Created on October 12, 2025

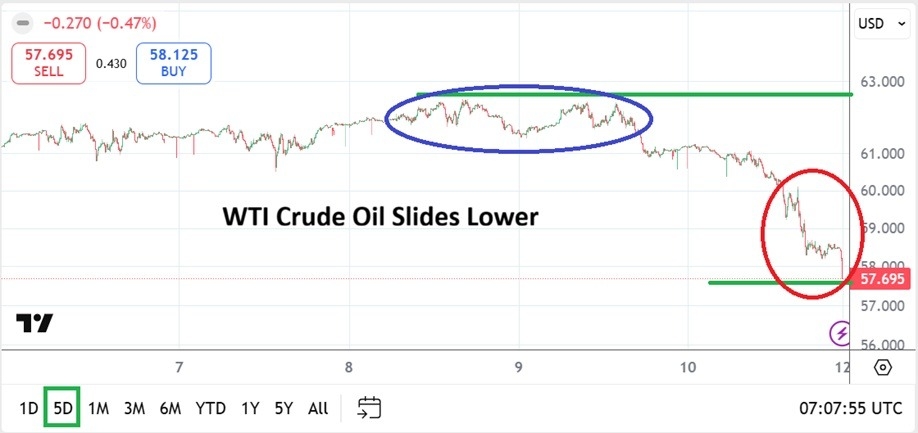

WTI Crude Oil closed near 58.700 USD on Friday and Monday’s opening should be monitored by all traders interested in the energy sector. The slide lower going into weekend occurred on the heels of President Trump’s sudden announcement that the White House will raise tariffs on China to nearly 100% on certain products. Although the markets have seen this show before from the U.S administration, financial institutions and large traders were seemingly caught off guard and reacted with selling in many assets.

The last time WTI Crude Oil languished within these lower values was in April and May of this year, which not coincidentally also occurred during heightened tariff rhetoric from the White House. Meaning the correlation to the renewed fevered pitch from President Trump has struck a nerve with large WTI Crude Oil traders again.

Temptation to Look for Reversals Higher

Day traders may be attracted to the potential of prices climbing from their current depths. While this would seem to be a logical idea, speculators need to be careful. The power of the price velocity lower which was seen on Friday kept WTI Crude Oil prices within their long-term lower elements as the trading session came to a close. The temptation to look for a reversal higher may be attractive, but risk taking tactics need to be used because WTI Crude Oil could find a way to move lower still.

Essentially since the end of the first week in August, WTI Crude Oil has traded around the 62.000 level with some consistency. Friday’s dive lower saw added selling it appears when the 60.000 ratio was broken and sustained below. Experienced commodity traders typically look at over-exuberant moves and then brace for a counter-reaction. Looking for upside on Monday may be what folks with deeper pockets and the ability to hold onto WTI Crude Oil may pursue.

President Trump and Focusing on the Next Big Thing

Recent developments in the Middle East have brought the potential of calmer days from the region to the fore. And if in fact the Middle East can stay quiet for a while, this may allow President Trump to turn his focus elsewhere. Meaning that China, Russia and the war with Ukraine could get increased attention.

The dive lower in WTI Crude Oil was definitely effected because of President Trump’s sudden remarks about China.Financial institutions and large traders will remain nervous about what comes next.While WTI Crude Oil looks like it sold off too fast on Friday, support levels around 57.000 may look promising, but traders should remember lower prices were seen in April and May of this year.

WTI Crude Oil Weekly Outlook:Speculative price range for WTI Crude Oil is 55.900 to 62.200

The momentum generated downward on Friday is a reminder that trading commodities are dangerous. Even from the presumed safety of CFD trading, speculators are subject to the quick trends which sometimes develop and cause a significant amount of fast trading. The ability to dive below 60.000, 59.000 and 58.000 within what felt like a blink of the eye on Friday cries out for risk management to be used. In fast conditions however, particularly in commodities not even stop loss orders can help sometimes. When volumes are in greater flux, getting a good price fill in wild market environments is not guaranteed.

Friday’s rapid pace lower may be enticing for day traders who believe WTI Crude Oil is too low. Simple targets near the 58.000 level may seem rather logical, but cautious speculators may want to watch the opening of WTI before jumping into trading waters on Monday. If a speculator uses conservative leverage and has the ability to take a wait and see approach, looking for slightly higher prices in WTI Crude Oil may feel correct. But again, when prices fell in April and May of this year, only half a year ago, values did go beneath 56.000 and lower.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.