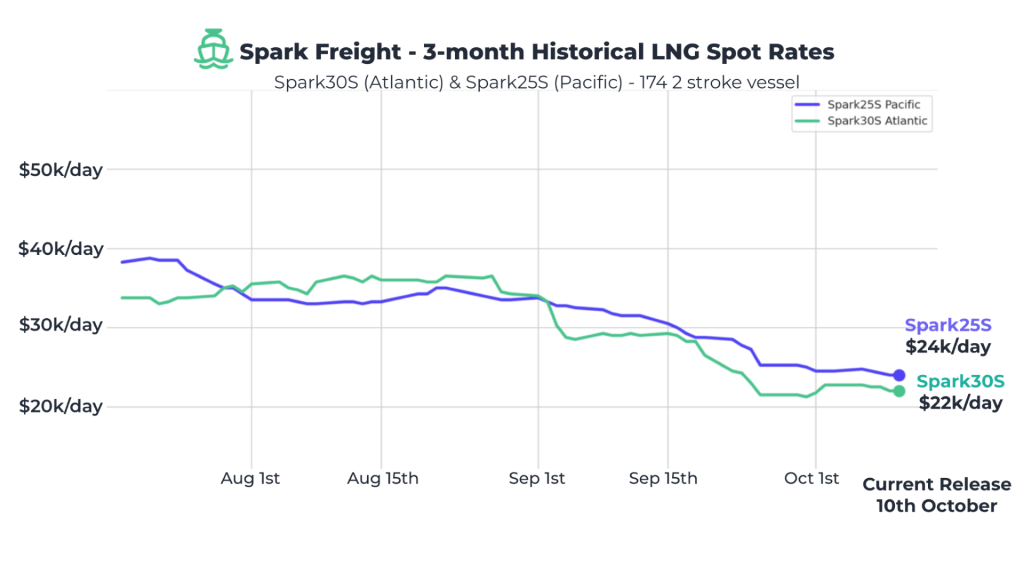

Spark’s product and pricing analyst, Janusz Rydzewski, told LNG Prime on Friday that Spark30S (Atlantic) LNG freight decreased by $750 per day week-on-week to $22,000 per day.

“Spark25S (Pacific) rates also softened, declining by $500 per day this week to $24,000 per day and marking a seventh consecutive week-on-week decline,” Rydzewski said.

European prices up

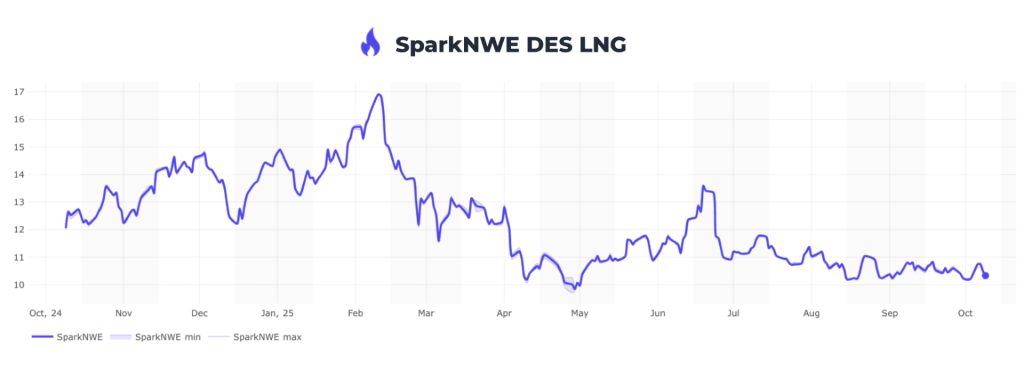

In Europe, the SparkNWE DES LNG rose compared to last week.

“The SparkNWE DES LNG front-month price for November increased this week, rising by $0.147/MMBtu to $10.330/MMBtu,” Rydzewski said.

Moreover, the basis of DES LNG to TTF “widened this week to around -$0.655/MMBtu,” he said.

“The US front-month arb to NE-Asia (via the Cape of Good Hope) is priced at -$0.038/MMBtu, still narrowly incentivising US cargoes to deliver to Europe,” Rydzewski said.

“The US front-month arb to NE-Asia (via Panama) is priced at -$0.043/MMBtu,” he said.

Image: Spark

Image: Spark

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU rose from last week and were 82.82 percent full on October 8, 2025.

Gas storages were 82.57 percent full on October 1, 2025, and 94.65 percent full on October 8, 2024.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in November 2025 settled at $11.080/MMBtu on Thursday.

Last week, JKM for November settled at 11.040/MMBtu on Friday, October 3.

Front-month JKM rose to 11.130/MMBtu on Monday and 11.135/MMBtu on Tuesday. It dropped to 11.115/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (Jogmec) said in a report earlier this week that JKM for last week “fell to mid-$10s/MMBtu on October 3 from low-$11s/MMBtu the previous weekend.”

“JKM reached its lowest level since May 2024 on October 1, driven by sluggish spot demand due to ample LNG inventories and sufficient supply in Northeast Asia. Subsequently, the price rose slightly as end-users in India, China, and Southeast Asia regained buying interest, encouraged by the low price levels,” Jogmec said.