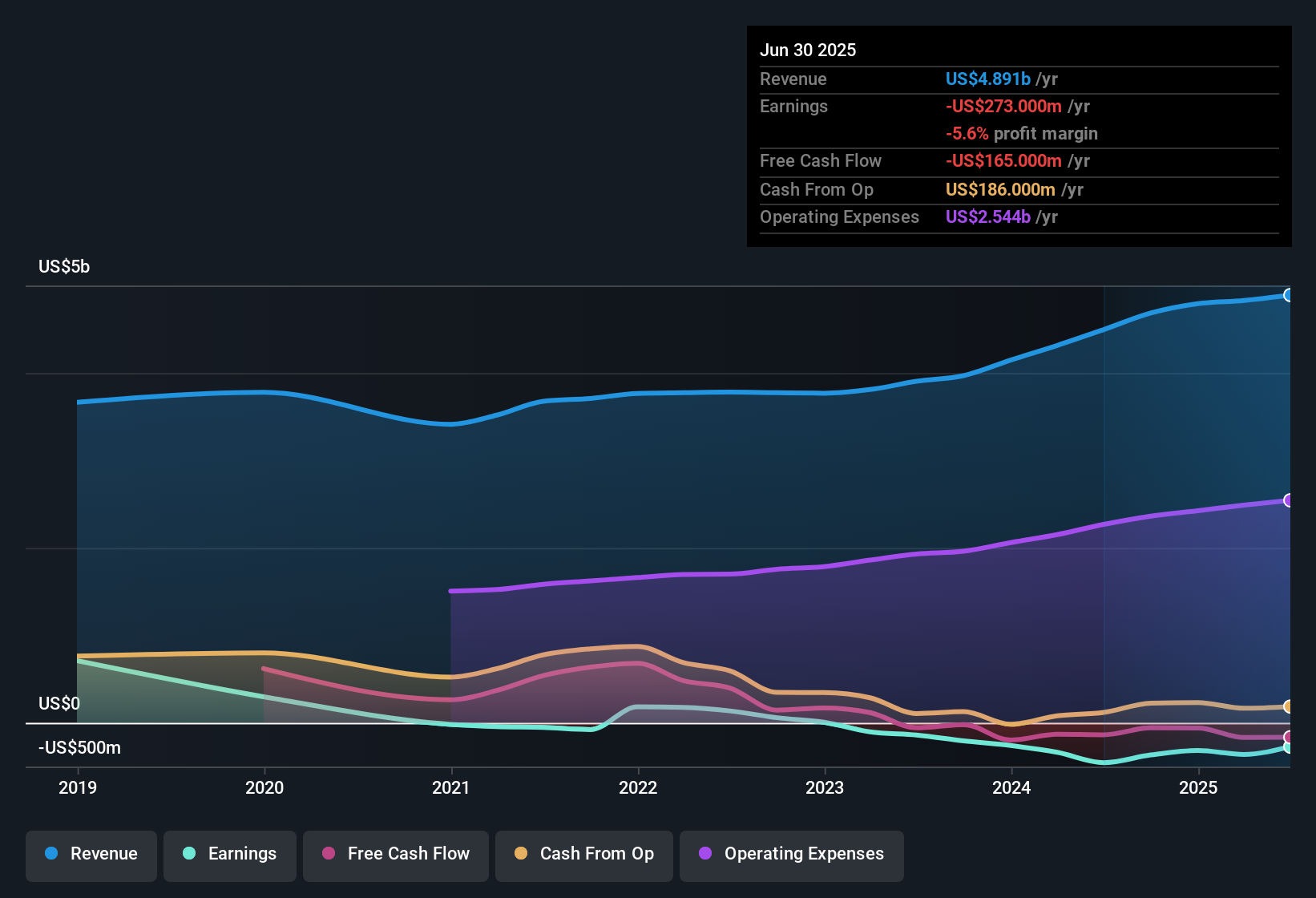

NYSE:BLCO Earnings & Revenue History as at Oct 2025

NYSE:BLCO Earnings & Revenue History as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Bausch + Lomb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com