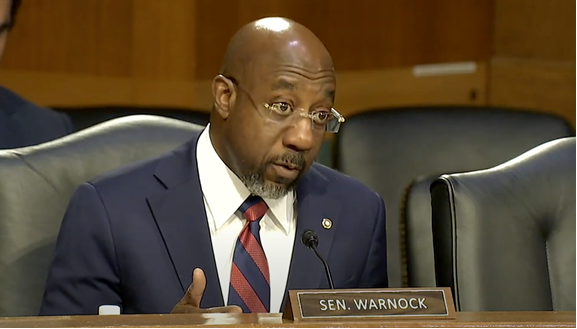

During a Tuesday Senate Agriculture Committee hearing, Senator Reverend Warnock highlighted a regulatory gap allowing asset trade without supervision by any federal regulator

Senator Reverend Warnock during the hearing: “If we’re going to create a situation where capital markets can thrive, for investors of all sizes, we need to have confidence that regulators are upholding the law protecting consumers.”

Watch the Senator’s remarks at the Agriculture Committee hearing HERE

Washington, D.C. – Today, U.S. Senator Reverend Raphael Warnock (D-GA), a member of the Committee on Agriculture, Nutrition, and Forestry, highlighted risks to consumers if overly concentrated crypto markets go unregulated. Senator Warnock expressed that the Commodity Futures Trading Commission (CFTC) needs to have the necessary resources to effectively supervise the digital commodity market.

“If we’re going to create a situation where capital markets can thrive, for investors of all sizes, we need to have confidence that regulators are upholding the law protecting consumers,” said Senator Reverend Warnock during the hearing. “And so I look forward to working with my Republican colleagues to ensure that the CFTC is properly resourced.”

Senator Warnock also addressed the CFTC’s preparedness for new authorities that digital asset market structure legislation will provide to the Commission.

“I’m especially concerned that customers may not be getting the best prices on trades, that they may be paying higher fees, and more consolidation will lead to less competition in the market and create more systemic risk,” Senator Warnock continued.

Senator Warnock has championed efforts to enforce ethics rules for investment and trading activity. Senator Warnock introduced the Ban Conflicted Trading at the Fed Act with former Senate Banking Committee Chairman Sherrod Brown and other colleagues to prohibit senior Federal Reserve officials from trading individual stocks. He also cosponsored bipartisan legislation prohibiting members of Congress from holding stocks and legislation requiring members of Congress to hold their investments in blind trusts, which would mean that legislators would have no knowledge or control over their investments, preventing any holding from causing a potential conflict of interest.

Senator Warnock has also pressed Brian Quintenz, President Trump’s nominee to be Chair of the CFTC, about the illegal firings of Democratic commissioners and his willingness to protect oversight and prevent partisanship from consuming the CFTC.

Watch video of the Senator’s full remarks HERE.

See below a full transcript of the exchanges between Senator Warnock, Rostin Benham, and Timothy Massad:

Senator Reverend Warnock (SRW): Thank you Chair Bozeman. Mr. Benham, last Congress, when we were considering legislation that would provide the CFTC with the authority to regulate the spot market for digital commodities, you testified before this committee that the CFTC would need $120 million to properly staff up and prepare to supervise and regulate an entirely new industry. Do you still agree with your previous testimony? Yes or no?

Rostin Benham (RB): Yes

(SRW): The President’s nominee to replace you, Mr. Brian Quintenz could not confirm that number, but he did indicate in his testimony before this committee that more funds would be needed to implement the new authorities for the CFTC chair.

Benham, to your knowledge, has the Trump administration requested additional funding or additional staffing at our financial regulators to properly support additional regulatory responsibilities?

(RB): No, it has not.

(SRW): So in six months, we have seen hiring freezes. We’ve seen staff reductions at the SEC, at the FDIC, at the OCC all while refusing to nominate democratic commissioners for historically bipartisan boards like the CFTC.

Chair Benham last year, you were consistent that new funding would be needed for new staff, staff training, and technological upgrades. So let’s say a new crypto market structure bill that gives the CFTC new regulatory responsibilities is signed into law. Could you share what are the risks associated with Congress failing to provide the CFTC with sufficient resources to properly supervise the digital asset industry?

(RB): Thanks, Senator. In short, the answer is, without the tools, which become the resources behind the authorization for the program, the program becomes essentially useless. There’s obviously a lot of talented staff at the CFTC, and I know they will work hard to implement the program, but we absolutely need resources at the agency to properly implement the program.

(SRW): Absolutely I agree with that. And clearly, investors of all sizes, if we’re going to make create a situation where capital markets can thrive, investors of all sizes, we need to have confidence that regulators are upholding the law protecting consumers, that they have the capacity to do so. And so I look forward to working with my Republican colleagues to ensure that the CFTC is properly resourced.

Regulatory certainty for the digital asset industry limits unnecessary risk, and it can help prevent the collapse of another cryptocurrency exchange firm. one thinks of FTX a few years ago. But I’m concerned that today, a handful of centralized firms have come to control multiple stages of the trading process, and all of that concentrates the risk creates conflicts of interest, in my mind.

Mr. Massad, good to see you again. Is it routine for centralized exchanges to also serve as the custodian of customer funds and be responsible for listing, trading, clearing and settling trades? Is this typically what we see?

Timothy Massad: Yes, it is, and they even have more vertical integration than that. And of course, most trading is through those intermediaries, not on chain.

(SRW): And what sorts of risks and inefficiencies or conflicts of interest may exist when exchanges are vertically integrated like this?

Timothy Massad: There’s all sorts of conflicts that can arise. For example, today, these trading platforms can do their own proprietary trading, so they can front run customer orders or misuse customer information.

They can have interest in the tokens that they list, that’s not prohibited either. They can have other business ventures, and with respect to custody, they can be charging separate fees and may not, you know, adhere to good custody rules and even the Clarity Act doesn’t even require these platforms to hold the Bitcoin that they say their customers own. It doesn’t require that.

(SRW): So this vertical integration creating additional unnecessary risks for customers. We saw this with FTX, with customers being unable to access their money months after the collapse of FTX, and I’m especially concerned that customers may not be getting the best prices on trades, that they may be paying higher fees, and more consolidation will lead to less competition in the market and create more systemic risk, like we saw in the case of FTX.

Mr. Massad, what provisions do you see in a Senate bill to limit the risk that large centralized firms may have on the digital asset market?

Timothy Massad: Sure. We need a comprehensive regulatory framework that prohibits these kinds of conflicts of interest.

So no proprietary trading, no interest in the tokens they list, no other business ventures that can pose conflicts. We need to impose best execution requirements on brokers. We need to impose strict custody rules, and you know, either consider separate custodians, or at least have rules that ensure that they really are holding the Bitcoin that they claim or the other assets that they claim their customers own, and they’re segregating it properly, and they’re not charging fees for that.

(SRW): Thank you so very much for your testimony. I look forward to working with my Republican colleagues to create a Senate bill that contains strong conflict of interest language so we can safeguard the financial system and protect consumers. Thank you very much, Mr. Chairman

###