Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

DXC Technology Investment Narrative Recap

To be a DXC Technology shareholder, you must believe that the company’s push into AI-powered enterprise solutions, such as Assure Smart Apps, can counteract ongoing revenue headwinds and help stabilize earnings. While this recent launch underscores a pivot to digital modernization, which remains the most important short-term catalyst, its impact on stemming the core GIS segment’s revenue decline may not be material in the near term, so top-line pressures persist as the biggest risk.

Among the latest developments, the new partnership between DXC, Digital Realty, and Dell Technologies to provide integrated private AI solutions further emphasizes DXC’s effort to expand its footprint in enterprise services. This supports the company’s potential catalysts by broadening access to scalable AI tools for large clients and increasing relevance in competitive digital transformation markets.

By contrast, investors should be aware that persistent declines in DXC’s GIS segment and the challenge of converting new bookings into realized revenue remain major concerns, particularly if…

Read the full narrative on DXC Technology (it’s free!)

DXC Technology’s narrative projects $12.1 billion revenue and $208.6 million earnings by 2028. This requires a 1.7% yearly revenue decline and a $170.4 million decrease in earnings from $379.0 million today.

Uncover how DXC Technology’s forecasts yield a $15.12 fair value, a 17% upside to its current price.

Exploring Other Perspectives DXC Community Fair Values as at Oct 2025

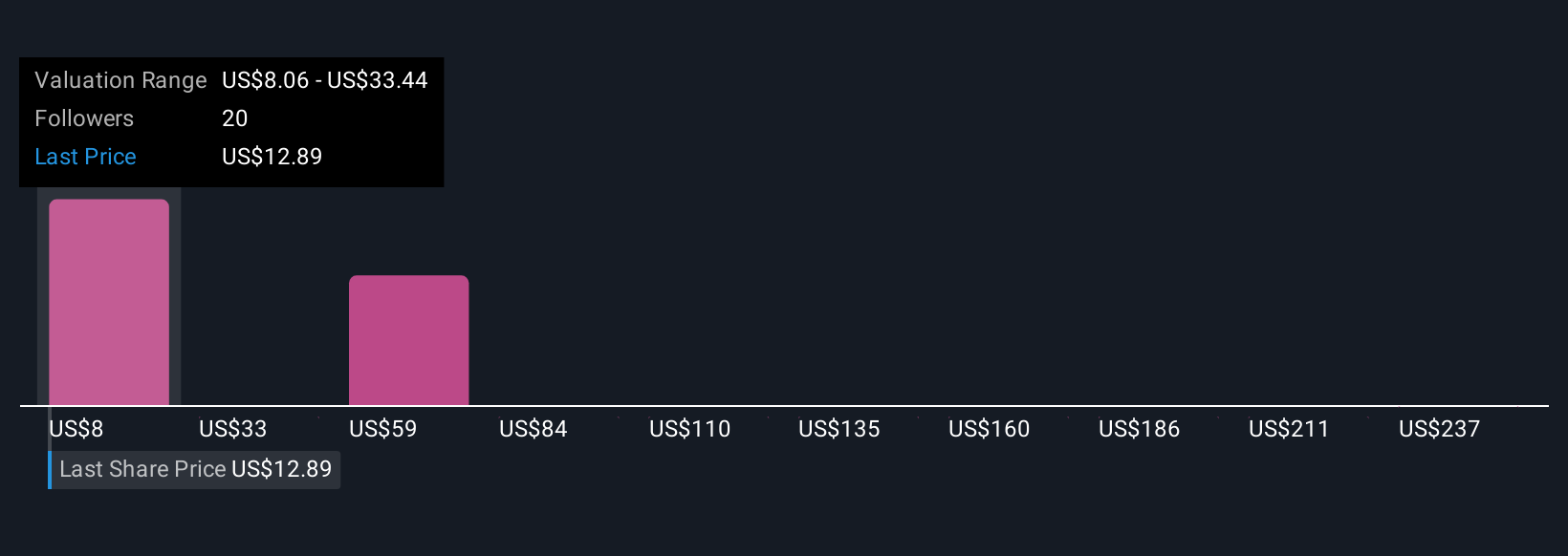

DXC Community Fair Values as at Oct 2025

Six members of the Simply Wall St Community gave fair value estimates for DXC ranging from US$8.06 to US$261.89. With this diversity of opinion, remember that ongoing revenue declines and execution risk are front of mind for many participants weighing the company’s ability to deliver.

Explore 6 other fair value estimates on DXC Technology – why the stock might be worth 37% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com