(Bloomberg) — Beneath the surface of the short-term ups and downs of financial markets, a longer-term repricing of multiple assets may be underway as investors seek to protect themselves from the threats posed by runaway budget deficits.

While new rounds of tariff threats between the US and China sent traders from riskier assets and into bonds in recent days, money managers have been increasingly discussing a phenomenon known as the “debasement trade.”

Most Read from Bloomberg

Those who believe in it are pulling away from sovereign debt and the currencies they are denominated in, fearful their value will be eroded over time as governments avoid tackling their massive debt burdens and even seek to add to them.

Further fuel is coming from speculation that central banks will face increasing political pressure to hold down interest rates to offset what governments owe — and in the process fan inflation by continuing to crank out cash.

WATCH: Adam Levinson of Graticule Asset Management Asia shares his views on the debasement trade.Source: Bloomberg

Just last week, Japan’s yen and its bonds were hit by waves of selling as stimulus-friendly Sanae Takaichi took a step toward becoming prime minister. Another round of political turmoil in France over its finances jolted the euro, and a looming budget in the UK is unnerving a gilt market still scarred by the 2022 selloff that swept Prime Minister Liz Truss from power.

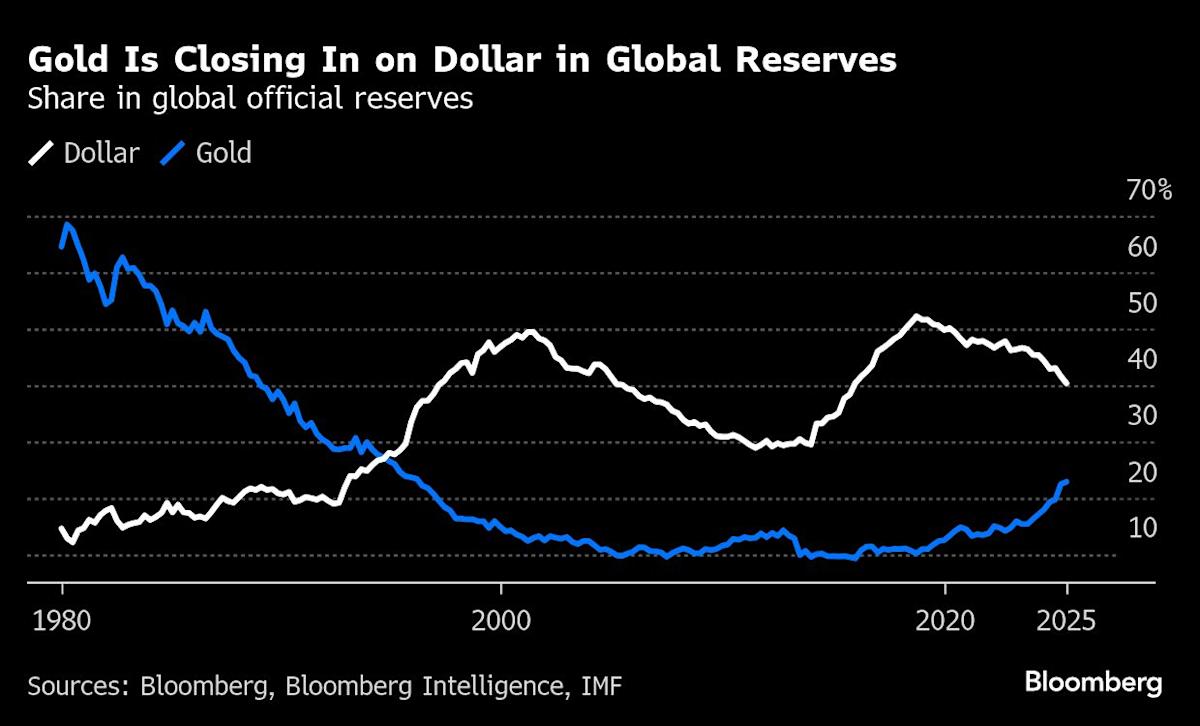

While the dollar has risen in recent weeks despite the US government shutdown, it’s still weaker over the course of this year after President Donald Trump’s trade war and tax-cut plans earlier sent it into the deepest tailspin since the early 1970s. His America First break with the global order and assault on the Federal Reserve’s independence have also sown doubts about whether Treasuries will continue to fully enjoy their status as the world’s main risk-free asset — underpinning long-term bond yields.

On the other side of the debasement trade, precious metals are benefiting from their traditional haven status and cryptocurrencies are rallying again, this time due to their purported function as a refuge from the impacts of government policy. Gold is up over 50% this year and recently surpassed a record $4,000 per ounce, while silver surged to an all-time high.

And while cryptocurrencies posted steep drops after Trump’s latest tariff threats spooked sentiment, Bitcoin is still up more than 20% this year and hit an all-time high.